Dear Money & Crisis Reader, Dear Money & Crisis Reader,

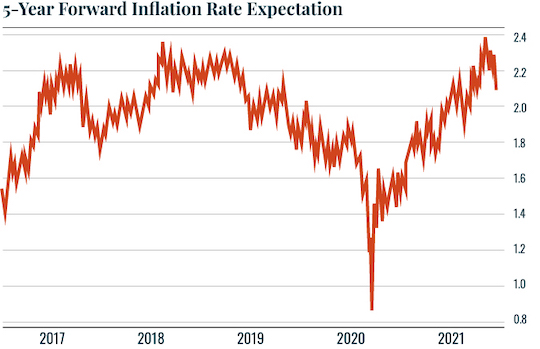

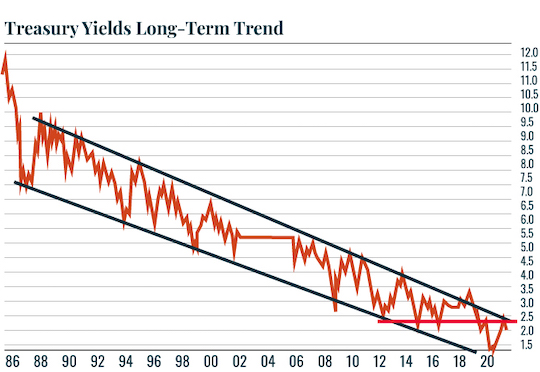

Yesterday I outlined how the Fed is extremely late to curb inflation. How do we know? The CPI has cleared 5%, the housing market is entering a bubble, stocks are roaring to new all-time highs, not to mention the prices of food and energy have been skyrocketing. Put simply, it only took an extreme level of frothiness as well as some of the worst inflation prints in decades for the Fed to decide it needed to do something. We’ve assessed how the markets initially reacted to the Fed’s move. But now it’s time to digest what the Fed actually did. A (Non)Intervention by the Fed Did it actually hike rates? No. Did it actually taper QE? No. Did it do anything besides change the market’s expectations regarding their monetary policy plans? No again. The Fed has clearly indicated it is willing to stomach higher inflation in the near-term to sustain the bubble in stocks and recovering economy. However, with inflation expectations rising (within 10 months they recovered over two years’ worth of declines)…  …and Treasury yields getting dangerously close to breaking their long-term downtrend (see the chart below)…  … the Fed was forced to temper those expectations. So, the Fed did what it does best: It made a verbal intervention — a statement of intent that things would be changing because of the current economic conditions. But was the Fed really serious about doing anything? |

Tidak ada komentar:

Posting Komentar