Dear Reader,

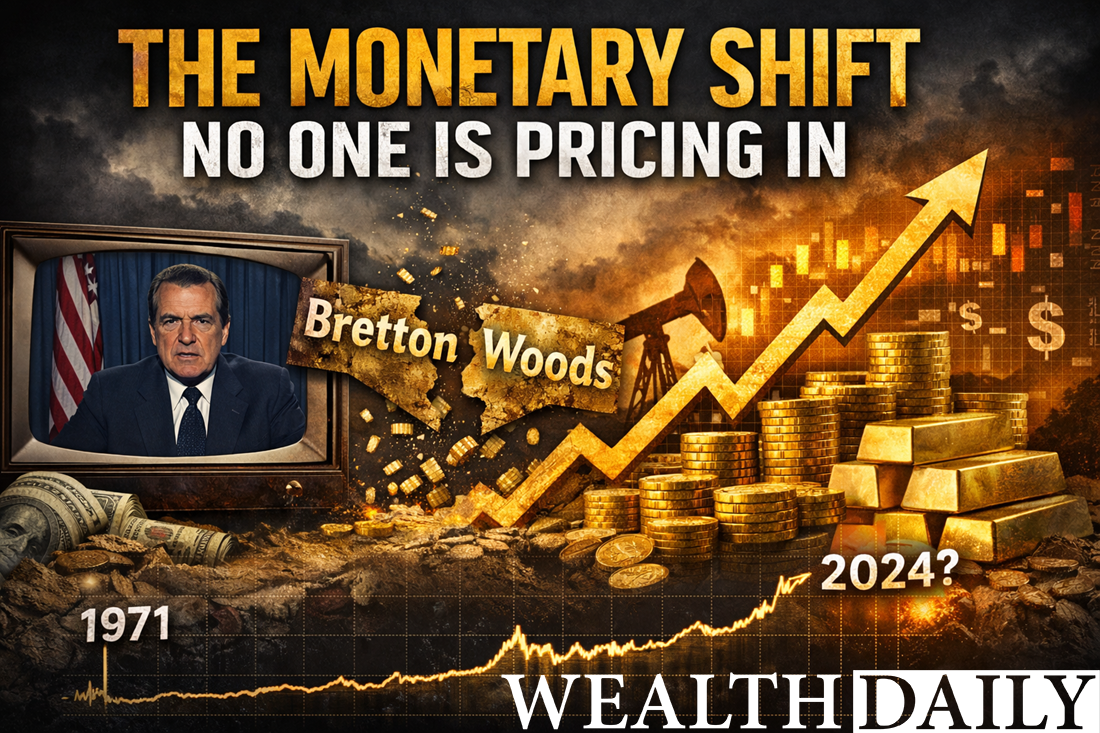

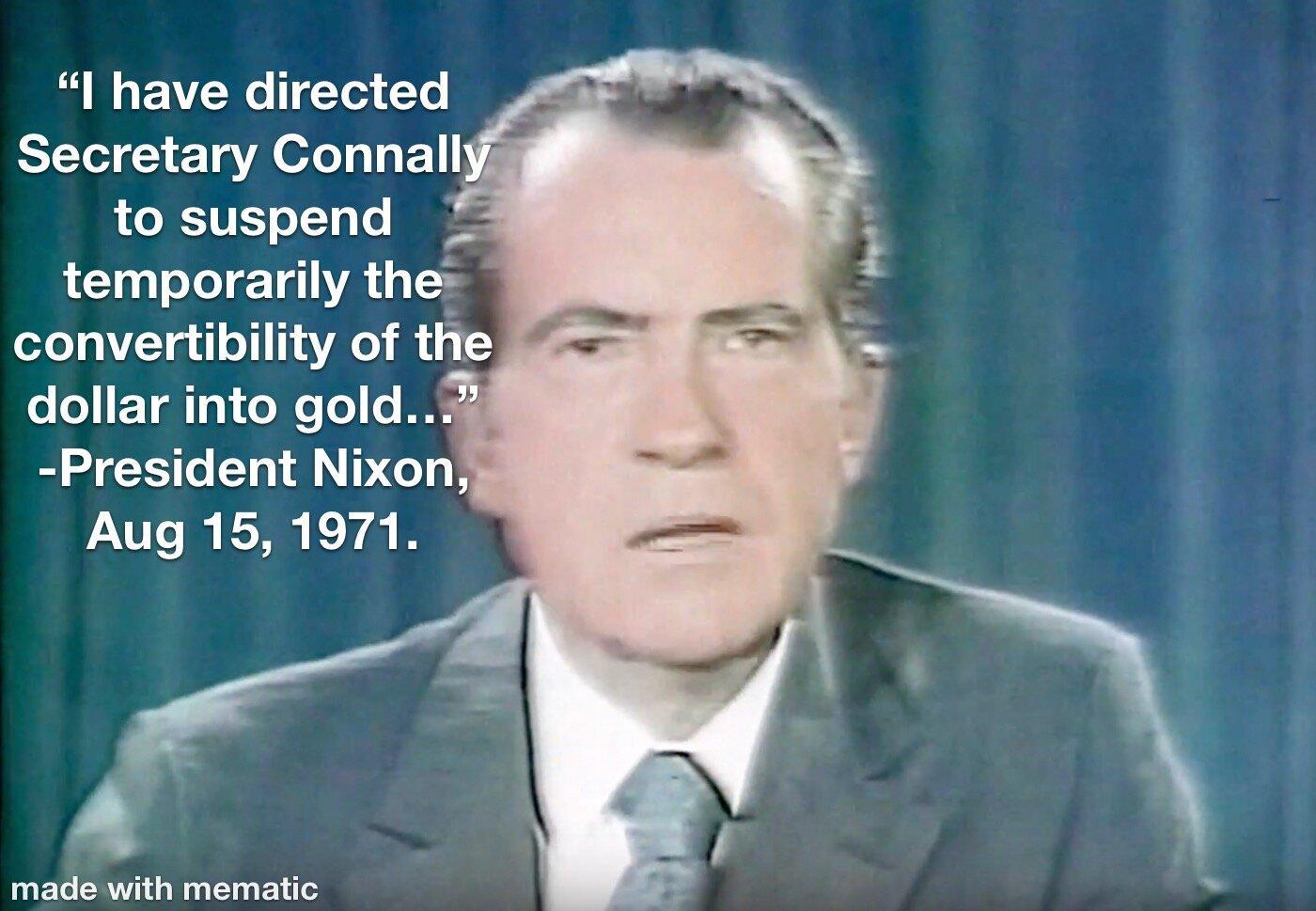

On August 15, 1971, Richard Nixon went on national television and did something most Americans barely understood at the time.

He "temporarily" suspended the convertibility of U.S. dollars into gold. And just like that, the last tether tying the dollar to a hard asset was cut.

The gold window closed.

The Bretton Woods system cracked.

The dollar became pure fiat.

And investors panicked.

They thought markets would crash.

They assumed confidence would evaporate.

They braced for systemic collapse.

Instead?

Asset prices soared.

Gold didn't die.

It was repriced.

And if you think that lesson is ancient history, you're missing what's happening right now…

The Monetary Earthquake No One Understood

Under Bretton Woods, foreign governments could exchange dollars for gold at $35 an ounce. It was the foundation of post-World War II monetary stability.

But by the late 1960s, the math didn't work anymore…

The U.S. had printed far more dollars than it had gold reserves to back them. War spending, social programs, expanding deficits — the liabilities ballooned while the gold base stayed fixed.

Foreign governments noticed.

And they began converting dollars into gold. U.S. reserves drained. Confidence cracked.

So Nixon changed the rules…

When the announcement came, markets didn't know how to price a world where the dollar floated freely without a hard anchor.

Many assumed catastrophe.

Instead, what they got was a structural repricing of everything…

What Actually Happened After 1971

From 1971–1980, gold rose from $35 to over $800 an ounce.

Oil prices exploded.

Industrial metals surged.

Hard assets broadly entered a supercycle.

The stock market didn't disappear… It struggled through inflation volatility, yes — but asset prices, particularly tangible assets, went vertical.

The 1970s were chaotic.

Bondholders were crushed. Cash lost purchasing power. Inflation raged.

But owners of scarce, real assets? They thrived.

The gold window closing didn't destroy value…

It transferred it.

That's what regime shifts do.

And now, five decades later, it looks like we're living through another one.

Today's Monetary Transformation

The current shift isn't a single televised speech…

It's slower. More complex. Digitized.

After 2008, central banks embraced quantitative easing. After 2020, trillions were created almost overnight. And debt levels exploded globally.

Now we're layering on:

This isn't incremental policy adjustment.

It's structural transformation.

Currencies remain untethered from hard constraints — and now they move at digital speed.

When Nixon closed the gold window, investors underestimated what that meant for hard assets.

Today, most investors are doing the same thing.

They're distracted by tech narratives. They assume central banks remain in control. They believe debt can expand indefinitely without consequence.

Unfortunately for them, history says otherwise.

How to Get a Six-Figure Payday From China's

Critical Metals Export Ban

China's recent export ban on gallium, antimony, and germanium has sent shock waves through global markets, threatening to cripple U.S. national security.

These critical metals are the backbone of America's defense infrastructure, essential for producing missiles, satellites, and fighter jets.

Without them, the U.S. military is paralyzed.

That's why the U.S. government is turning to a tiny American mining company to secure a reliable domestic supply of these vital materials.

And early investors could see a six-figure payday.

History Doesn't Repeat — but It Rhymes

In 1971, investors feared collapse.

Instead, they got a decade-long repricing of gold and commodities.

Today, investors fear volatility, tightening cycles, geopolitical friction.

But they're missing the larger shift..

Central banks are accumulating gold at record levels.

Supply chains are being re-shored.

Strategic minerals are being weaponized.

National security is tied directly to resource access.

Gold isn't just an inflation hedge anymore.

It's becoming a strategic monetary asset again.

If the rhyme holds, this isn't the end of a gold move.

It may be the beginning of a much longer bull market in hard assets than anyone currently anticipates.

And if that's true, positioning now — before the rank and file wake up — is critical.

How to Play the Rhyme Before the Crowd Rushes In

In every structural bull market, there are layers of opportunity.

Explorers. Producers. Hybrids.

Each offers a different kind of leverage to higher gold prices.

So let's break them down with a few examples…

Austin Gold Corp. — Where Torque Lives

Austin Gold Corp. operates primarily in Nevada — arguably the best gold mining jurisdiction in the world.

And here's why that location matters…

Infrastructure exists. Mining law is clear. Political risk is minimal compared to many global jurisdictions.

That's part of the reason why explorers like Austin don't need to build mines to create massive value.

They simply need to prove ounces exist.

And here's where the leverage kicks in.

If gold rises meaningfully from here — say $500, $1,000, or more per ounce — every ounce discovered in the ground becomes exponentially more valuable.

Projects that were marginal suddenly look economic. Economic projects suddenly look strategic. Strategic projects suddenly attract acquisition interest.

In past gold bull markets, small explorers like Austin Gold delivered 3x, 5x, even 10x returns as discovery risk declined and takeover premiums emerged.

Austin sits right in that torque zone today.

It's small enough to move dramatically. It's positioned in top-tier geology.

And it operates in a macro environment where rising gold prices can dramatically revalue in-ground assets.

Exploration carries risk. But in regime shifts?

That's where explosive upside tends to live.

AI has a Dirty Secret...

AI has a dirty secret...

Companies have been "stealing" our personal data to train their AI models.

And thanks to the U.S. government enacting an obscure Korean War-era law...

This secret has led to the discovery of the easiest passive income stream we've ever seen.

Starting at just $10 and five minutes to get set up...

You could start receiving regular passive payouts of as much as $3,452.50 per month in "AI Equity Checks."

Get all the details on this easy passive AI income stream here.

Newmont Corporation — Margin Expansion at Scale

Newmont Corporation is one of the largest gold producers on Earth.

Scale matters — but leverage matters more.

Mining is capital intensive up front. But once operating, costs are relatively stable compared with gold price volatility.

If all-in sustaining costs sit around $1,300–$1,500 per ounce and gold rises from $5,000 to $6,000, that incremental margin largely flows straight to the bottom line.

That's operating leverage.

It means that higher gold prices don't just increase revenue — they expand profit margins.

And historically, that's when institutional capital rotates heavily into major producers.

Newmont also benefits from diversification across multiple jurisdictions and the ability to acquire smaller companies to replenish reserves.

In previous bull cycles, majors became consolidation engines — buying explorers and mid-tier producers as valuations climbed.

If gold enters a sustained repricing phase, Newmont doesn't just benefit passively.

It becomes central to sector momentum.

For investors who want exposure to gold's upside without pure exploration volatility, Newmont offers scale, liquidity, dividend potential, and serious cash-flow expansion if gold pushes materially higher.

It's not flashy. But it's powerful.

Goldgroup Mining — The Hybrid Upside Play

Goldgroup Mining occupies an interesting middle ground…

It has producing assets — meaning real revenue and operational experience — but also exploration upside.

That combination can be extremely potent in a bull market.

Existing production benefits immediately from higher gold prices through expanding margins.

Meanwhile, exploration projects gain value as the gold price assumption used in economic models rises.

This dual engine — production plus discovery — creates flexibility.

Cash flow can fund growth. Growth can attract re-rating. Re-rating can attract acquisition interest.

In past cycles, mid-tier and hybrid companies often outperformed during the middle innings of a gold bull run because they offered both stability and upside.

They're not binary bets. But they're not lumbering giants either.

If gold continues its structural climb, companies like Goldgroup can experience valuation expansion from both improved margins and increased strategic value.

That's a powerful setup in a world where majors need reserves and investors need growth.

The Window Is Closing Again

In 1971, investors thought gold was finished. But it was just getting started.

Similarly, today, many investors think gold's recent move is overextended.

But they're focusing on short-term price swings instead of long-term structural transformation.

We are witnessing a monetary evolution. We are witnessing sovereign debt expansion. And we are witnessing central banks re-embracing gold.

If history rhymes — and it often does — this could be the early innings of a much longer bull market in gold and hard assets than most expect.

And when the mainstream crowd finally realizes what's happening?

They won't ease in slowly.

They'll rush. They'll chase. And they'll overpay.

And by then, the easy gains will already be behind us.

So the question isn't whether the rhyme will complete itself…

It's whether you're positioned before the rank and file figure out what's at stake.

1971 didn't end gold.

It unleashed it.

Don't wait for history to finish rhyming.

Get invested before everyone else hears the music.

To your wealth,

Jason Williams

@TheReal_JayDubs

@TheReal_JayDubs

Angel Research on Youtube

Angel Research on Youtube

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

Tidak ada komentar:

Posting Komentar