| Forget Coronavirus… Fed-Virus has Completely Infected the Markets  Dear Money & Crisis Reader, Dear Money & Crisis Reader,

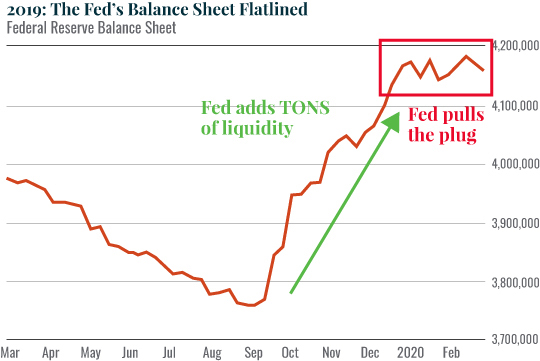

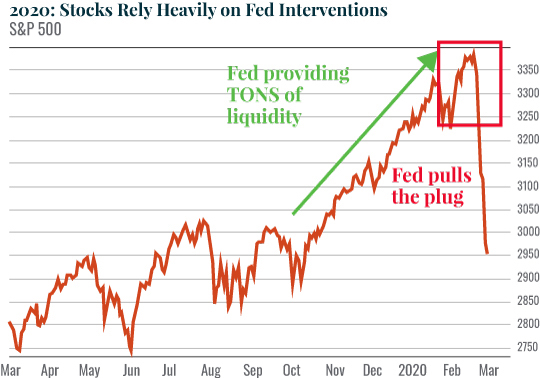

I want you to listen to me very carefully. The Fed – not the coronavirus – is what got us into this mess. The Fed created the bubbly environment in which stocks could implode. The coronavirus was just the pin. Let me explain. Back in 2018, the Fed embarked on an aggressive campaign to normalize policy. This involved the Fed raising interest rates four times per year while also shrinking its balance sheet by some $400 billion. Put another way, the Fed made money more expensive, while also pulling some $400 billion in liquidity from the financial system. The Fed claimed it could do this without hurting the financial system. But the Fed was wrong. It blew up the junk bond market, eventually leading to the December 2018 stock market meltdown in which stocks went straight down.  Fearful of causing another similar collapse in 2019, last year the Fed began to ease monetary policy aggressively heading into the fourth quarter of the year (September-December). The Fed cut rates three times. It also launched a $60 billion per month quantitative easing (QE) program through which it printed new money and used this money to buy debt securities from banks. And it even launched several repo programs through which it allowed hedge funds and financial firms to park assets with the Fed in exchange for cash. All in all, from September 2019 to December 2019, the Fed provided some $100 billion in liquidity to the financial system every single month. The Fed then stopped these policies on a dime in mid-December. From that point onward, the Fed's balance sheet, which expands when the Fed is providing liquidity to the financial system, completely flatlined. You can see these developments in the chart below.  Now, you can see the impact these policies had on the stock market in the chart below. The Fed created this environment with its monetary policies. The fear of an economic slowdown due to the coronavirus was simply the "pin" that burst this mini-bubble.  The big lesson here is this: The financial system is now completely addicted to Fed liquidity. The Fed can try to talk tough about withdrawing liquidity from the system, but at the end of the day, the market is going to force the Fed's hands. Which means… very soon, the Fed is going to be forced to start engaging in even MORE aggressive monetary policies. We're talking rate cuts, more QE, and eventually admitting that it is buying stocks to force the markets higher. I believe this process is already underway. And these interventions are going to trigger one of the greatest trading opportunities in the history. |

Tidak ada komentar:

Posting Komentar