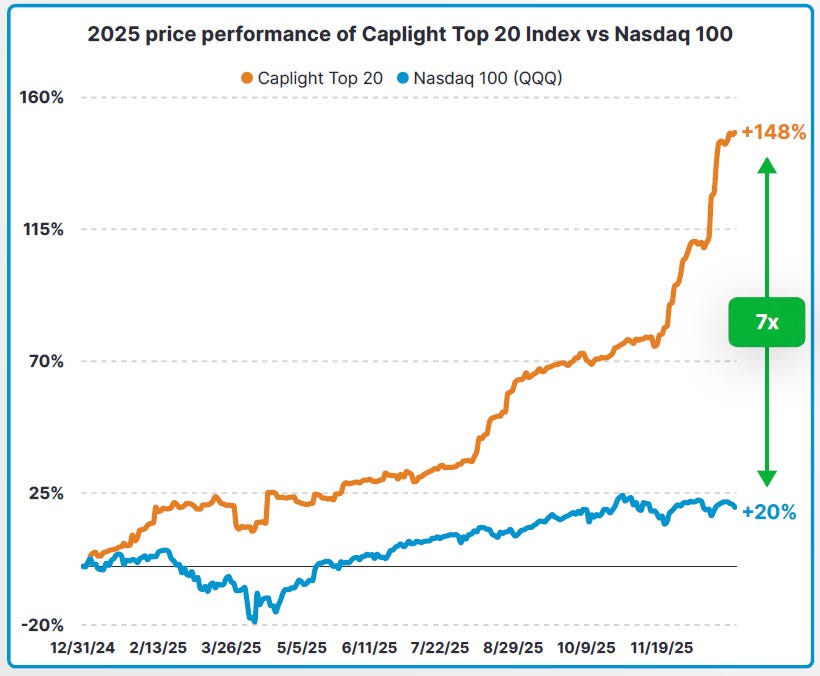

The largest private technology companies outperformed the public markets by 7x in 2025. Caplight’s Top 20 Index is a financial index tracking the performance of the largest late-stage, venture-backed, private companies with active secondary markets. The index is dominated by the largest six companies - OpenAI, SpaceX, Anthropic, xAI, Databricks, Stripe - which account for 86% of the Top 20 Index by valuation. Investors who prioritized access to these names, rather than public market darlings like NVIDIA, Google, Amazon, etc., saw significantly better returns in their portfolios last year. Ultra-high net worth family offices are showing very high demand for OpenAI, SpaceX, and Anthropic in particular. One investor recently told us a story involving an UHNW family trying to get directly on Anthropic’s cap table with a $140M check. The effort was fruitless, and they ended up investing a smaller amount into an SPV that fed into another SPV. A sign of the times. According to Caplight’s data, 2025 was the strongest venture capital secondary market since 2021.

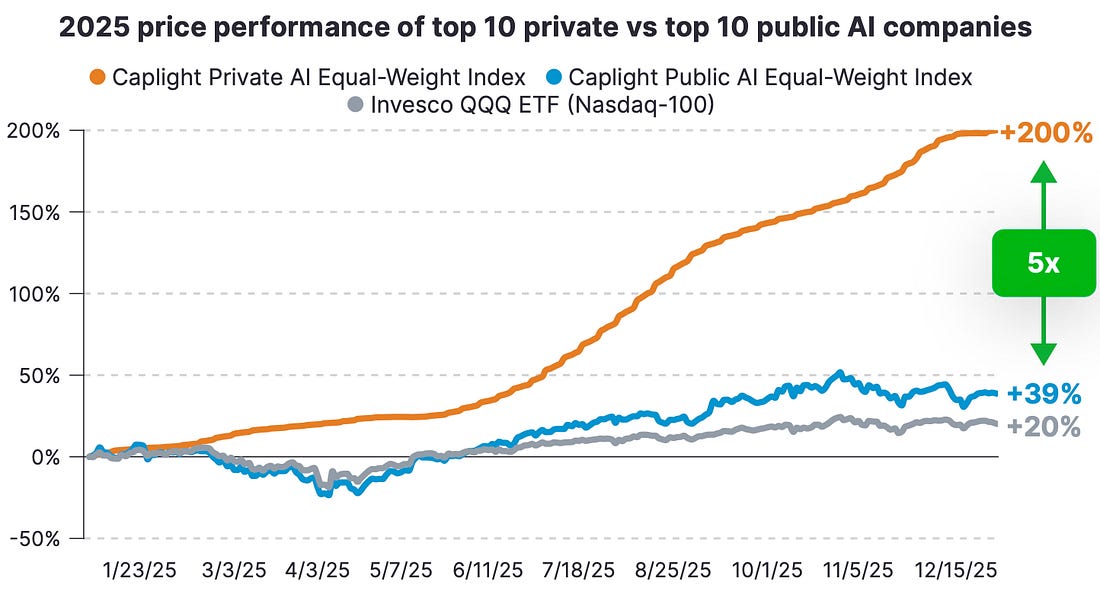

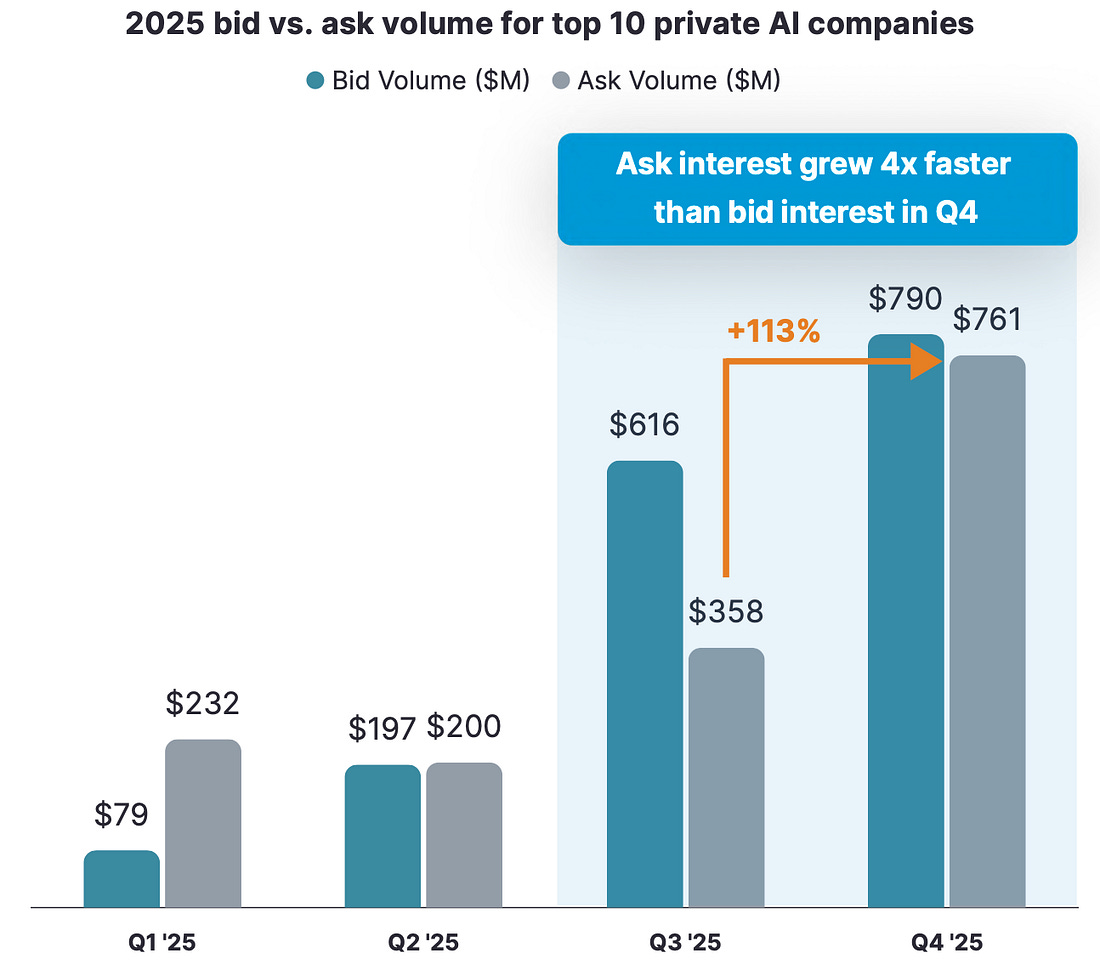

Mercor (+423%), Anthropic (+402%), Skild AI (+368%), Crusoe (+244%), ElevenLabs (+205%), OpenAI (+144%), and Perplexity (+94%) led the way for private AI companies. On the public side, companies like AMD (+77%), Google (+65%), TSMC (+54%), ASML (+53%), NVIDIA (+39%), Microsoft (+15%), and Meta (+13%) saw very solid returns, but paled in comparison to the private market’s stars. The delta is multifactorial, but it’s useful to focus on two key drivers. First, the pure-play AI companies are all private due to AI being a recent phenomenon. Every company built from the ground up with a focus on AI was founded in the past ten years. Google, NVIDIA, and AMD are the closest thing you get to pure AI exposure on the public markets. Second, the private markets are less sensitive to macroeconomic pressures. Investors on the public side trim exposure in the face of geopolitical uncertainty, while the private market is much less reactive in the short/medium terms. The top three private tech companies - SpaceX, OpenAI, and Anthropic - are all aiming to graduate to the public side this year. These 3 companies combined account for 23% of the entire VC pre-IPO market. The big three also accounted for 17% of secondary market activity. Lastly, an interesting shift took place around the end of year mark: investors are now looking to lock in gains as quarter-over-quarter ask volume increased at 4x the rate that buy volume increased. There are three main storylines to watch going forward: IPO Games.Who has the most successful debut? OpenAI, Anthropic, and SpaceX are all three very different companies and it will be peak cinema to watch this blockbuster trio of IPOs pan out in real time. If you are a tech investment banker, get your rest in now. Anthropic is likely expected to have the lowest valuation, but public investors might like them relative to OpenAI, a much more expensive foundation model name. In addition, Anthropic has been making great in-roads into enterprise adoption while OpenAI is leaning into building a consumer oriented platform (ChatGPT Health is a preview of this, expect similar releases in the future, i.e. ChatGPT for Personal Finance). On the secondary market, Anthropic’s valuation skyrocketed in 2025 as investors saw it as a stable, cheaper alternative for foundation model exposure - the company’s secondary valuation grew 2.8x faster than OpenAI’s. I’d even go as far as saying the smart money’s on Anthropic: earlier this week it was reported that Sequoia Capital is joining a private round for Anthropic despite already investing in rival companies OpenAI and xAI. The round is being led by Coatue and GIC. Private Delta.Will private markets go mainstream? The top 10 names are trading at public market valuations, and provided more portfolio growth than the public side. Going forward, the secondary market will need to evolve to support more liquidity, transparency, and ease of access for interested investors. The biggest barrier to a highly liquid secondary market is information asymmetry. Are secondary buyers getting information rights? Where do they sit in the capital stack? How do liquidation preferences affect their exposure? These access barriers are not simple problems. Investors must be cautious. Money Machines.The largest venture capital funds are just getting warmed up. Andreessen Horowitz announced their new $15B fundraise two weeks ago. Founders Fund closed on $5B a year ago. You should expect Thrive to announce a new fund in the next six to twelve months, likely between $7B - $10B. More money than ever has been secured in the hopes of crowning the next Sam Altman or Dario Amodei. The amount of capital at the later stages combined with more transparent secondary markets means that early stage venture capital investors will start taking more chips off the table, earlier. The venture capital market will continue to bifurcate into a16z/FF/Thrive/Sequoia/GC/Lightspeed and boutique early stage investors that don’t touch anything at the Series A stage or onwards. The middle market Series A/B firm is dead, save for sector specialists who have carved out their respective niches. It won’t be long before the pre-seed/seed boutiques start exiting positions entirely when the big boys pick up the tab at Series A/B stages. No more holding for an IPO exit ten years down the road; pre-seed funds are exiting at Series A when a16z turns their portfolio company into a unicorn, just a few years after the initial investment. Be on the lookout for signals that this shift is taking place. Venture capital is now officially two separate asset classes. for your eyes only. |

Kamis, 22 Januari 2026

Flying Private: The Delta Between Venture and Public Markets

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar