Dear Money & Crisis Reader, Dear Money & Crisis Reader,

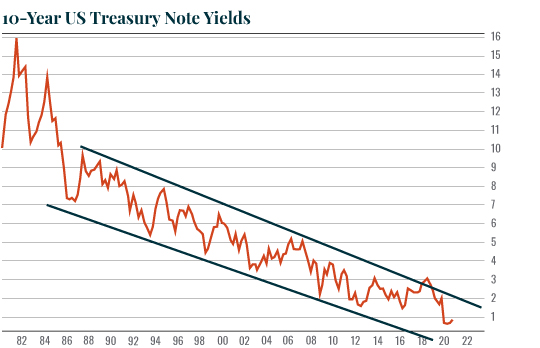

Over the last few weeks, I’ve spent a lot of time presenting the different outcomes for the market depending on who ends up winning the 2020 presidential election. Today I’d like to take a moment to talk about one way in which Joe Biden and President Trump are similar. Both have shown themselves to be BIG believers in government spending. During the eight years of the Obama administration, for which Joe Biden served as vice-president, the U.S. grew its debt load from $11 trillion to $19 trillion ($8 trillion total, or roughly $1 trillion in new debt per year). President Trump has proven to be no different. During his first four years, he grew the U.S. debt load from roughly $20 trillion to over $26 trillion. To be fair, a significant portion of this debt growth (approximately $3 trillion) occurred in response to the economy being shut down due to the COVID-19 pandemic. However, the fact remains that even if the pandemic hadn’t happened, President Trump was on track to add nearly $5 trillion to the U.S. debt load during his first four years (a little over $1 trillion per year). Put simply, regardless of who ends up actually winning this presidential election, we can expect the debt binge to continue. The Fallout of Too Much Debt This debt binge will require bond yields to remain at or below historical lows in order for the U.S. to continue financing itself. This means a continued bull market in bonds, with bond yields staying within the confines of the downward channel that has guided their direction for most of the last 30-plus years.  In order to maintain this bull market in bonds (bond prices rally when their yields fall), the Fed will continue to play a major role. During a private lunch, former Fed Chair Ben Bernanke once told a group of hedge fund managers (who paid $250K a pop for his time) that the Fed would be unable to raise rates to their historic average of 4% during his lifetime. Current Fed Chair Jerome Powell has proven this statement accurate. |

Tidak ada komentar:

Posting Komentar