The Long and Short of

Trump's Great "Shakeout" Dear Reader,

Maybe it’s not totally obvious to you just yet.

But it is to me…

There’s a massive “shakeout” underway, thanks in no small part to President Trump’s unconventional handling of his first 100 days in office.

And it’s about much more than just tariffs.

Elon Musk has done things with DOGE that seemed unimaginable just months ago.

And anyone still betting on the status quo is finding themselves in an awkward, if not totally uncomfortable position right now.

I’m talking about investors, of course, but also C-suite executives at America’s largest corporations.

For sure, Trump is creating something of a “Great Divide” between the companies that are well-suited for the new normal and those that are desperately clinging to the past.

I understand it can seem challenging to make sense of it all. But I promise you … you’ll want to take action in this environment. Do not let this shakeout confuse or paralyze you!

This is most certainly a “stock picker’s market,” whether you’re a short-term options trader or a long-run oriented investor.

And as always, I’m highly confident that the stock rating system I developed in 2020 is all you need to make sense of which stocks are poised to thrive through this shakeout … and which ones will, well, be shaken out of the winner’s circle and get left behind.

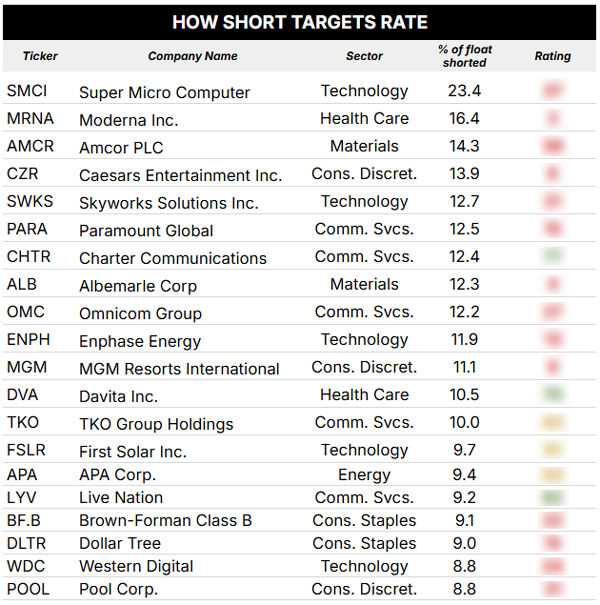

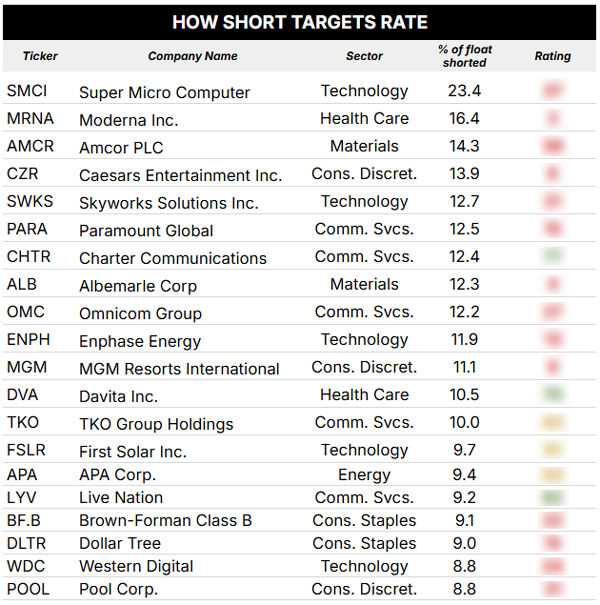

Today, we’ll have a look at a list of the market’s most-heavily shorted stocks.

These are stocks investors have given a big “thumbs down” to amidst the shakeout.

Let’s see what my system has to say about them… |

Wall Street gives "Buy" ratings to 94% of companies, yet only 4% create all market gains. Something just isn’t right. That's why Adam O'Dell developed an unbiased system that could have warned investors before Silicon Valley Bank collapsed — and now flags 1,878 high-risk stocks. Is your portfolio safe? Check now… | Give credit to the folks over at Bespoke Investment Group for identifying S&P 500 members with the highest short interest currently…

You’ll see these companies have between 8% and 23% of their publicly-available share count shorted. This means investors have put their money on an eventual decline in their share price … to a much greater degree than the average stock.

Have a look…  Maybe you can spot the trend here?

My system has the majority of these heavily-shorted stocks rated “Bearish” or worse — 14 of the 20 stocks, in fact.

Meanwhile, there are only three stocks on this list rated “Bullish” or better… 3 Stocks + My Newest “Green Zone” Stock

Deserve Your Attention Those three “Bullish” rated stocks are Davita Inc. (DVA), Live Nation Entertainment Inc. (LYV) and Charter Communications Inc. (CHTR).

Essentially, the market is saying these stocks are not going to be winners of the shakeout that’s underway … but my system says they should do just fine or, even better, beat the market by 2x to 3x over the next year.

Of course, one of us must be wrong.

Either the stocks will underperform the market and prove all the “shorts” correct in their analysis…

Or the stocks will outperform and prove my system the wiser of us.

Of course, please note that these are not official recommendations of DVA, LYV or CHTR.

While my Green Zone Power Rating system does an excellent job of cleanly sorting stocks into “bearish,” “neutral” and “bullish” camps…

My Green Zone Fortunes newsletter is where our best works shines, and where you can gain access to a model portfolio that’s positioned to deliver market-beating returns through Trump’s second term and beyond, no matter what shape this shakeout ultimately takes.

In fact, we’re releasing a new recommendation to paid-up Green Zone Fortunes subscribers today…

We’re buying into a stock that’s up 13% since Trump’s November 5 election win … a feat that precisely none of the so-called “Magnificent 7” stocks have accomplished.

Click here to see how you can gain full access to my system and Green Zone model portfolio today.

To good profits,

Adam O'Dell

Editor, What My System Says Today

| What My System Has Revealed Lately: | |

Tidak ada komentar:

Posting Komentar