September 24, 2024

Top 7 Takeaways from 2 Major Crypto Events

Dear Subscriber,

|

| By Bruce Ng |

Last week, two of the most significant events in the crypto industry took place.

Token2049, which was held on Sept. 18-19, is a global conference series that brings together crypto and web3 industry leaders to network and share ideas.

Solana Breakpoint, which took place immediately after on Sept. 20-21, narrows the focus to just the Solana network.

Organised by the Solana Foundation, this event brings together developers, industry experts, artists, students, creators, entrepreneurs and community members from around the world to explore the latest developments in blockchain technology and web3 in the Solana ecosystem.

Both Token 2049 and Solana Breakpoint where the bigwigs of crypto hang out. Even some TradFi giants make an appearance, as well.

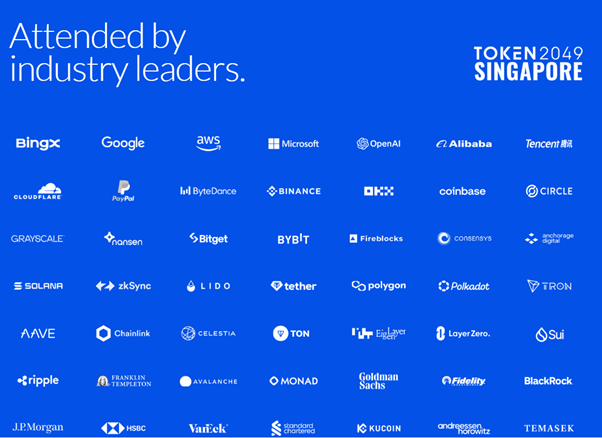

This is only a partial list of all the big names in attendance at this year’s Token2049 event.

Source: Token2049.

Click here to see full-sized image.

And these conferences are where the juiciest news can be found about where the industry is heading.

I’m not talking cheap gossip. The insights that are shared or gleaned from events like these can be strategy-defining for investors.

Now, I should be clear: A lot of this is speculation.

Before putting money on the line, investors should do their own due diligence, no matter how impressive or appealing the news circulating the conference halls may be.

But I’d be remiss if I didn’t share the highlights I’ve collected from interviews with participants of both events.

Top 7 Takeaways from Both Events

-

First, there has been a resurgence in optimism among developers.

The atmosphere at both conferences seemed more bullish compared to recent years. Confidence levels among developers were noticeably higher, with a proliferation of innovative projects, particularly in Layer-2 chains for the Bitcoin ecosystem, infrastructure and decentralized AI.

-

Bittensor (TAO, Not Yet Rated), which my colleague Jurica Dujmovic has written about in the past, is likely to become a top 10 protocol. Bittensor is tied to the AI narrative as a decentralized network that offers a collaborative platform for sharing and enhancing AI models.

This jump to the No. 10 spot would put it at $14 billion in market cap (at current prices). If this occurs, its price could likely climb up by about 3.5x.

-

In fact, decentralized AI had a HUGE presence at Token2049. Decentralized AI coins like Zero1 Labs (DEAI, Not Yet Rated), Worldcoin (WLD, Not Yet Rated) and NEAR Protocol (NEAR, “C”) were all talked up as coins which are riding the AI narrative.

-

Some industry experts think that Solana (SOL, “B”) might flip Ethereum (ETH, “A-”). That is, overtake it in terms of its market cap. This is because a lot of projects are building on Solana.

One example is Soon, an SVM stack that allows for settlement on any L1. It allows any Layer-2 blockchain to settle its transactions on any other Layer-1 blockchain. In other words, you get the speed of Solana and the security and decentralization of other chains that you choose. Even Ethereum.

-

Pendle Finance (PENDLE, “B+”) will play a big part in Bitcoin (BTC, “A”) coming to DeFi. This interest rate swap/derivatives platform is unique in that it offers fixed yields and fixed expiry dates. That’s unheard of in DeFi, where yields are variable.

So far, Pendle has been focused on Ethereum-based DeFi on the Arbitrum (ARB, “B-”) network. But it plans to bring these trading instruments to DeFi on the Bitcoin blockchain.

-

The industry is moving away from speculation to focus on real-world utility. The last bull market in 2021 was marked by wild speculation. And while there is still plenty of that, the overall tone of these two conferences has pivoted to a more grounded one as the focus stayed on real-world use cases.

Projects addressing finance, supply chain and sustainability issues were prevalent. The crypto space is slowly but surely transitioning into a mature market. With that comes the potential for more sustainable growth in these areas.

-

Consumer facing apps will likely be the next big thing in crypto. As more people enter the crypto space, developers will have their work cut out for them. Accessibility will be a top concern. But apps offer a familiar way to package this new technology for a mainstream crowd.

Does this mean all these insights will bear fruit and prove true?

Not at all.

But they reveal where developers and projects are looking to go in the future. And for investors who don’t want to be left behind, it pays to look ahead with them.

I’ll be following up with some of these leads in future Weiss Crypto Daily updates. So, keep a weather eye out for those.

Best,

Dr. Bruce Ng

P.S. While the insights from Token2049 and Solana Breakpoint have you looking to future opportunities, I want to inform you of one happening right now.

And only for a limited time.

It’s not on the blockchain. It’s actually in the lucrative and fast-growing business of space and satellite technology. A realm I happen to know a bit about as a rocket scientist myself.

And just for this week, Weiss Members like you have a rare second chance to claim early pre-IPO shares in this mega-disruptor BEFORE nearly all angel investors, venture capitalists or big banks.

You can learn more about it, and how to make the most of this rare opportunity, here.

Tidak ada komentar:

Posting Komentar