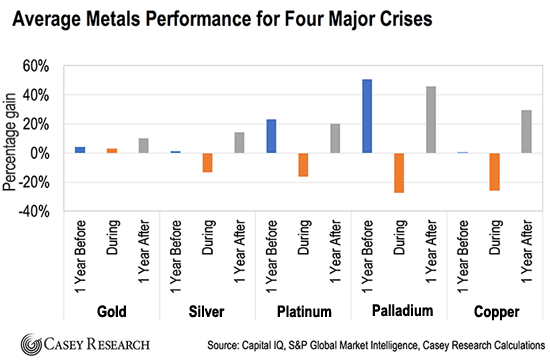

By David Forest, editor, International Speculator You’ll want to print out today’s essay and keep it close by. Last year, my team and I conducted a deep-dive analysis in our International Speculator newsletter. We looked closely at the top resources to own leading up to, during, and after a financial crisis. This information is critical right now, as we find ourselves in the middle of an economic crisis and a looming recession due to the coronavirus pandemic. This may sound gloomy – and certainly part of the strategy in getting through a bear market or a crash involves positioning to protect your wealth from big losses. But I’m also interested in the opportunities for major profits that might come in commodities as a result of a breakdown in the financial system. And it’s the potential for such gains that makes a financial crash a little less frightening – and maybe even something to take advantage of. Our Findings So how exactly should we protect ourselves and profit from an emerging crash? To find out, let’s look at how different metals have performed in past crises. My team and I put together this data – not just for the 2008 crash, but the last four major financial crises: the Japan meltdown (1990-1992), the Asian financial crisis (1997-1998), the dot-com bubble (2000-2002), and the Great Financial Crisis (2007-2009). We then took all metals that have comprehensive historical data available: gold, silver, platinum, palladium, copper, zinc, vanadium, tin, nickel, and aluminum. Then, we plotted their average performances during the three “acts” of each crisis: -

One year prior to the crisis -

The period during the crisis -

One year after the crisis (the recovery) This showed us three things. First, it showed which metals did well in the time just before a crisis. Second, it showed which metals were the best store of value during investor panic. Third, it showed which metals are best to buy at the depths of a crisis in order to profit from the recovery that’s historically taken place the year following a crash. Here’s how that picture looks… Below is the average performance for our 10 metals during the last four big crises. Let’s start with the first five – gold, silver, platinum, palladium, and copper:

And here are the next five – zinc, vanadium, tin, nickel, and aluminum:

These are unprecedented times, and we’re still in the early stages of this crisis… so it’s too early to predict how each of these metals will hold up today. But by analyzing their performances during past crises, we can get a firm grasp of which commodities to keep our eye on. Let’s go through some of the specific takeaways. Major Base Metals (Copper, Zinc, Nickel, and Aluminum) Base metals can get hit hard during tough economic times. The data backs this up – during the last four crashes, the worst-performing metals have been aluminum, copper, zinc, and nickel. On average, these major base metals fell 25-45% during market panics. This makes sense, given these metals are tied to industrial activity. When the economy hits major speed bumps, investors dump these first. The major base metals are also increasingly traded by speculative investors worldwide – and when markets get wiped out, speculative positions get liquidated. The major base metals do deliver slight gains before a crash. But they really shine afterward. In the year following major crashes, standout nickel gained an average 87%. Copper and zinc showed average one-year gains of 29% and 22%, respectively. Investment Takeaway: When markets are exposed to a significant correction or crash – like today – be very selective with exposure to the major base metals. The best strategy is to buy base metals firms that also hold significant precious metals. If the markets do correct, adding base metals stocks at the bottom to benefit from the immediate rebound is a time-tested, winning strategy. | Minor Base Metals (Tin and Vanadium) One of the most interesting findings from our research: Minor base metals held up surprisingly well. Both tin and vanadium delivered solid gains in the year prior to crises. But unlike the major base metals, which fell 25-45%, tin only dropped an average 12% during crashes – which was a better performance than precious metals silver, platinum, and palladium. Vanadium actually posted a 1% average gain during crashes. Investment Takeaway: The minor base metals are good bets for the current unsteady market environment. Even as the broad market continues to suffer, these minor base metals retain value. A major reason they’ve historically held up well in crashes is that there’s been little speculative trading in the minor metals. But a point of caution: That’s changed in recent years. Financiers have created investment vehicles like exchange-traded funds to facilitate wider investment in minor metals – especially those related to electric vehicle batteries. That increasing speculative investment could make minor metals more volatile during crashes than we’ve seen previously. | Precious Metals (Gold, Silver, Platinum, and Palladium) Our research proves that gold is the way to go during uncertain times. During the last four major financial crises, gold was the only metal that increased in value during a crash (aside from minor metal vanadium), gaining an average 3%. The yellow metal also delivered gains before and after the crashes – rising an average 4% in the year prior to a crash, and 10% in the year after. Interestingly, silver fared much worse during crashes. Silver took a significant hit during the crises, falling an average 13%… and barely showed any gains in the years leading up to major crashes. Meanwhile, platinum and palladium both performed well in the year after a crash, rising 20% and more than 40%, respectively. Investment Takeaway: Gold is the safest place to be in uncertain times – having a history of holding value well and delivering solid gains. History shows us silver isn’t as reliable. Perhaps because of its industrial uses, silver tends to take a much larger hit during crashes. It does rebound well after the storm clears, so best to wait until a bottom before taking a position. And while platinum and palladium both suffer during a crisis, they can deliver solid gains on either side of one. | Regards, ![[signature]](https://d15s74raupkmp7.cloudfront.net/editorial/cdd/sig/df-sig.png)

David Forest

Editor, International Speculator P.S. Keep this essay nearby… and shift your portfolio according to the historical performance of these metals as the market changes. In the meantime, gold remains one of our top picks… and you can profit even more from the metal by holding the top gold companies. These are firms sitting on rich gold deposits with strong teams behind them. I have a special way of pinpointing these projects… because I have exclusive access to a NASA satellite. Learn how I find gold from space right here.

Like what you’re reading? Send your thoughts to feedback@caseyresearch.com.

In Case You Missed It… The "$500 Crypto Retirement Plan"? The #1 most-trusted person in cryptocurrency is releasing a new "$500 crypto retirement plan." His last top five picks could've turned $500 into $1 million in less than two years. His next five could be even more lucrative, no matter which way the price of Bitcoin moves next. Click here to watch.

|

Tidak ada komentar:

Posting Komentar