| Vaccinate Your Portfolio... Now! Surviving and Thriving During the Global Pandemic of 2020

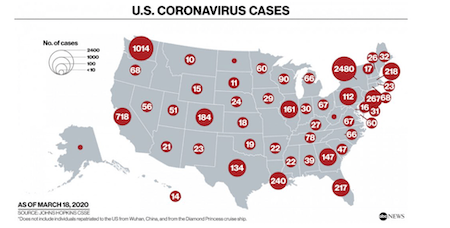

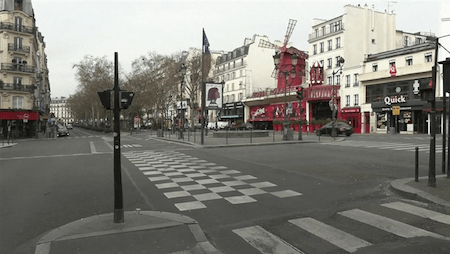

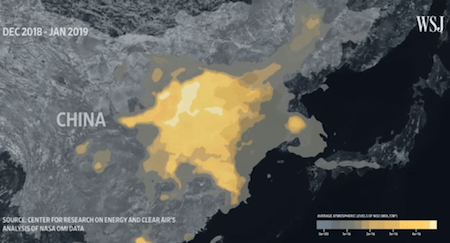

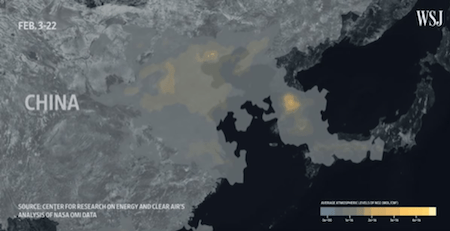

Vaccinate Your Portfolio... Now! Dear Laissez Faire Today Reader, A 35-year old from China just decimated your portfolio with coronavirus. This 35 year old "patient zero" has precipitated a total collapse of the US economy, including the loss of thousands and thousands in your portfolio… the loss of jobs foe people you know… and, god forbid, could be, the loss of life for one of your loved ones. By now the coronavirus is having a major impact on your daily life… your work… your family… schools… bars, restaurants… your ability to travel and enjoy life as you have come to know it. Since all of this is true, I'd like to offer you an opportunity to vaccinate your investment portfolio -- free of charge -- starting just minutes from now. You can do this with Gold and Silver Today. Let me back up and explain… Scientists and doctors who track contagious diseases try to identify "patient zero" of any outbreak. Despite their best efforts to stop him, "patient zero" arrived in Seattle on a plane from China on January 19. As of this morning, there are currently 1,014 known cases in Washington State. Here's where the numbers get interesting: "patient zero" was just one of hundreds of passengers… on 60 flights a day... arriving from China. Since "patient zero" landed in the Seattle - just three weeks again -- infected people have been confirmed in all 50 states:  Source: ABC News Globally the pandemic looks even worse.  Source: The Guardian In Europe -- the hardest hit outside of China -- Italy, France, Germany, Great Britain, Ireland… all on lock down.  Closed bars and restaurants all across Europe Source: Edinburgh Evening News  The Moulin Rouge in Paris Source: NBC News  The Spanish Steps in Rome Source: Mercury News Usually these famous European sites are teeming with tourists, especially during the spring. One of our sources in Paris says the city is under virtual martial law. You're not allowed out on the street unless you have a written note. And then only to go to the grocery store. "I fear this draconian approach is only days away for the U.S.", he says. Dr. Brian Monahan estimates, unless extreme measures are taken, there will likely be 70-150 million people in the U.S. to contract the coronavirus. The virus death rate is currently 10x the Type A flu strain -- which kills between 16,000 and 20,000 people every year. You do the math. Hundreds of thousands could die. The last pandemic of any comparable scope, the Spanish Flu in 1918, killed some 680,000 Americans. The World Health Organization declared COVID-19 a "global pandemic" only one week ago. So there is still time, still some hope. And there is hope for your money, too. We have lived, worked and invested our way through three very serious market downturns: the Tech Wreck in 2001... the Housing/Mortgage meltdown in 2008… and the commodities bust in 2012. But nothing like this. Frankly, we were already due for correction in the markets… even past due. Since reaching historic highs last week, the markets are now in a bear market. The DOW has seen historic down days, losses of 2100 and 2900 on successive Mondays. It's a bloodbath. Closing yesterday below 20,000 erasing all the gains made since Trump took office. And… the worst has yet to be calculated The financial contagion alone could cost you and many of your compatriots billions in retirement funds. The world's largest manufacturer is quarantined Here's a good visual:  This is a picture of Chinese pollution B.C. -- before coronavirus:  This is a picture of Chinese pollution A.C. -- after coronavirus No pollution in China = no production. Chinese factories are not making toys for the kiddies anymore... Foxconn is not making iPhones… The factories are not even producing enough raw material to make your prescription drugs… diabetes, antibiotics, blood pressure... The disruption in the supply chain is going to have a huge impact on global trade. Let's face it, it's already happened. We've already seen what devastation has been wrought in the US stock markets. We're confident you're anxious to even look at your 401(k) account. What about your IRA? Now is the time to vaccinate your own portfolio. Your own money. How? For all of written history one asset has provided a bulwark against contagion in the markets. Ever since trading began, one asset has remained a store of value. As we enter this "unprecedented" epoch in our history, using this one asset could be the only way to save your portfolio. What's the asset? I think you already know. But let me tell you this first. Hands down the best way to buy, sell and trade this one asset today is with an account from… The Hard Assets Alliance It's easy to set up. Easy to use. And best: the setup is free. Free of charge. We say this with as much urgency as we can muster. Open an account and put a portion of your assets in gold. Yes, gold -- the one asset used to store value for thousands of years. This pandemic is downright biblical, so you need an asset that has passed the test of time since before the bible was even written. The Hard Assets Alliance has a state-of-the-art trading platform where you can buy and sell fully allocated gold bullion. You can buy, sell and trade silver and other precious metals too. Their fees are low, so you get your lion's share of the profits when you sell. And better yet, at the point of purchase, Hard Assets Alliance allows you to either take delivery, or… get this… You can store your metals in one of six different vaults around the world. New York and Salt Lake City here in the US or you can also store your gold outside the United States in ultra-secure offshore vaults in London, Singapore and Australia. Opening an account is secure, and it takes just 9 minutes to go from opening an account to funding to buy your gold and silver. In 20 years of business, we've come across many gold companies that want us to put their products in front of you. Many of them promised us huge commissions. Translation, that meant huge markups for you. We have consistently said no. Instead, we did the hard work on your behalf… finding the best way to buy, sell and store gold… in an easy platform… with super low costs. We found all of that – and more – in the Hard Assets Alliance platform. We liked it so much, in fact, that we bought a stake in it. So, while we're providing you with an easy way to vaccinate your portfolio today, you should also assume we're going to benefit from increased trading activity. You CANNOT afford for time to pass Just ask yourself… What if the pandemic does get worse? What if the economy continues to collapse? What if Trump uses this as an excuse for the government to nationalize the airline industry… nursing homes… cruise ships… and more? We don't seem very far from that already. What if true panic sets in? Will you be prepared by adding gold as a hedge against collapse? Or will be you one of the sad few left behind when the chaos hits?  Source: The Oakland Press No more pasta, toilet paper, or water to buy. Not at any price. Soon those "gold shelves" could run empty, too… What happens when you wait and there's no more gold to buy? Not at any price? It's still not too late. I trust you'll make the right decision… Open your account here… Regards,

Addison Wiggin

Founder, Agora Financial

Parent company of Laissez Faire P.S. Once you open your account you'll gain immediate access to a live event we're hosting tomorrow Friday, March 20 at 3pm: Surviving and Thriving During the Global Pandemic of 2020 We've assembled our top analysts in science, economics and bear market trading. Hosted by yours truly, you'll hear from:  Hosted by Addison Wiggin, best-selling author and founder of Agora Financial. Addison also shares some personal anecdotes of the pandemic... Hosted by Addison Wiggin, best-selling author and founder of Agora Financial. Addison also shares some personal anecdotes of the pandemic...

Graham Summers, founder of Phoenix Press and author of the best-selling author of The Everything Bubble: The Endgame For Central Bank Policy. Graham helps us addresses serious concerns about the markets and economy at large: Graham Summers, founder of Phoenix Press and author of the best-selling author of The Everything Bubble: The Endgame For Central Bank Policy. Graham helps us addresses serious concerns about the markets and economy at large:

- Treasuries were up 37% in a day on Tuesday, a mind-blowing and historic event. What does that signal for the overall health of the financial markets?

- In the best-selling book Everything Bubble: The Endgame For Central Bank Policy, Graham warned that the Bubble would pop and it would create a lot of economic pain. Did the Bubble pop this week?

- A promise of $1 trillion injection in the economy at the same time a grace period on taxes… What are your thoughts on the measures the Treasury took this week? Including the plan to start mailing $1,000 checks to everyone?

- What happens if the $trillion doesn't last through the crisis... an overall view of the impact on the economy itself... concerns about a major bank in real trouble... airlines... small businesses, bars and restaurants...?

- Are we headed for depression?

Ray Blanco, science advisor to Agora Financial and editor ofTechnology Profits Confidential,Agora Financial's FDA Trader, andBreakthrough Technology Alert, breaks down the science behind the coronavirus and the pandemic spread: Ray Blanco, science advisor to Agora Financial and editor ofTechnology Profits Confidential,Agora Financial's FDA Trader, andBreakthrough Technology Alert, breaks down the science behind the coronavirus and the pandemic spread:

- What is the COVID-19, it's history, where it came from and where it's going?

- How long will we be in crisis mode? Will our healthcare system collapse?

- They started testing a vaccine in Seattle this week. What's the process for finding a cure? How soon can we expect a working vaccine to roll out?

- What investment plays stand to "benefit" from the scientific search for a treatment and vaccine?

Zach Scheidt, editor ofLifetime Income Report and Income on Demand — investment advisories dedicated to finding Wall Street's best yields - delivers income and capital preservation strategies you should use even if the pandemic persists: Zach Scheidt, editor ofLifetime Income Report and Income on Demand — investment advisories dedicated to finding Wall Street's best yields - delivers income and capital preservation strategies you should use even if the pandemic persists:

- As the Covid-19 crisis spreads, how should investors prepare for the long haul?

- If investors haven't prepared for such crises, is it too late to take to act now?

- What do you recommend for those with 401(K)s or IRAs or other retirement funds?

Former CIA Officer, Jason Hanson, is the Founder and CEO of Spy Escape Evasion. Jason will give us "Spy Secrets" to keeping safe that 99% of Americans will never know: Former CIA Officer, Jason Hanson, is the Founder and CEO of Spy Escape Evasion. Jason will give us "Spy Secrets" to keeping safe that 99% of Americans will never know:

- In pandemic mode, how do we keep our families safe?

- The average person hasn't prepared for this kind of crisis… We've seen the fights over TP… shortages of antibacterial sprays, water. What can people do now to prepare and stay prepared?

- What kind of gear should people keep with them at all times during the crisis?

All of these urgent questions -- and more -- will be answered in the free summit: Surviving and Thriving During the Global Pandemic of 2020. Please note: We're NOT selling access to this summit. We're NOT charging any fees. The only way you can gain access to Surviving and Thriving During the Global Pandemic of 2020 is to open your account with Hard Assets Alliance once you do you'll gain access to the summit for free. The summit will air tomorrow, Friday, March 20 at exactly 3pm. We want you to have an account with Hard Asset Alliance so it's easy for you to execute the trades we'll be recommending throughout the pandemic. If you show you're the serious reader we're looking for… by opening an account today… we'll send you access to the summit FREE of charge. The account opening is free. There are no minimum funding requirements. And once you've completed the short account opening process, you'll be able to shop for the type of gold bars and coins you want to buy right away. P.P.S. Don't wait for the pandemic to spook the markets any longer… click the button below and vaccinate your financial portfolio today. <<<Open an Account Now>>> Remember, when you open your account with Hard Assets Alliance you'll gain immediate and free access to the summit Surviving and Thriving During the Global Pandemic tomorrow Friday, March 20 at 3pm. Open your account today. Again, a quick disclaimer… we like the service that Hard Assets Alliance provides so much that we've purchased a stake in the company itself. So you should assume we will receive some sort of compensation if you choose to do business with them. |

Tidak ada komentar:

Posting Komentar