| You know my shtick. I love dividends. I like scoring capital gains too, of course. Selling stock for more than you bought it for feels great. But I love dividends. I love when that cash hits my account each quarter. So given that I love dividends, it shouldn’t be surprising that real estate investment trusts (REITs) are some of my favorite assets to buy. Because REITs avoid U.S. federal income taxation at the corporate level, they tend to be some of the highest yielders in the market. A high yield doesn’t always represent the best value. Some of the best REITs, and those enjoying fantastic industry tailwinds, are some of the lowest yielding. And some high-yielders, like this massive REIT, aren't worth the price of entry.

Suggested Stories: 3 Huge Monthly Dividends Set to Soar (One Yields an Incredible 7.6%) Our Hotlist Revealed 300% and 80% Winners — One Is Still a Buy

| At first, what this man unboxes live on camera will confuse you… But then, it will start to sink in… And your life may never be the same. | |

Chart of the Day

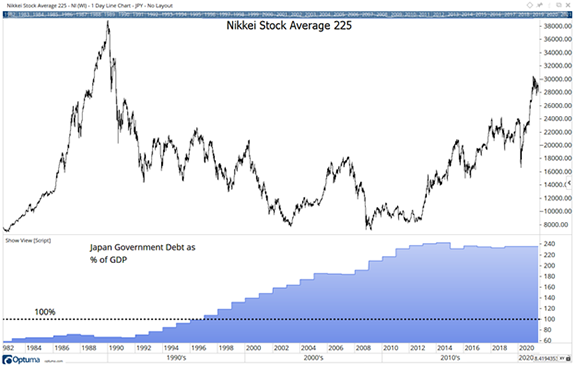

Washington is polarized. But there does seem to be agreement that spending is set to increase, which will increase national debt. The details on the current budget request are uncertain, but Biden’s goals are clear enough: He calls for spending to increase to $8.2 trillion by 2031 to upgrade the nation’s infrastructure and expand the social safety net. Investors may be concerned that increased spending will lead to increased national debt. And some economists worry that debt can slow economic growth and harm the stock market. Japan set a precedent, shown in the chart below, to help us understand the impacts of government debt.

Suggested Stories: The Economic Rally Is in Trouble How Inflation Can Hurt Stocks

| Could America become the world's No. 1 manufacturing power again? Sounds unbelievable, but one overlooked technology is making it possible. It's going to create 63 million middle-class jobs … and a $100 TRILLION mega-economic boom, according to the World Economic Forum. It's also going to create a new millionaire class of investors, thanks to one little-known stock at the forefront. | |

|

1958: Alaska became the 49th state in the Union. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar