Watchlist: February 2026 Edition.this Thiel Fellow just bicep curled $60M without breaking a sweat. five startups to scout this month.The etymology of the word “flex” can be traced back to the father tongue of languages, Latin - “flectere” means to bend, and “flexus”, the past participle, means to bend or curve. Usage of the word has grown sharply over time since the early 1900’s, when it meant to bend or tense a muscle group, most notably the bicep. The literal definition - a physical demonstration of strength capacity - has been recently refined into a more abstract interpretation derived from urban culture. “Flex” in today’s language economy refers to “a boastful statement or display”, popularized largely by hip hop culture from the 2000s to present, and then officially convocated into mainstream vernacular through social media, i.e. “weird flex” circa 2018. To flex is to express yourself in the worst way possible Like buying a $300,000 Maybach, taking the doors down, cutting the roof off, and driving the German landyacht like a car from Mad Max. This is a thorough flex; unapologetically braggadocious, pushing consumerism to the cliff with no regard for human life. While the meaning of “flex” has remained constant over the past decade, its essence is slowly shifting. At the root of this shift is increased societal awareness around a medical explanation for our hyperconsumerist tendencies. Those with experience fasting from food can attest to an interesting occurrence that sometimes takes place: after a few hours of fasting, the hunger pains disappear, and then come back infrequently; when the fast is over and you make the decision to eat again, your mind plays a trick on you, and rather than eat an appropriate amount of food, you binge in an attempt to psychologically make up for not eating the past few meals. Since your body has briefly grown accustomed to a low energy state, the influx of food hits harder than usual. Afterwards, you realize the feeling you were searching for by doubling up on food never arrived. The scientific term for this fatale is “post-fast hyperphagia” or “rebound hyperphagia”, and I have been drawn in by her siren song more times than I care to admit. The consumerist equivalent of rebound hyperphagia preys on the newly wealthy and the old money crowd alike. Man overspends on unneeded luxuries to compensate for his past pains - a triple black Bentley Bentayga to remind you of all the times your company should have died, a blood red 458 for all the lovers that left, a cream colored Sunseeker to drown out childhood trauma. Spend and then spend some more, the high you are chasing is almost here. Her lies encounter minimal resistance from the mind’s security system because deeply knotted pain is ever present in our somatic memory. So we flex until our arms hurt Alas, the remedy to any illness starts with recognition. The people are slowly waking up from slumber, realizing that good things are good up until a certain point, and a societal transition is taking place, moving us away from excess consumption and towards beauty, substance, and peace. Simplicity is the new luxury. There’s a statistic going around that roughly 10% of Thiel Fellows have founded billion dollar companies and about 33% of Thiel Fellows have started companies valued at a hundred million dollars or higher. Ceteris paribus, the odds of starting a billion dollar business are 2x higher for Thiel Fellows compared to Y-Combinator graduates (~4.5%), and more than 10x higher for a venture backed startup (<1%). The most prominent billion dollar Thiel Fellows include Vitalik Buterin (Ethereum), Lucy Guo (Scale AI), Dylan Fields (Figma), Chris Olah (Anthropic), Walden Yan (Cognition AI), Brendan Foody, Adarsh Hiremath, Surya Midha (Mercor), and Austin Russell (Luminar Technologies). Zaid Rahman will join this list soon. The former Columbia University student dropped out to become a Thiel Fellow in 2017. And his company recently raised a $60M Series B to build the financial operating system for an abandoned market. Flex is building an AI-native private bank for high net worth, middle-market business owners. The problem Rahman’s solving is deep pain for high net worth business owners; individuals who own middle-market companies have complex financial lives both on a company level and a personal level; managing both is a perpetual grievance. With Flex, owners get a single platform to control all parts of their financial lives at once, while leveraging artificial intelligence to find easy wins that result in tangible cost savings and simplicity.

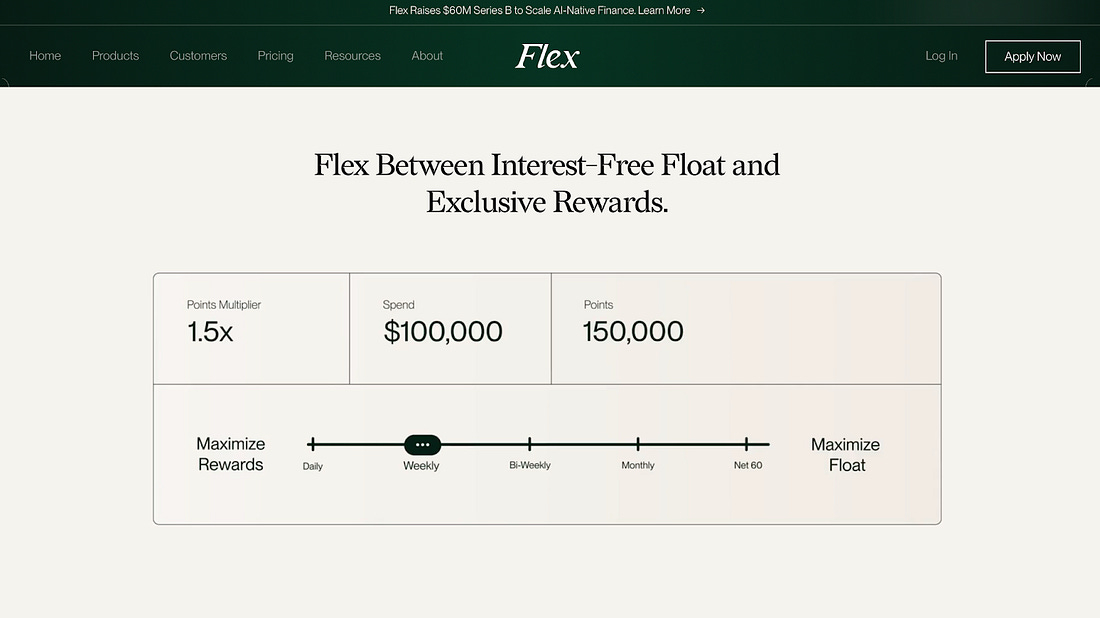

The primary product is their Flex Net-60 credit card known as the Flex Card, the first three-in-one business credit card that offers interest free float (an 0% interest loan) for up to 60 days, allowing business owners to get easy money on hand for much longer than any other card on the market, all while retaining the optionality to “flex” between interest-free float time period and maximize personal travel and lifestyle rewards for the business owner. It’s the easiest decision a middle market business founder can make. This is Flex’s wedge, a Trojan horse into their customers’ financial lives. Using the Flex Card as top of funnel, the company sucks unsuspecting customers into their vertically integrated financial operating machine. At the heart of the beast is an AI-driven underwriting system that allows for precise risk analysis, which then enables Flex to offer more tailored products outside the scope of traditional banks. Over the course of 2025, Flex:

Flex’s story since its founding in 2021 has been one of consistency and steady growth. It took roughly a year to hit $1M+ in transactions, and then two more years to hit $1B+ in transactions. They acquired Ghost Financial, a finance tool platform for ghost kitchens, in 2023. 2024 was the year of in-person events and brand building. Ramp’s growth was much more explosive than Flex’s for a number of reasons:

Flex is not Ramp. They are comfortable playing in a much smaller initial market than Ramp. They are comfortable with a flatter growth curve than Ramp. They are comfortable serving a forgotten demographic. But Flex’s much smaller initial market is filled with individuals all safely in the top 1% of America net worth wise. Their flatter growth curve meant that Ramp, Brex, Airwallex, and other competitors ignored the opportunity completely. Their forgotten demographic makes for exceptionally loyal customers. If Ramp is building the business card equivalent of JPMorgan, the world’s largest investment bank, underwriting every major company under the sun, Flex is building Goldman Sachs’ private wealth arm, a trusted financial partner for the high value individuals. With all that said, an amusing similarity between the two companies is their use of athlete marketing. The partnership is an on-brand activation, leveraging a sport often overshadowed by football, basketball, and even another racing league, F1, to drive awareness. Flex’s earliest investors are feeling giddy about the upwards momentum. Jonathan Wasserstrum, founding partner at Unwritten Capital and Flex seed investor, told mainstreet media that “Flex has been a fun one to watch. When we first invested, they were focused on the construction industry. Needless to say, they’re expanding their customer base and product in a massive way. And the most fun part is that they are just getting started.” Ben Zises, founding partner at SuperAngel.Fund, and Flex pre-seed investor, sent us the following LinkedIn post which tells the origin story of his relationship with Zaid. Per the post, “My relationship with Flex began in April 2020, when I received a DM on X (then Twitter) from founder Zaid Rahman about a new idea he was exploring. At the time, I hadn’t yet transitioned into full-time investing and didn’t have the bandwidth - so I asked him to keep me posted. He did. And I’m glad he did.” In October 2021, Zises made his first investment in Flex, followed by a second check in October 2022 alongside Fifth Wall, Hustle Fund, Not Boring, Banana Capital, and Jonathan Wasserstrum. Flex’s $60M Series B was led by Portage Ventures with participation from Crosslink Capital, Titanium Ventures, Wellington Management, and others. Next round could be Zaid Rahman’s biggest flex yet. Galadyne

Inception AI

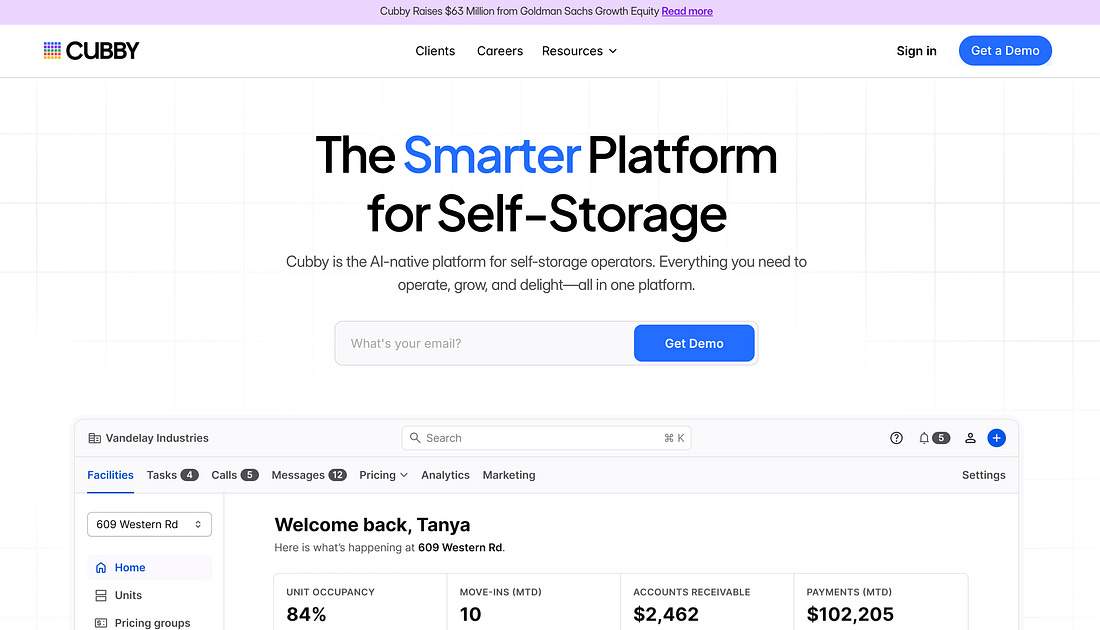

Cubby

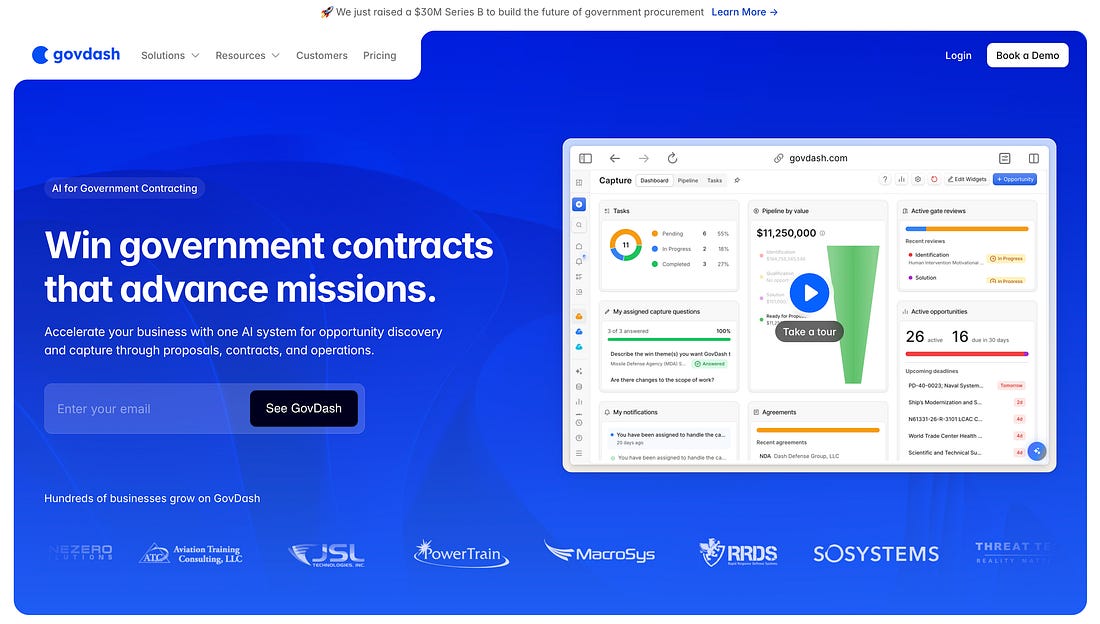

GovDash

for your eyes only. |

Kamis, 12 Februari 2026

Watchlist: February 2026 Edition.

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar