March 31, 2023

Your Portfolio Insurance Plan

Dear Subscriber,

|

| By Mahdis Marzooghian |

We’re only three full months into the year, yet it seems we’ve witnessed a year’s worth of market drama and turbulence already.

I am not just talking about — and won’t get into, for your sake — the Federal Reserve/inflation narrative we’ve been dealing with for over a year.

I’m talking about the recent banking sector news that rocked markets and turned already bearish investor sentiment even more bearish — the collapse of Silicon Valley Bank and Signature Bank.

And then there was the latest news out of Europe about Credit Suisse’s demise.

Again, I will spare you the details as I’m sure you have already seen your fair share of news coverage on the subject.

But in an increasingly disaster-prone and unpredictable world, one of the smartest moves investors can make is to have a protection plan.

We all have health, home and auto insurance for unforeseen disasters and emergencies, so it’s only logical that investors also have …

A Portfolio Insurance Plan

I’m not just talking about hedging with traditional, conservative assets, either. I’m talking about hedging with alternative investments, which should have a place in every investor’s portfolios. According to Forbes:

“The portfolio for 2023, no matter your net worth, risk tolerance, or time horizon, should include an increased allocation to alternatives. With their low correlation to traditional asset classes like stocks and bonds, alternatives could blunt inflation- and recession-induced volatility and buoy returns more than dividend stocks alone.”

Alternative investments were previously reserved for accredited investors and seasoned traders.

But now everyday investors can easily access alternative assets, like commodities and collectibles — the two categories I’ll explore in detail today — plus a third, bonus option I’m going to tell you about at the end, so make sure you stay with me until then.

Alternative Investment types.

Click here to see full-sized image.

And similar to how health, home and auto insurance plans give you options, there are various types of alternative investments that can meet your individual investing needs.

First, let’s look at …

Alternative Investment No. 1:

Commodities Like Gold

While there are a number of commodities for investors to get into, gold is a hot-ticket item not just with investors, but with central banks!

According to our Natural Resources Analyst Sean Brodrick in his latest Weiss Rating Daily issue:

“Last year, central banks added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles. Around the globe, central banks added another net 77 metric tonnes to their gold reserves in January.”

As Sean recommended, you could get into gold miners, such as the VanEck Gold Miner’s ETF (GDX), which is in the sweet spot for you to buy right now before it takes off.

Three-month technical chart of the GDX showing the 50-day moving average (orange) and 200-day MA (blue).

Click here to see full-sized image.

Last week, the GDX formed a golden cross pattern — an extremely bullish technical pattern that occurs when the short-term moving average crosses above the long-term moving average. You can see it on the chart above in the purple circle. Since then, the ETF is up 6.7%.

Additionally, the U.S. dollar’s ongoing slide not only bolsters gold’s rise, but historically speaking, the yellow metal has proven to be the one asset people continue to turn to when everything else goes sideways.

Alternative Investment No. 2:

Collectibles Like Wine

Collectibles are another tried and true alternative investment, consisting of items worth far more than their original sale price. According to Forbes:

“When purchased intentionally, with thoughtful research, collectibles have the potential to appreciate in value and deliver better-than-decent returns. You don’t have to spend hundreds of thousands of dollars to reap those rewards, either.”

Collectibles allow you to not only diversify but to invest in your passions. Let’s say you’re a fine wine enthusiast and want to consider it as an alternative investment.

For one thing, wine provides downside protection because wine prices typically don’t correlate strongly with the market. And you don't need an expensive wine cellar to add wine to your portfolio.

Enter Vint and Vinovest, platforms that allow you to invest in fine wine from around the world starting with just $25 and $1,000, respectively.

With Vint, you can buy shares of wine collections, and you don't need to be an accredited investor or wine connoisseur to get started.

Vinovest, on the other hand, is quite like an automated investment adviser and provides automated wine investing for various types of portfolios.

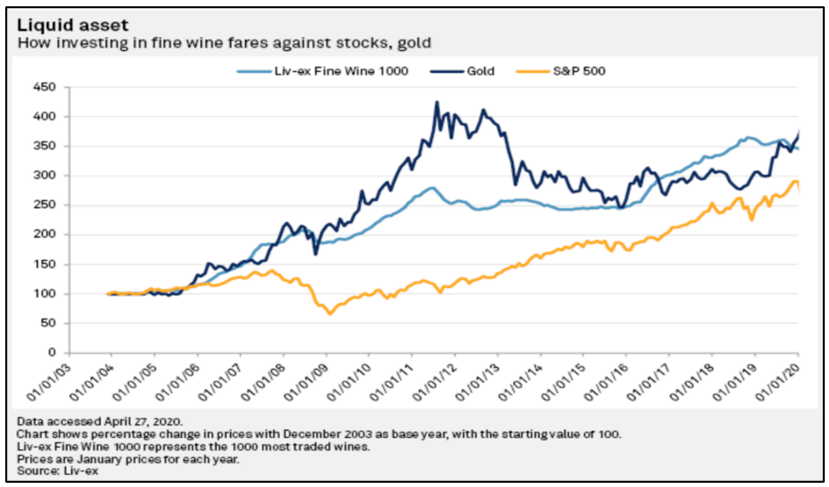

Both Vint and Vinovest handle the storage and wine insurance. And according to Vint and Liv-ex 1000 data, wine has outperformed the S&P 500 since 2006.

Liv-ex 1000 vs. S&P 500.

Click here to see full-sized image.

There are numerous other alternative investments to consider, though I should note the above chart shows how both gold and wine have outperformed the S&P 500 since 2006.

As always, conduct your own due diligence to see which category — or categories — best meet your investment goals and needs.

Alternative Investment Bonus Idea:

Private Equity

Lastly, here’s the bonus third alternative investment, as promised: private equity.

Earlier this week, Startup Investing Specialist Chris Graebe unveiled an opportunity in crowdfunding for a startup that’s well-positioned to disrupt a $100 billion industry. With private equity crowdfunding, you no longer have to be an accredited, institutional investor.

Click here to learn how to claim an early stake in this startup.

All the best,

Mahdis Marzooghian

Assistant Managing Editor

Weiss Ratings Daily

Tidak ada komentar:

Posting Komentar