Feeling Defensive? Avoid These

4 Low-Quality Stock Bombs Hey folks, Adam here…

Yesterday, we examined the consumer staples sector through the lens of my Green Zone Power Rating system. This sector held up best last week as the sell-off accelerated.

That makes sense, considering this “Steady Eddie” sector is a popular one to flock to when investors are feeling defensive.

Of course, not every defensive stock is a favorable investment right now. As I showed yesterday, only half of the 44 stocks in the S&P 500 sector rate as “neutral” or better on the Green Zone Power Rating system — half rate “bearish” or even “high-risk!”

In a volatile market like this, I don’t want you to get suckered into seemingly “safe” stocks only to suffer outsized losses.

With that, let’s dig deeper into consumer staples to see what my system says… | Government insider, Jim Rickards, is back with a wild, new prediction.

“Millions of Americans could soon make a small fortune.

Not thanks to crypto or artificial intelligence – but a multi-trillion-dollar government asset which could be unlocked as soon as May 3rd.”

For many investors, he says, this could be a life-changing event.

But only if you act before May 3rd.

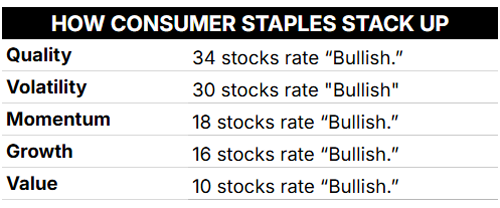

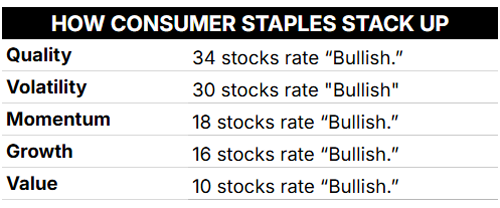

For the full details, click here. | Poor Quality in Consumer Staples Sector Yesterday, I shared this table below with you:  It shows you how many consumer staples stocks rate “Bullish” or better on individual Green Zone Power Rating factors. As I mentioned in my analysis, this sector is currently full of quality, but not cheap, “Steady Eddie” stocks.

Seeing that 34 out of 44 consumer staples stocks rate “Bullish” on my Quality factor, I took a closer look at the 10 poor-quality stocks in the sector.

As you might recall, my Quality factor considers a company’s profitability using various metrics, including return on assets, equity and invested capital. We measure these numbers over both short- and long-term time frames.

Beyond profitability, my Quality rating also includes information about a company’s debt load and its ability to service that debt.

And that’s where we’re going to focus today…

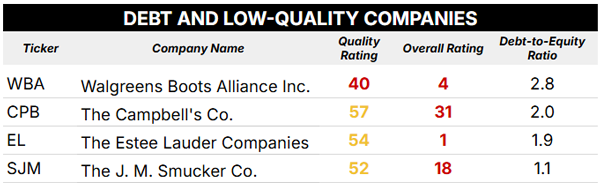

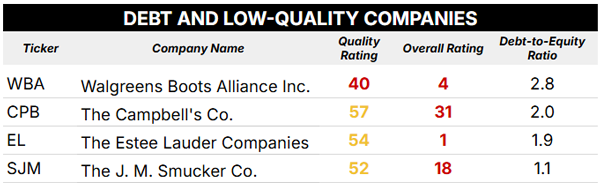

Below, you’ll see four of the 10 stocks that currently fail to rate “Bullish” on Quality, along with their Overall rating and Debt-to-Equity Ratios.

Have a look:  Debt-to-equity is important because it tells us if a company is overleveraged with a potentially dangerous amount of debt.

As a yardstick, the average debt-to-equity ratio of S&P 500 companies is currently 0.6, meaning that for every $1 of equity on the books, they’ve taken on 60 cents of debt. And while it varies by industry and business model, a ratio above 1.0 can begin to raise red flags.

As you can see above, each of the four stocks I’m highlighting today has a debt-to-equity ratio in excess of that line in the sand. This is no doubt a contributor to their inability to earn “bullish” quality ratings.

What’s more, three of the four stocks rate “high-risk” overall, with Campbell’s Co. (CPB) rating slightly higher but still in the “bearish” zone (20-40).

So, clearly … each of these seemingly “Steady Eddie” staple stocks is not well-positioned to provide investors with stability during the current market turmoil.

Digging deeper, you might think that a dominant drug-store chain like Walgreens would be an “essential” part of American’s everyday lives, no matter what’s happening in the economy or markets. But my system is warning of trouble ahead… |

A secret meeting just took place in Las Vegas.

Inside exclusive sky suites at the Aria Resort, Wall Street executives gathered to behind closed doors.

They aren't warning the public. They're positioning themselves for what's coming.

By the time you see the headlines, it will be too late. But there's still time — if you act now.

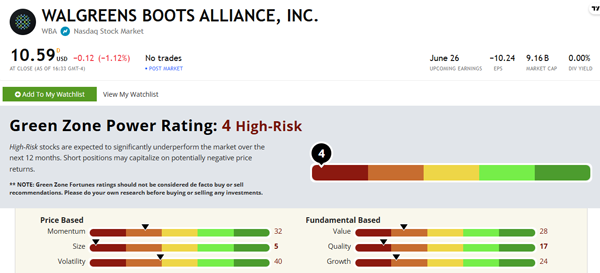

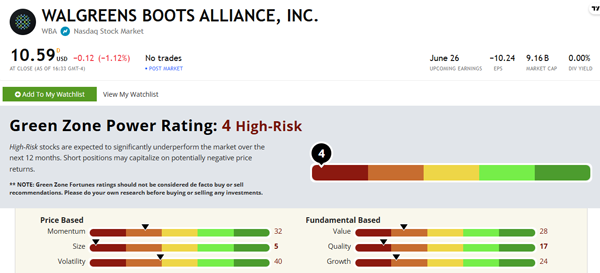

Watch this controversial video now, and send it to everyone you know. | Walgreens Is Borrowing … A Lot Walgreen Boots Alliance’s (WBA) debt-to-equity ratio of 2.8 is a massive red flag and a big contributor to its 40 rating on Quality. For comparison, the health and personal care retail industry debt-to-ratio average is currently 1.1.

It’s clear that Walgreens is relying on debt heavily to finance its future…

What happens if interest rates rise … and/or Walgreen’s income falls? It could spell serious trouble!

Of course, Quality is only one factor of my Green Zone Power Rating system. It’s always important to look at the whole picture.

But that picture isn’t pretty, either…  Walgreens (WBA) rates a “High-Risk” 4 out of 100 overall. Stocks in this category historically lag the broader market over the next 12 months and are particularly vulnerable to steep declines during down markets.

All told, I do not want my money in Walgreens right now … and I’m urging you to steer clear of the stock as well.

Further, if you’re looking for “defensive” corners of the market in this difficult environment, I suggest you not assume that the entire consumer staples sector is a “safe” place to hide.

You really have to dig deeper and take a holistic approach to assessing each stock’s best and worst qualities … which is what we do in my flagship newsletter, Green Zone Fortunes.

Until next time…

To good profits,

Adam O'Dell

Editor, What My System Says Today

P.S. If you want full access to my system click here to see how you can join Green Zone Fortunes today. | What My System Has Revealed Lately: | |

Tidak ada komentar:

Posting Komentar