Five Retail Stocks to Buy Amid the Supply Chain Squeeze 08/31/2021 | | | "What is that thing for?" my friend Dave asked when he saw my new iPhone 12 Pro. He was talking about the weird extra lens on the back. It has nothing to do with taking pictures... But it is the key to a $350 billion tech revolution. And this technology will make today's smartphones and computers obsolete by 2022. Let me show you what this lens does (it will blow your mind!) and why it holds the potential for up to 10,000% gains. Click here for the full story. Click Here... | | | | Five retail stocks to buy amid the ongoing supply chain squeeze include three companies known as discounters, a fourth that is not dependent on foreign-made merchandise and a fifth that is one of the world's biggest and best-known providers of modestly priced products.

The five retail stocks to buy feature companies that may be able to navigate the current freight backlog better than many other retailers that also will be affected by the slowed delivery of goods from overseas manufacturers. BoA Global Research listed four of the stocks as a buy, while seasoned stock picker Jim Woods, who leads the Intelligence Report and Successful Investing newsletters, as well as the Bullseye Stock Trader advisory service, chose the final one.

Paul Dykewicz interviews Jim Woods, who recommends a retailer to buy in Intelligence Report.

BoA consulted with Christopher Chase, marketing manager at the Port of Los Angeles, to provide firsthand information about the state of the current freight backlog. Chase reported that the cargo currently on the water or expected to load in the next month should arrive on time for peak season, but November holiday orders could be at risk of delay.

Three Discounters Head the List of Five Retail Stocks to Buy

Potential winners from supply chain delays include discounters such as Burlington Stores Inc. (NYSE:BURL), also known as Burlington Coat Factory, an off-price retailer, and a division of Burlington Coat Factory Warehouse Corporation. The company operates 740 stores in 40 states and Puerto Rico, with a corporate headquarters in Burlington Township, New Jersey.

However, the share price has plunged recently. For example, Burlington fell 9.2% on Aug. 26 despite the company reporting positive earnings for second-quarter fiscal 2021 that topped the Zacks consensus estimate and showed improvement from the same quarter the year before. Bargain hunters may find the stock price worth purchasing after its recent drop to $299.49 at the close of trading on Aug. 31.

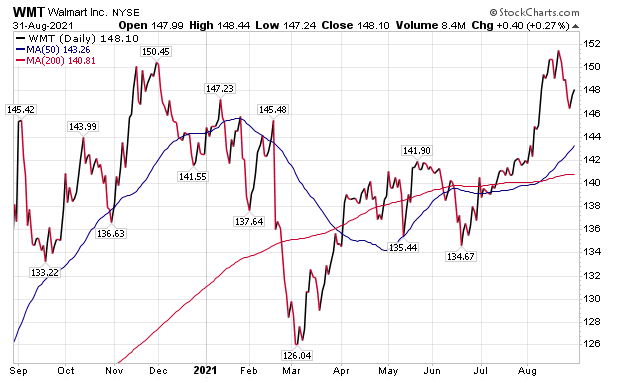

Chart courtesy of www.StockCharts.com

Potential Bargain Burlington Stores Gains Spot Among the Five Retail Stocks to Buy

Burlington's revenues failed to attain analysts' consensus estimate, despite rising from the fiscal second quarter for the previous year. CEO Michael O'Sullivan commented that the "trend is difficult to predict" and the business will be managed flexibly to chase opportunity or pull back if needed. The straight talk seemed to have unsettled certain investors amid the share price's drop.

"In addition, we are seeing a huge imbalance between supply and demand in global logistics systems," O'Sullivan said. "This is driving up freight and supply chain expenses and it will put significant pressure on our margins for the balance of the year."

BoA's price objective for Burlington is $370, based on 39x a fiscal 2022 earnings estimate to reflect strong performance and the opportunity for earnings to continue beating analysts' forecasts. This is a premium to the off-price peer group, but Burlington's above-average expected earnings growth and ongoing margin expansion warrant a premium valuation, BoA concluded.

Potential risks to Burlington meeting the price objective set by BoA are weaker-than-expected comparable store sales and reduced gross margins than now estimated.

Ross Stores Ranks Among the Five Retailers to Buy

Ross Stores, Inc. (NASDAQ:ROST) is an S&P 500, Fortune 500 and Nasdaq 100 company headquartered in Dublin, California, with fiscal 2020 revenues of $12.5 billion. The company operates Ross Dress for Less, the largest off-price apparel and home fashion chain in America with 1,585 locations in 40 states, the District of Columbia and Guam at the end of fiscal 2020.

Ross aims to offer quality, in-season, name brand and designer apparel, accessories, footwear and home fashions at savings of 20% to 60% off regular department and specialty store prices. The company also operates 274 dd's DISCOUNTS stores in 21 states that feature moderately priced quality, in-season and name brand apparel, accessories, footwear and home fashions at savings of 20% to 70% off department and discount store regular prices.

Chart courtesy of www.StockCharts.com

BoA's $150 price objective is based on a price-to-earnings (P/E) of 27x the investment firm's fiscal 2022 estimate. Its analysis found Ross deserves to trade at a premium to specialty retailers (averaging a multiple of 17x) due to its capability to post outsized comparable store sales, its track record of growth despite economic volatility, significant new store potential and a history of returning excess cash to shareholders through buybacks and dividends.

Risks to meeting BoA's price target are potential lower comparable sales than currently estimated, gross margin contraction due to markdowns, execution problems and a pullback in spending by middle- and moderate-income customers.

TJX Secures Slot Among Three Discounters on List of Five Retail Stocks to Buy

The TJX Companies, Inc. of Framingham, Massachusetts, is an off-price apparel and home fashions retailer in the United States and worldwide. With a mission of offering "great value" to its customers every day, the company's management team uses what it describes as a flexible business model to serve one of the widest demographic reaches in retail.

Historically, the TJX Companies serve a broad range of value-conscious consumers, while trying to deliver steady sales and earnings growth through many retail and economic environments domestically and abroad. TJX is one of the few large U.S.-based brick-and-mortar retailers of apparel and home fashions to have expanded successfully internationally with operations in nine countries across three continents.

The company's management plans significant long-term store growth both in the United States and internationally. Before the COVID-19 global health pandemic, TJX management managed to produce strong financial returns and cash flow simultaneously to invest in the growth of the business and return cash to shareholders.

Chart courtesy of www.StockCharts.com

BoA's price objective of $90 on TJX reflects a P/E of 25x its fiscal 2023 and 2022 calendar estimates. This is in line with the off-price group average. The investment firm views the multiple as warranted, since TJX has outperformed the retail industry domestically, has a solid international growth opportunity and significant square footage growth potential. Plus, TJX has a track record of returning excess cash to shareholders in a non-pandemic environment and high returns on invested capital.

Potential risks to the price target are weaker comparable sales than BoA now models, prolonged fleetwide store closures due to the coronavirus and continued margin pressure as TJX absorbs wage and freight inflation and supply chain expenses, as well as potential weakness in Europe.

Bath & Body Works Gains Place Among Five Retail Stocks to Buy

Bath & Body Works, Inc. (NYSE: BBWI), a specialty retailer based in Columbus, Ohio, offers a breadth of exclusive fragrances for the body and home through its Bath & Body Works stores. Formerly known as L Brands, Inc., Bath and Body Works announced on Aug. 3 that it completed the previously announced separation of its Victoria's Secret business into an independent, publicly traded company named Victoria's Secret & Co. The new company includes Victoria's Secret Lingerie, PINK and Victoria's Secret Beauty. Victoria's Secret common stock began trading that day on the New York Stock Exchange under the ticker symbol VSCO, while Bath & Body Works common stock started trading the same day under the new ticker symbol BBWI.

"We are thrilled to have reached this milestone and to launch Bath & Body Works as a standalone public company," said Andrew Meslow, chief executive officer of Bath & Body Works. "Innovation remains at the foundation of Bath & Body Works, and with our leadership positions across key product categories, strong performance across channels, and highly loyal and growing customer base, we are poised to continue our track record of industry-leading growth and profitability."

The separation was achieved through the distribution of 100% of the shares of Victoria's Secret to holders of Bath & Body Works common stock after the market close on Aug. 2. Bath & Body Works stockholders received one share of Victoria's Secret common stock for every three shares of Bath & Body Works common stock held at the close of business on the record date of July 22.

Bath & Body Works' net sales soared to $1.704 billion for the second quarter ended July 31, 2021, compared to net sales of $1.253 billion for the second quarter ended Aug. 1, 2020. Bath & Body Works sales for the second quarter of 2021 zoomed 54% compared to the same period the prior year.

Chart courtesy of www.StockCharts.com | | | Gold is going on a big run. Billionaires who hated gold are suddenly loading up. And even Bank of America is calling for $5,000 gold in the years ahead.

Today, one of America's top investors over the last 40 years has a new way to play gold... and it could make investors like you a fortune. Click here to find out his prediction. Click Here... | | | | Victoria Secret's Financial Performance Reveals Weakness Amid the Pandemic

Shares of Victoria's Secret slid and those of Bath & Body Works climbed after the two now-separate retailers reported their respective quarterly earnings results for the first time. Victoria's Secret shares closed Thursday, Aug. 19, down 3.5% at $69.15, while Bath & Body Works shares jumped more than 10% to $65.51.

While trying for a turnaround, Victoria's Secret announced its sales for its fiscal second quarter ended Aug. 1 increased to $1.61 billion, up from $1.07 billion for the same quarter a year ago. But the company's revenues have not been able to match pre-pandemic levels. Victoria's Secret's management also held back on offering an outlook for the full fiscal year due to uncertainty from the COVID-19 pandemic that poses problems in assessing consumer demand.

Pandemic-related disruption to Victoria's Secret's supply chain also is expected to boost freight and product costs by up to $100 million this fall and hurt its profitability in the fiscal fourth quarter, company management said.

BoA's price objective for Bath & Body Works of $90 values the company at 13.5x its fiscal 2022 estimated enterprise value (EV) / earnings before interest, taxes, depreciation and amortization (EBITDA). The investment firm expects continued growth as all of BBW's categories are beneficiaries of consumer demand trends spurred by COVID-19. This multiple reflects its history of consistent growth. A standalone BBW will command a higher multiple, BoA predicted.

A possible risk to meeting BoA's price objective is if comparable sales fall below estimates.

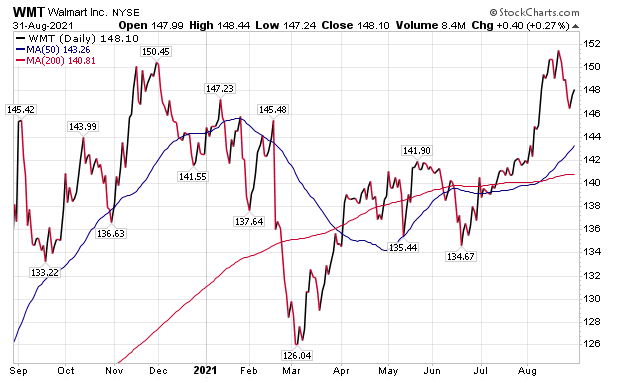

Five Retail Stocks to Buy Include Walmart

Walmart (NYSE:WMT), a giant Bentonville, Arkansas-based retailer, reported revenue for fiscal second-quarter ended July 30, 2021, of $141.0 billion, up a modest 2.4%, weighed down by roughly $8.9 billion in divestitures. Excluding currency fluctuations, total revenue would have ticked up just 0.6% to $138.6 billion, the company reported on Aug. 17.

The company's consolidated operating income for the just-concluded second quarter reached $7.4 billion, up 21.4% from the same quarter a year ago. Consolidated operating income as a percentage of net sales jumped 83 basis points. In addition, Walmart's adjusted earnings per share of $1.78 excluded the effects, net of tax, of net losses on equity investments of $0.26 per share.

Walmart's U.S. business showed strength. One example was increased market share in its U.S. grocery business. Comparable transactions during the just-finished fiscal quarter jumped 6.1%. Plus, Walmart U.S. operating income gained 20.4% in the latest fiscal second quarter, with adjusted operating income rising 12.0%.

"When inflation creeps higher, consumers tend to buy where their dollars are treated best," said Jim Woods, editor of the Intelligence Report and Successful Investing newsletter, as well as the leader of the Bullseye Stock Trader advisory service. "One way to play this is to own the biggest discount retailer in the world, Walmart."

Woods recommends WMT in his Intelligence Report Income Multipliers portfolio. The stock has been a profitable recommendation for his subscribers.

Chart courtesy of www.StockCharts.com

Sales at Walmart U.S. eCommerce Outpace Those of Its Domestic Brick-and-Mortar Stores

Walmart U.S. eCommerce sales grew 6% and 103% on what management described as a "two-year stack." The company's advertising businesses increased globally and nearly doubled in the United States compared to the same quarter a year ago.

Current and prospective shareholders may appreciate that Walmart has repurchased $5.2 billion in shares year to date, or around 25% of the $20 billion authorization announced earlier this year. Such share repurchases help to support the stock price.

Bob Carlson, a pension fund chief who heads the Retirement Watch investment newsletter, said a number of retailers are likely to do well in the next year or two.

"I believe economic growth will continue at a strong rate," Carlson said. "Households are in the best financial position they've been in some time."

Delta Variant of COVID-19 May Slow Five Retail Stocks to Buy

The highly transmissible Delta variant of COVID-19 has spiked concerns from health experts about a new surge in the spread of the virus across the United States. The Centers for Disease Control and Prevention (CDC) is blaming the variant for a rash of new case numbers and rising death rates.

However, the variant is leading to a jump in the number of people vaccinated from COVID-19. As of Aug. 31, 205,026,070 people, or 61.8% of the U.S. population, have received at least one dose of a COVID-19 vaccine. The fully vaccinated total 174,121,529 people, or 52.4%, of the U.S. population, according to the CDC.

COVID-19 cases worldwide, as of Aug. 31, total 217,632,545 and led to 4,518,377 deaths, according to Johns Hopkins University. U.S. COVID-19 cases thus far have reached 39,197,606 and caused 640,089 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five retail stocks to buy can help investors to profit amid the pandemic, since people always are looking to buy bargains, especially with quality included. | | | Do you know how to tell before the bottom drops out of the market? In this brand new, FREE, e-book, you'll learn five tips, tools, and strategies that can keep you from costly losses during dips and corrections... and save your account before a meltdown.

Get the full story by downloading Five Tips for Overcoming Market Volatility. Because not only will these strategies let you sleep soundly at night... they will keep your money growing while they're protecting it! Click Here... | | | | Sincerely,

Paul Dykewicz, Editor

StockInvestor.com

| | About Paul Dykewicz: Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul also is the author of an inspirational book, "Holy Smokes! Golden Guidance from Notre Dame's Championship Chaplain", with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz. | | | | | |