Five Biopharmaceutical Stocks to Buy for Profits Amid the Pandemic 06/30/2021 | | | Most options traders place risky trades, then HOPE for a big payout. But, did you know that 70% of traders get "burned by options?" Jim Fink does things a little differently... he "breaks" the biggest rule in options trading... and walks away with a win -- 85% of the time. This unique twist on options trading could hand you an extra $67,548 per year.

Get the full details Click Here... | | | | Five biopharmaceutical stocks to buy offer investors a chance to profit while supporting companies that develop treatments for health problems through biological solutions.

The five biopharmaceutical stocks to buy are part of an industry that generally is well-financed, with companies backed by an average of 3.5 years of cash to fund research and development (R&D) initiatives, compared to just 1.5 years at the peak of the 2008-09 financial crisis, according to BoA Global Research. Funding of biopharmaceutical stocks has risen dramatically since 2015, with more than $550 billion in cash amassed to keep these companies advancing their R&D programs, BoA reported in a June 29 research note.

Overall, global spending on medicines is projected to produce a 3-6% compound annual growth rate (CAGR) through 2025 to total about $1.6 trillion by 2025, excluding spending on COVID-19 vaccines, according to a recent report by the IQVIA Institute for Human Data Science (NYSE:IQV). The report, "The Global Spending and Usage of Medicines," relied on invoice price levels to forecast total cumulative spending of $157 billion on COVID-19 vaccines through 2025 aimed largely at the initial wave of vaccinations to be completed by 2022.

In subsequent years, booster shots are expected to be required on a biannual basis, based on the length of immunity and the emergence of viral variants. Two therapy areas -- oncology and immunology -- each are forecast to grow at a 9-12% CAGR through 2025, spurred by sizable hikes in new treatments and medicine use, according to the institute.

Oncology Treatments Are Among Targets of the Five BioPharmaceutical Stocks to Buy

Oncology alone is expected to add 100 new treatments over five years, contributing to a rise in spending of more than $100 billion, totaling more than $260 billion in 2025. Immunology growth is projected to slow from its 17.3% CAGR of the past five years as reduced cost treatments offset growth in volume and drug launches.

In addition, many new therapies are expected in neurology. Treatments also are slated for novel migraine therapies, rare neurological diseases and Alzheimer's and Parkinson's.

"Biotechnology stocks have been doing well recently, and that's likely to continue," said Bob Carlson, leader of the Retirement Watch investment newsletter. "Companies continue to announce breakthroughs, and a number of biotech companies are going public."

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz.

Pension Fund Leader Likes Biotech ETFs as Alternative to Five Biopharmaceutical Stocks to Buy

It is "tough" to identify the best individual stocks in the biopharmaceutical sector, but Carlson said he would recommend a diversified exchange-traded fund (ETF) for most investors. However, even that is difficult, because of differences in the stocks held by the leading ETFs. The best move might be to hold positions in the two leading biotech ETFs, he concluded.

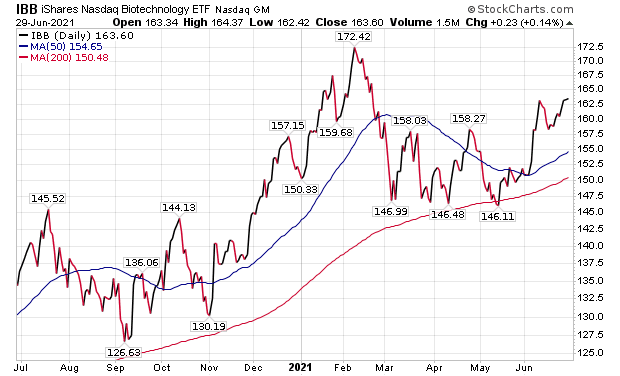

iShares Biotechnology (IBB) aims to track the NASDAQ Biotechnology Index, so it holds only stocks listed on the NASDAQ that are classified as either biotechnology or pharmaceutical companies, Carlson said. IBB tends to be the more volatile of the two funds, and over some periods its returns can be substantially higher or lower than alternatives, Carlson cautioned.

Despite the volatility, IBB gained 25.21% in 2019, 26.01% in 2020 and 7.79% so far in 2021. Its three-year annualized return is 14.24% and its five-year return is 14.71%, Carlson said.

Chart courtesy of www.StockCharts.com

SPDR S&P Biotech (XBI) Offers Another Path Aside from Five Biopharmaceutical Stocks to Buy

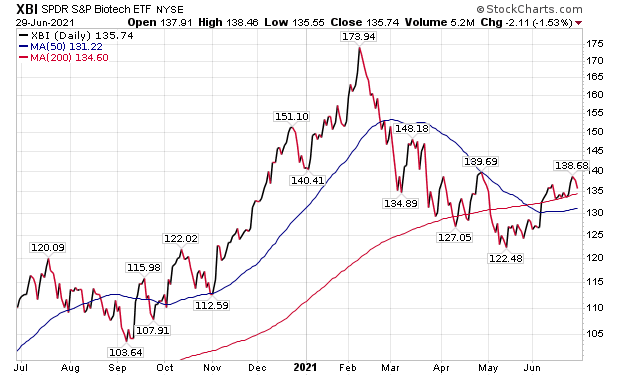

The other ETF Carlson recommended is SPDR S&P Biotech (XBI). That fund aims to track the S&P Biotechnology Select Industry Index. That sector index is derived from a U.S. total market composite, so it is not limited to S&P 500 stocks. But the fund uses a sampling strategy to try to track the index instead of holding all the stocks in the index.

"XBI tends to favor stocks with greater liquidity, so it doesn't own many smaller companies or those with limited trading volume," Carlson said.

Though it is less volatile than IBB, XBI is more volatile than the market indexes and the health care sector. The fund returned 32.56% in 2019 and 48.33% in 2020, but so far in 2021 it is down 1.46%. Plus, the fund's annualized returns are 13.01% over three years and 21.94% for five years.

Chart courtesy of www.StockCharts.com

Five Biopharmaceutical Stocks to Buy Are a Challenge to Categorize

The difficulty of classifying stocks and funds in the biopharmaceutical sector is shown by Morningstar's placement of these two funds in different categories, with IBB put in Specialty-Technology and XBI going in Specialty-Health.

IBB tends to hold larger capitalization companies than XBI. Despite their differences, Morningstar indicated the two funds have a high correlation of 94%, Carlson said.

Pharmaceutical stocks, in general, are attractive, since they trade at a historically low valuation to the S&P 500, Carlson said., They sell at a 40% discount to the S&P 500, even though many pharmaceutical companies have improving drug pipelines and attractive growth prospects, Carlson added.

Pharmaceutical stocks and funds have pulled back in recent months partly due to uncertainty about drug-pricing legislation in Washington, Carlson said. Some people are advocating that Medicare should be allowed to negotiate prices directly with the pharmaceutical companies to reduce drug prices. | | | You don't have to invest directly in cryptocurrencies to profit from the crypto revolution. In fact, you can do it using one little-known stock.

,br> Over 12 months, shares of this stock skyrocketed from just $6.06 to $73.03 – a gain of 1,105% in just a year. In other words, had you invested $5,000 in this company a year ago, you could've had an extra $55,250 in your bank account today. Click here to find out more on this stock. Click Here... | | | | Money Manager Kramer Indicates Five Biopharmaceutical Stocks to Buy Could Grow Mightily

"The real distinction for me at this point isn't really about whether a drug developer draws on biotech materials or more conventional chemistry in order to treat illness," said Hilary Kramer, who heads the GameChangers and Value Authority advisory services.

The first standalone biotech companies that went public in the 1980s have grown to be able to go "toe-to-toe" with big pharmaceutical companies and, in some cases, are now integrated into industry behemoths, Kramer continued. For example, Celgene has been acquired by Bristol-Myers Squibb Inc. (NYSE:BMY), said Kramer, who also hosts the "Millionaire Maker" radio program.

"A few even pay dividends," Kramer said.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

BoA Global Research Recommends Five Biopharmaceutical Stocks to Buy

Jazz Pharmaceuticals (NASDAQ:JAZZ) received a $223 price objective (PO) and a buy recommendation from BoA Global Research, based on a valuation of 10.5x enterprise value (EV)/earnings before interest, taxes, depreciation and amortization (EBITDA) projected in 2022. BoA's valuation multiple shows confidence that JAZZ will navigate concerns about the expiration of certain patents and the company's growth profile.

The EV/EBITDA multiple of 10.5x compares to the company's peer group that trades at 9x, which BoA described as appropriate based on JAZZ's growth outlook vs its rivals. However, JAZZ has risks that include possible slower-than-expected sales growth from its Vyxeos or Sunosi launches and weaker-than-expected sales growth of Xyrem, including failure to gain approval of next-generation formulations of Xyrem that could cause the pharmaceutical to lose its exclusivity prior to 2023.

Possible catalysts to help JAZZ exceed BoA's price target include greater-than-expected sales growth from launching its Vyxeos chemotherapy or its narcolepsy treatment Sunosi. A second boost would be less-than-expected generic erosion of Xyrem (e.g., due to setbacks setting up a generic risk evaluation and mitigation strategy (REMS)), while a new plus would be future business development transactions becoming a key part of JAZZ's strategy.

Chart courtesy of www.StockCharts.com

Five Biopharmaceutical Stocks to Buy Feature FibroGen

FibroGen Inc. (NASDAQ:FGEN) gained a $43 price objective from BoA, based on a risk-adjusted discounted cash flow (DCF) analysis. Risks that may prevent FibroGen from meeting that price target include underperformance of the launch of its chronic-kidney-disease-related anemia drug Roxadustat vs. BoA projections, low demand or reduced net pricing and competitor data proving to be superior in efficacy and safety.

Possible catalysts for FibroGen to exceed the BoA price target on the stock could take shape if Roxadustat launch beats forecasts, its labeling for cardiovascular risk and cancer tops expectations and its competitor data reveal weaker efficacy and safety profile. BoA also wrote FibroGen's Pamrevlumab monoclonal antibody to treat idiopathic pulmonary fibrosis and pancreatic cancer achieves key clinical milestones in 2022-23.

BoA wrote on June 22 that Roxadustat clearly has demonstrated efficacy. Now, a key regulatory consideration will be the treatment's safety and whether it meets historical statistical benchmarks, BoA added.

Chart courtesy of www.StockCharts.com Chart courtesy of www.StockCharts.com

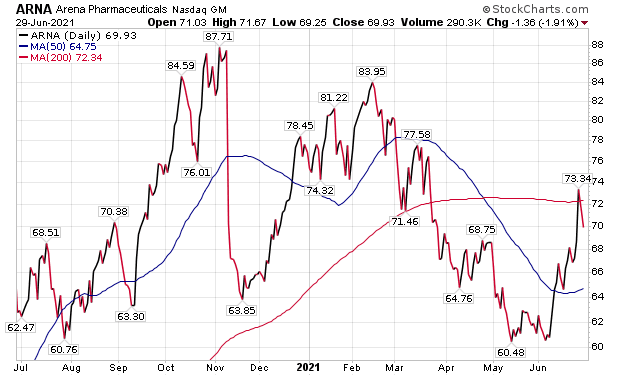

Arena Pharmaceuticals Wins Spot Among Five Biopharmaceutical Stocks to Buy

Arena Pharmaceuticals (NASDAQ:ARNA) earned a buy rating and a price objective of $87 from BoA, based on a risk-adjusted DCF analysis. In BoA's DCF, it assumed sales forecasts through 2036 for Etrasimod, a once-daily, oral S1P1,4,5 modulator undergoing multiple phase 3 trials for moderate to severe ulcerative colitis. That BoA assessment included the expected loss of exclusivity (LOE) in 2034, assuming a five-year patent term extension.

Risks that may prevent the company from achieving BoA's price target include increased competition in Etrasimod's target market to treat ulcerative colitis, if Ozanimod Ph3 clinical data to treat relapsing Multiple Sclerosis (MS) and inflammatory bowel disease substantially raise the bar for Etrasimod. Other risks could include Etrasimod failing to replicate Ph2 UC data in ongoing Ph3 and proving unable to demonstrate efficacy in Ph3 for atopic dermatitis, also known as eczema.

A reason for exceeding the price target may be Etrasimod producing impressive Ph3 data in treating atopic dermatitis, with clinical efficacy and safety similar to Dupixent, a prescription medicine used to treat people aged 6 and older who have moderate-to-severe eczema that is not well controlled. If so, Etrasimod may offer biologic-like efficacy but without the safety baggage of the Ph3 JAK inhibitors, according to BoA.

Chart courtesy of www.StockCharts.com

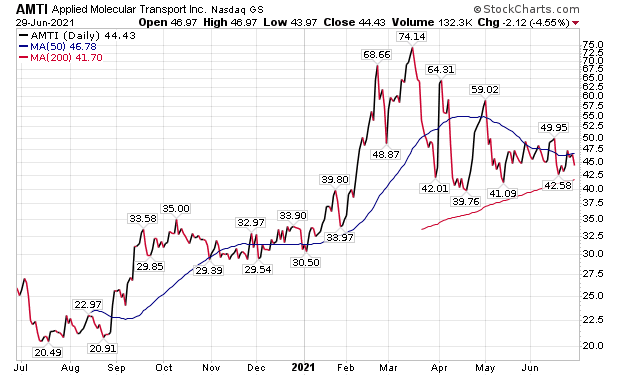

Five Biopharmaceutical Stocks to Buy List Applied Molecular Transport

BoA assigned Applied Molecular Transport Inc. (AMTI) a buy recommendation and a price objective of $68 per share, based on a risk-adjusted, sum-of-the-parts DCF analysis. The investment firm forecast AMTI would keep developing new drug candidates, while risk-adjusting for possibilities that the company may be unable to secure durable molecule-specific patents after expiration of intellectual properties. Possible risks to meeting the price target will include the outcome of Phase 2 clinical trials of AMT-101, a potential surprise emergence of competing platform for oral delivery of the treatment and possible dilution of existing shares issued at a discount.

Catalysts that could help the stock outperform expectations may include non-dilutive financing through a partnership or licensing that is not reflected in BoA's forecast. Another catalyst would be a possible acquisition of the company at a premium price.

Chart courtesy of www.StockCharts.com

BeyondSpring Breaks into List of Five Biopharmaceutical Stocks to Buy

BeyondSpring Pharmaceuticals (NASDAQ:BYSI) received a buy rating and a $25 price objective from BoA, based on a risk-adjusted DCF analysis. The outlook hinged on key assumptions, including meeting cash flow forecasts through the 2036 patent life of Plinabulin, a small molecule under development and in a worldwide Phase 3 clinical trials to treat non-small-cell lung cancer. BoA projects that Plinabulin will produce $670 million in 2030 estimated risk-adjusted sales.

Possible risks to the company achieving the BoA price target could include a failure of Plinabulin to show desired results in clinical trials, slower-than-expected commercial uptake of that treatment in chemotherapy-induced neutropenia (CIN) and potentially dilutive cash raising efforts to commercialize the drug.

To outperform the price target, BeyondSpring might attain better-than-expected clinical data and commercial uptake of Plinabulin. The company also could be acquired at a premium price, according to BoA.

It is possible AMT-101 could produce the best in biologic efficacy and safety in its Phase 2 trial, according to BoA. That outperformance currently is not reflected in BoA's market share model assumptions.

Chart courtesy of www.StockCharts.com

Kramer Offers Picks in Addition to the Five Biopharmaceutical Stocks to Buy

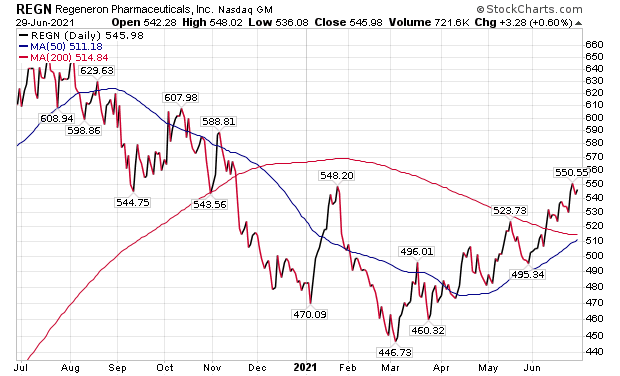

As for Kramer's favorite biopharmaceutical stocks, she praised Regeneron Pharmaceuticals Inc. (NASDAQ:REGN), Vertex Pharmaceuticals Inc. (NASDAQ:VRTX) and Alexion Pharmaceuticals Inc. (NASDAQ:ALXN). All three stocks will give investors an experience similar to owning pharmaceutical goliaths, Kramer counseled. Those biotech stocks already have generated billions of dollars in wealth for their shareholders, but maybe they will triple or quadruple again in the lifetime of current investors on their way to becoming full-fledged industry giants, she added.

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com | | | Do you know how to tell before the bottom drops out of the market? In this brand new, FREE, e-book, you'll learn five tips, tools, and strategies that can keep you from costly losses during dips and corrections... and save your account before a meltdown.

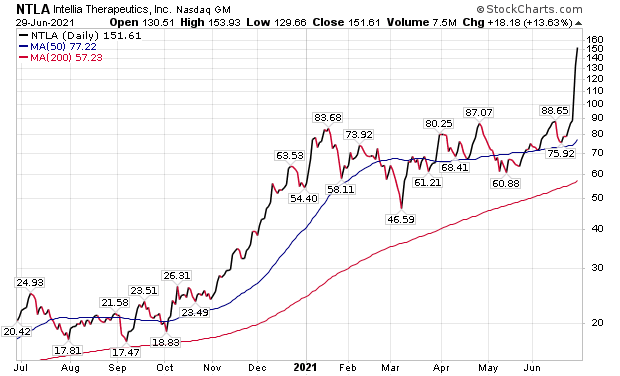

Get the full story by downloading Five Tips for Overcoming Market Volatility. Because not only will these strategies let you sleep soundly at night... they will keep your money growing while they're protecting it! Click Here... | | | | "But if your idea of biotech investing revolves more around the thrill of early-stage companies plotting moon shots on complicated disease targets, you want to stay small, diversified and patient," Kramer said. "I've been talking about CRISPR gene editing technologies for at least a decade. Now, some of the most advanced names in the field are finally working their way around to human beings. As long as you have the patience, you can never be too early in the baby biotech world. But you can be too late. Once the big clinical data release hits the market, you'll never get the same chance to invest in an unproven quantity again.

"Take Intellia Therapeutics Inc. (NASDAQ:NTLA), for example. Unless something goes seriously wrong, we probably won't get a lot of entry points below $100. Those days are gone. Instead, buy the names that are out of favor."

Chart courtesy of www.StockCharts.com

Right now, Kramer said she loves Iova Biotherapeutics Inc. (NASDAQ:IOVA) and its new spin on fighting cancer. It could easily be a $100 stock again over time, she added.

Chart courtesy of www.StockCharts.com

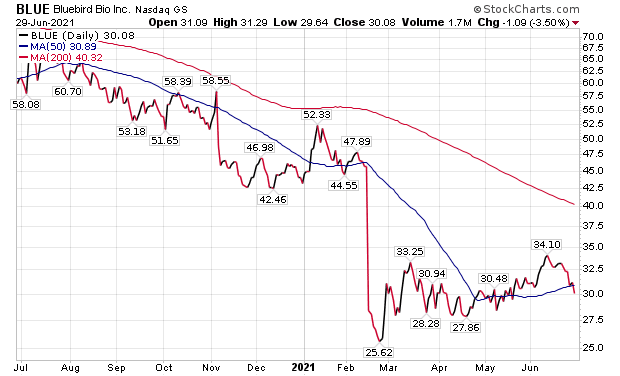

"I haven't given up on Bluebird Bio Inc. (NASDAQ:BLUE)," Kramer said. "Similar target; huge potential. Precision BioSciences Inc. (NASDAQ:DTIL), which has been a real sleeper but could one day both cure diseases and global hunger with a single genetic platform. Of course, it might take years if it happens at all, so stay diversified and resilient. But if you are in biotech, odds are good you want to aim high."

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

Five Biopharmaceutical Stocks to Buy as New Variants of COVID-19 Spread

The increasingly transmissible Delta variant of COVID-19 has spread to almost every state in America, raising concerns among health officials about potential future spikes in cases. Genetic variants of SARS-CoV-2 have been emerging and circulating around the world throughout the COVID-19 pandemic, according to the Centers for Disease Control and Prevention (CDC).

A variant has one or more mutations that differentiate it from other variants in circulation. The Delta variant is expected to become the dominant coronavirus strain in the United States, the CDC director recently said. With more than half the U.S. population not fully vaccinated, public health officials caution that a resurgence of Covid-19 cases could occur in the fall when many unvaccinated children are expected to return to school.

Progress in the COVID-19 vaccination process lifts hope that new cases and deaths will keep dropping. So far, 179,940,202 people, or 54.2% of the U.S. population, have received at least one dose. Those fully vaccinated total 154,199,664 people, or 46.4%, of the U.S. population.

In addition, the Food and Drug Administration (FDA) recently approved a third COVID-19 vaccine, manufactured by Johnson & Johnson (NYSE:JNJ), which requires only one dose rather than two, as with the first two vaccine providers: Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA).

COVID-19 cases worldwide have hit 181,764,498 and caused 3,937,050 deaths, as of June 30, according to Johns Hopkins University. U.S. COVID-19 cases totaled 33,652,098 and have led to 604,474 deaths. America has the dubious distinction as the country with the most COVID-19 cases and deaths.

The five biopharmaceutical stocks to buy give investors ways to profit amid the pandemic while helping to fund the development of new treatments. Increased COVID-19 vaccine availability, an improving economy and a recent $1.9 trillion federal stimulus package should help to lift the valuations of the five biopharmaceutical stocks to buy. | | | Sincerely,

Paul Dykewicz, Editor

StockInvestor.com

| | About Paul Dykewicz: Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul also is the author of an inspirational book, "Holy Smokes! Golden Guidance from Notre Dame's Championship Chaplain", with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz. | | | | | |

Tidak ada komentar:

Posting Komentar