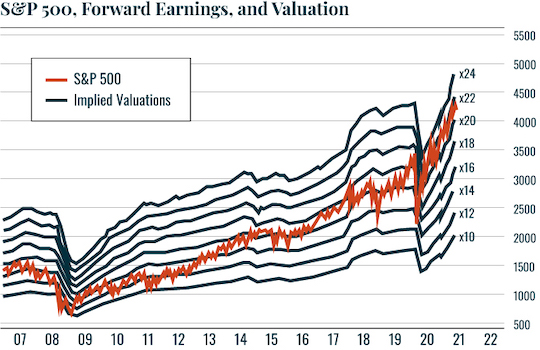

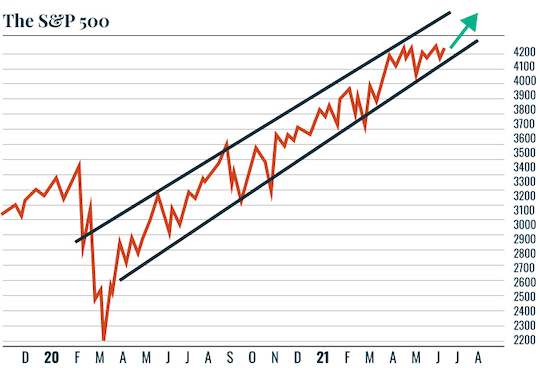

| With that in mind, take a look at what long-term Treasury yields have been doing in the last year (red parabola). The yield on the 30-year U.S. Treasury more than doubled from 1.2% to 2.4% from August 2020 to March 2021. Now look at what the yield on the 30-year U.S. Treasury has done since the Fed release last week (blue square). Talk about a reversal!  With Treasury yields falling again, this opens the door to stocks being valued in bubble-territory. As economist Edward Yardeni has noted, at 22 times forward earnings, the S&P 500 would be priced around 4,500 by year-end.  Things could go even crazier from there. Provided there isn’t some black swan event, if yields on the long-term Treasury continue to fall to new lows (say 1.5%), this would allow for stocks to go into true “looney tune” bubble territory. We’re talking 5,000 and higher in the S&P 500.  Even if we don’t see stocks get to that height, the door is open to a spectacular crash all based on the Fed’s bluff. I’ll explain why in tomorrow’s article. Until then… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar