Wealth Daily readers know that the financial world often reverberates with warnings long after reality has already begun its seismic shift.

But last week one of the most powerful voices on the planet — Ray Dalio, the founder of Bridgewater Associates — sounded an alarm that is both a culmination of years of analysis and a clarion call that the economic age we thought was stable is unraveling before our eyes.

Dalio didn't mince words at the World Governments Summit in Dubai earlier this month: The world is "on the brink" of a capital war, a new form of conflict where money itself becomes the weapon of choice.

In this war, traditional battlefield terms like tanks and missiles are replaced with debt, sanctions, currency dominance, and the strategic control of capital flows.

And in this emerging age of financial warfare, Dalio argued, there is one asset that stands as the ultimate defensive position: gold.

To anyone who has been following the MoneyQuake thesis — that gold and hard assets are not only back, but destined to define the next era of finance — Dalio's words aren't just insightful. They are vindication.

The Debt Monster That Ate the World

Dalio's warning isn't speculative. It's grounded in a stark assessment of the global balance sheet:

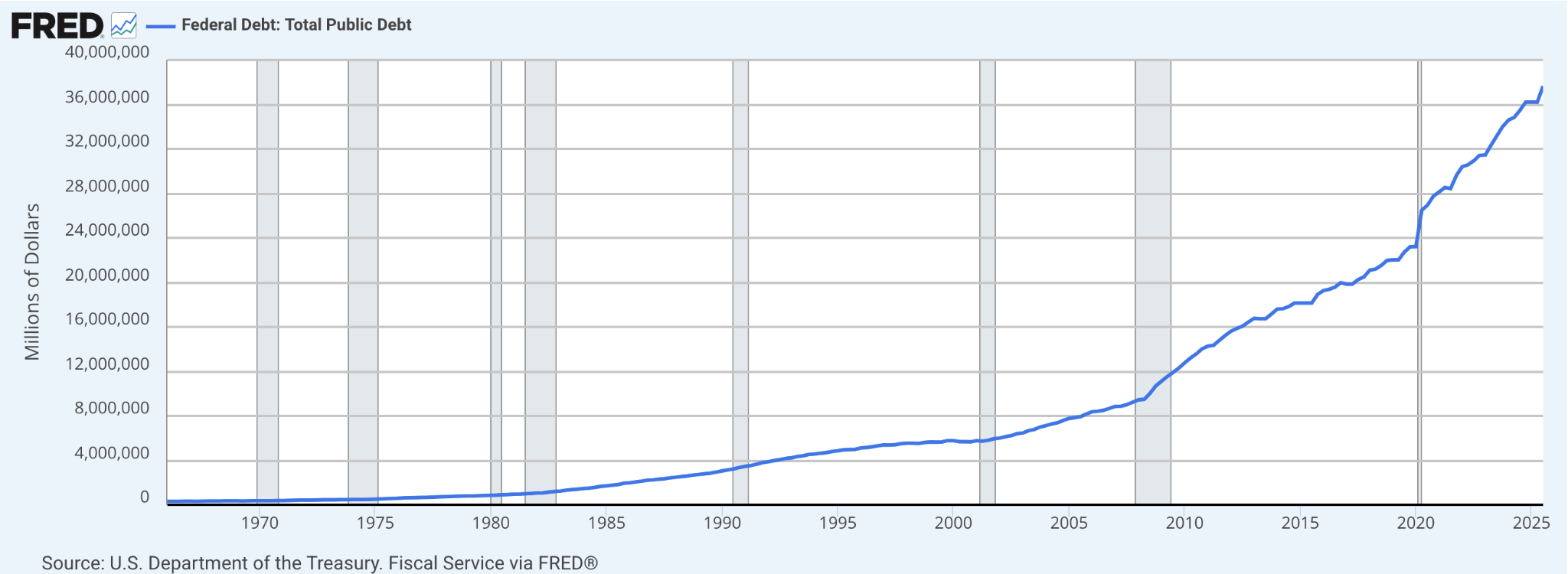

- U.S. national debt has ballooned to well over $38 trillion, a mountain of IOUs that no one — not governments, not investors, not markets — believes will be repaid in "real money" without massive inflation or currency devaluation.

- Foreign holders of U.S. Treasuries — once the cornerstone of global capital allocation — are beginning to flee. European pension funds have begun reducing exposure to U.S. debt, fearing loss of trust and the weaponization of sovereign credit.

- The "rule-based system" that anchored the post-World War II order is fraying, especially as geopolitical tensions between the U.S., China, Europe, and others intensify.

In Dalio's view, this isn't just another business cycle. It's the breakdown of the global monetary order — the same structural shift that the MoneyQuake framework has been pointing to for years. The old system was built on trust in government debt, faith in the dollar's dominance, and the illusion that liquidity would always save the day. That faith is now evaporating.

Trump's Tariff Windfall is Turning Into Cash Checks — Did You Claim Yours?

Nearly $400 billion a year is now flowing into Washington from foreign imports.

A portion of that money is already being redirected into "Tariff Rebate Checks," paying qualifying Americans up to $8,276 every quarter.

The next payout window is approaching fast.

Click here for the details.

Weaponizing Money and the New Geopolitics

Dalio's concept of a "capital war" is profound because it reframes conflict around the most potent lever of modern power: money itself. Instead of missiles, nations use sanctions, asset freezes, restrictions on capital flows, currency alliance strategies, and debt leverage as tools to extract strategic advantage.

This is not academic. We saw this play out when:

- Russia was cut off from SWIFT and its access to global capital trashed in 2022.

- Western sanctions on Chinese access to advanced tech have reshaped global supply chains.

- And now the U.S. dollar's privileged reserve status is being challenged as foreign holders question whether they can trust a system that is increasingly weaponized.

When money itself becomes an instrument of conflict, the dynamics shift dramatically. Countries can no longer rely on debt as a neutral store of value. Markets can no longer assume that liquidity will always cushion the fall. And investors can't assume the U.S. dollar will continue as the safe harbor it once was.

Why Gold? The Oldest Money in the New Age

In this emerging capital war, Dalio's answer isn't stocks, bonds, or fancy algorithms. It's gold — the oldest form of money humanity has ever known.

In his Fortune interview and at other forums over the past year, Dalio has repeatedly described gold as the safest asset in a world where fiat currencies and sovereign debt are losing their legitimacy. Gold, he said, is an apolitical asset that's not the liability of anyone else, and it benefits precisely when trust in paper money declines.

Gold's logic is simple:

- Fiat money can be printed at will.

- Debt is a promise that can be diluted through inflation or repudiated through default.

- Currencies can be weaponized or sanctioned.

- But gold — because it cannot be created at will — holds value when trust in all those other constructs disappears.

This is exactly what MoneyQuake has been preaching: The old financial architecture, built on cheap credit and unbacked currency, is collapsing under its own contradictions. As that happens, scarce and intrinsic value assets like gold don't just retain wealth — they outperform.

Dalio's Allocation Recommendation: A Practical Hedge, Not a Prophecy

Dalio hasn't just been vocal about gold's role in theory — he has given practical allocation guidance as well. Over the past year, he's recommended that investors consider a 5%–15% allocation to gold as part of a diversified portfolio, precisely because traditional assets like bonds and fiat hold significant downside risk in today's environment.

To many old-line portfolio managers, that might sound radical. But in the MoneyQuake framework, it's sensible:

- Traditional 60/40 portfolios assume stability in bonds and fiat — an assumption that is crumbling.

- Allocations to gold and other hard assets act as insurance against the destruction of purchasing power.

- When central banks increase holdings of gold, investors should notice — this is not comfort buying, it's strategic positioning.

It's not a speculative bet. It's rational liquidity management in an era where debt is no longer safe and money itself is a weapon.

Pentagon Cover-Up Crumbles!

Get the Ticker Before the Mass Awakening…

Some people will deny this. Most will be too puzzled to act. And a few will get filthy rich.

Because what I'm about to reveal involves a hall of mirrors and a rabbit hole 1000 miles deep, constructed for ONE REASON.

To keep a lid on the World's Greatest Secret.

Dalio and the Dollar's Decline: More Than Just Talk

You've heard MoneyQuake's thesis on the demise of the dollar — that the global reserve currency status of the U.S. dollar is structurally threatened by debt accumulation, geopolitical competition, and loss of confidence in fiat money. Dalio's warnings align with that view.

In index after index, metric after metric, the dollar's dominance is weakening. Foreign holders of U.S. Treasuries are shedding those positions. The yen, euro, and emerging market currencies are exploring alternatives to a dollar-centric system. And gold's share of global central bank reserves — historically associated with financial trust — is increasing.

Dalio's remarks recognize that when the underlying trust in a currency erodes — whether because of fiscal recklessness, geopolitical friction, or monetary weaponization — that currency loses its power to act as money. And when money fails, people fall back on durable stores of value.

Gold is, by definition, that store. Its appeal isn't dependent on promises, politics, fiscal promises, or central bank balance sheets. Its appeal is embedded in scarcity and the consensus of centuries.

A Nixon-Era Lesson for the 21st Century

Whenever Dalio talks about gold, he often draws historical parallels. He references the early 1970s — the last time the dollar's reserve currency status was truly questioned, leading President Nixon to sever the final tie between the U.S. dollar and gold.

This moment brought us decades of fiat money, credit expansion, and financial engineering. But it also unleashed the very forces we see today — explosive debt, weakened currency, political polarization, and markets divorced from real economic growth.

In many ways, Dalio is signaling that the 1971 moment is repeating, and this time with more force. The bridge between paper money and real value is once again under threat — and gold is the bridge asset that stands outside the system of promises.

The Monetary Reformation Is Already Underway

One of the most important narratives MoneyQuake has championed is that we are in the midst — not at the cusp — of a monetary reformation. A new paradigm is replacing the 50-year experiment with unbacked money and endless credit. And in this new paradigm:

- Debt is no longer the safe asset it once was.

- Fiat currencies face structural decline.

- Traditional bonds are losing their luster.

- Gold and hard assets are ascending as anchors for real wealth.

What Dalio is describing isn't hypothetical. It's happening. And for those who interpret markets through the lens of cycles and underlying monetary forces — not just headlines and short-term rallies — this moment is unmistakable.

What This Means for You Right Now

If you are a Wealth Daily reader, you already know this: Wealth is not made by following the crowd. It is made by anticipating shifts in the economic order and positioning accordingly.

Ray Dalio's warning about a capital war and his endorsement of gold do not mark the start of a trend — they mark the recognition of a trend that has been unfolding for years: the market's retreat from fiat trust and its embrace of scarcity value.

Gold is more than a hedge. It is a vote of confidence in stability when everything else is unstable. And as the debt picture worsens, geopolitical tension rises, and monetary systems strain, that confidence will be rewarded in markets — and in real purchasing power.

Dalio's message aligns perfectly with the pillars of the MoneyQuake thesis:

- Debt is the defining risk of this era.

- Fiat currencies are in structural decline.

- Monetary reformation is already here.

- Hard assets like gold are at the center of the next financial epoch.

The Bottom Line

When one of the most powerful investors alive — someone who has managed the world's largest hedge fund and spent a lifetime studying debt cycles — says we are on the brink of a capital war and that gold is the most reliable asset to own, you ignore it at your peril.

This is not fear-mongering. It is waking up to the realities that markets have been whispering for years — that trust in debt and unbacked money is evaporating, and that wealth will increasingly be judged by what you own when currencies fail, not by what you hold in paper promises.

The MoneyQuake isn't coming.

It's already here.

Get to the good, green grass first…

The Prophet of Profit,

Tidak ada komentar:

Posting Komentar