Dear Money & Crisis Reader, Dear Money & Crisis Reader,

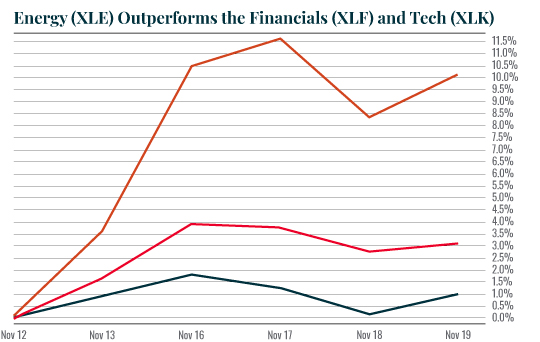

The market is undergoing a rotation courtesy of the vaccine news. Rotation is when capital moves from one sector to another. Typically, capital moves from winning industries, to industries that are lagging behind. In our current market, this would mean money moving from the tech sector, which has been THE market leader since the March lows, into areas like energy and financial stocks: two of the worst performing sectors. And that is indeed what we saw this week in the markets, with energy (XLE) returning 10%, financials (XLF)returning 3% and tech (XLK) essentially flat.  THE issue for the markets now is whether or not this trend continues. If it does, it would suggest the economy will continue to open up. Reflation plays (plays associated with economic resurgence) will become THE market leaders where you want to put your money. If it doesn’t — if XLE and XLF roll over while XLK begins to rally again — this would suggest the economy will be moving back into lockdowns again. That environment favors tech which is one of the few sectors that can grow when people are forced to stay at home. Will These Trends Continue? With that in mind, let’s take a look at some ratio charts for energy vs. tech (XLE:XLK) and financials vs. tech (XLF:XLK). |

Tidak ada komentar:

Posting Komentar