Publisher's Note: Own the NatGold Mint — Not Just the Token

Don't just buy the car — own the factory.

Most investors will access NatGold via the token. This round lets you own the NatGold Mint — the company that mints the first digitally mined, gold-backed token and keeps 20% of every issuance.

That's the difference between buying what the factory makes... and owning the factory itself.

Private Placement is now open.

Final pre-launch window: your chance to own equity in NatGold Digital before tokens go live.

- Use of proceeds and timing: Completes the build ahead of the Q1 2026 Tokenization Event; leadership does not anticipate additional financings once tokens are live.

- Platform economics: Operating margins of over 98% and near-zero cost of goods once gold resources are certified and tokenized; a compounding inventory from 20% of every token minted.

- Momentum and moats: Over $400 million in token reservations across 161 countries (as of Feb. 4, 2026); 11 provisional patents (protected IP position); leadership from ex-SEC and Barrick/BHP.

Deadline: This financing round closes later this month (or sooner if fully subscribed).

When this door closes, you'll either own the mint — or be buying the product from it.

👉 Secure your equity allocation now.

This is the last pre-launch window to secure equity before the inaugural Q1 2026 Tokenization Event.

👉 Claim your spot before the window shuts.

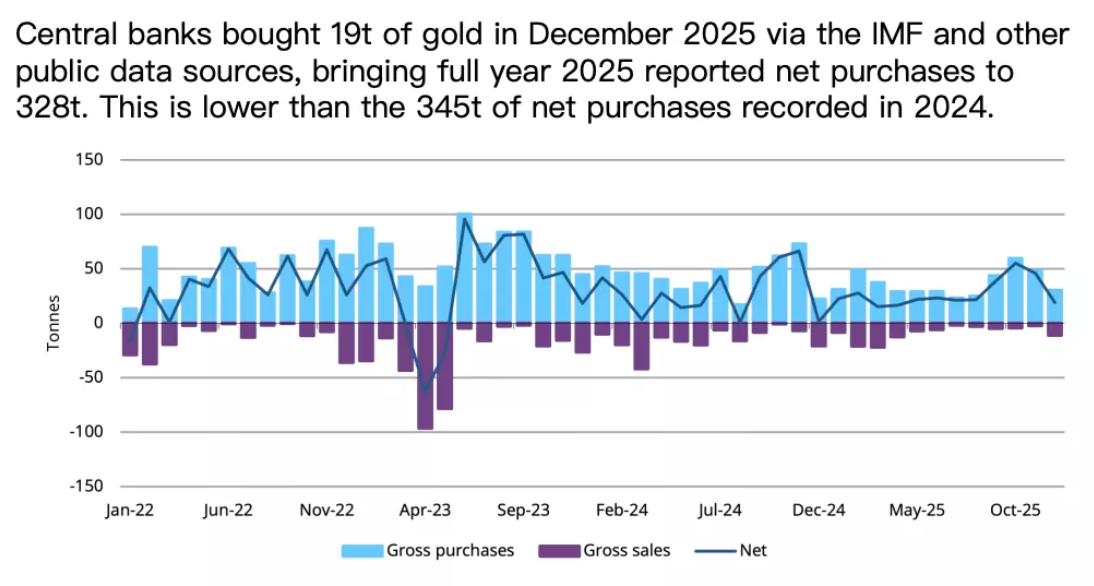

There's a reason this chart isn't on CNBC or Bloomberg. But you'll see it on every gold website, Kitco and the World Gold Council to name a few.

It shows something that contradicts the dominant narrative.

It shows behavior, not opinion.

It shows policy, not panic.

While investors were told gold had gone "too far"…

While traders panicked over a correction…

While headlines whispered "top"…

The largest buyers in the world kept buying.

Not ETFs. Not Reddit traders. Not momentum funds.

Central banks.

Per Gold.com:

Although central banks bought less gold in 2025 than they did in 2024, last year's purchases were still relatively high versus pre-2020!

And that single fact explains why the recent correction was not the end of the rally — but the beginning of its next chapter.

That is what just happened in gold. We didn't witness the end of a bull market. We witnessed a transfer of ownership from emotional traders to structural buyers. The price moved. The thesis did not.

And the most important buyers in this market never blinked.

Central banks.

Let me explain…

Scene One: The Buyers Who Never Sell

According to the latest data through December 2025, central banks continued to add gold even as prices surged and then corrected. Poland led the world with record purchases. China maintained one of the largest official reserve positions on Earth. Kazakhstan, Brazil, and Turkey continued to add ounces steadily.

But the real story isn't just what's reported — it's what isn't. A meaningful share of central bank accumulation happens off the radar, only showing up months later when the metal is already secured. That means actual sovereign demand is likely higher than the public numbers suggest. This isn't speculative behavior. It's strategic behavior. It's not momentum trading. It's monetary policy.

Central banks don't chase rallies. They prepare for crises.

They don't buy stories. They buy permanence.

Gold is not a trade for them. It is insurance.

And they are buying it in bulk.

Scene Two: The "Crash" That Wasn't

Yes, gold pulled back sharply at the end of January, losing nearly $1,000/oz.

But that pullback was mechanical, not fundamental. It was driven by profit-taking after one of the fastest vertical moves in modern gold history.

Leveraged money took gains. Headlines overreacted. Algorithms did what algorithms do. But the underlying demand never cracked. Sovereign accumulation never slowed. Long-term positioning never reversed. In real bull markets, corrections don't signal the end — they reset sentiment so the next leg can begin.

This was not a breakdown. This was a breather. This was a transfer of supply.

From traders… to Treasuries.

If gold were truly "too high," central banks would have paused.

They didn't. There were net buyers during gold's record rally in the second half of 2025.

They bought the dip in September.

Scene Three: Wall Street Joins the Chorus

Now layer on what the big banks are saying. JPMorgan sees gold climbing toward $6,300 per ounce, even after the correction. That's not a hype call. That's a reserve-flow call. It's based on balance sheets, not charts. Other global institutions are revising targets higher for the same reason: the behavior of reserve managers has changed. The dollar is no longer the only safe reserve. Treasuries are no longer unquestioned. Geopolitics is no longer background noise. Gold is being repositioned from hedge to strategic asset.

Not because of fear. Because of design.

Gold is being chosen. It's the queen of the prom!

And gold is ground zero of the MoneyQuake.

Reminder: What Moneyquake Really Is

MoneyQuake is not a ticker. It is not a trade. It is not a one-year theme.

It is a regime shift.

A slow earthquake under the monetary system.

- Debt levels too large to normalize or be paid back

- Fiat trust quietly eroding

- Central banks hedging themselves

- Real assets re-priced

- Gold re-monetized

In the last cycle, gold rose on panic. In this cycle, gold is rising on policy.

That is the difference. And differences matter.

AI Is STEALING From You

(Claim up to $41,430 a Year as Payback)

It's time to delete ALL of your social media accounts.

Why? Because AI firms are downloading every part of your digital identity to train AI models like ChatGPT WITHOUT your permission or any compensation.

OpenAI openly states that "your data is used to improve model performance."

Your private conversations and personal information are building fortunes for billionaires, so it's about time you got paid too.

Luckily, I've found a government-backed income stream that could pay you up to $41,430 a year in "AI equity checks."

Best of all, it takes only five minutes and as little as $10 to get started!

Follow these three simple steps to receive your first check.

Scene Four: Gold Goes Digital — and Money Follows

Now comes the part that changes the story.

In January 2026, Paxos Gold — a blockchain-based gold token backed 1:1 by physical bullion — recorded the largest inflows in its history.

Read that sentence again!

This didn't happen during a crypto boom, because Bitcoin has been sucking wind. Bitcoin is down 36% since October.

It didn't happen during a speculative frenzy. It happened while crypto markets were sluggish. That tells us something profound: capital is not leaving digital finance — it is migrating toward digital stability. Investors aren't abandoning blockchain. They are anchoring it to gold.

Crypto is no longer trying to replace gold.

It is becoming a delivery system for gold.

Gold now moves at internet speed.

And the money is following it.

Scene Five: Why Natgold Is Different

Most investors think in terms of ownership.

"I own gold."

"I own a miner."

"I own a token."

NatGold operates at the infrastructure level. It operates within the geology!

It is not just exposure to gold. It is exposure to issuance.

That's the difference.

Owning the coin is one thing. Owning the mint is another.

If gold is being digitized… If gold is being tokenized… If gold is being integrated into modern finance…

Then value will not only accrue to the metal.

It will accrue to:

- Certification

- Tokenization

- Issuance

- Distribution

That is the layer NatGold plays in.

Paxos proves demand exists.

NatGold positions where issuance happens.

That's not speculation. That's structure.

Scene Six: This Is Not a Trade — It's a Timeline

Central banks don't reverse strategy in six months. Monetary systems don't shift in one cycle.Repricing doesn't end after one rally.

This is early innings.

Gold is being re-monetized. Every reserve purchase is a vote. Every token inflow is confirmation. And every bank forecast is validation.

This is not how tops form.

This is how foundations harden.

Final Scene: Short-Term Noise, Long-Term Signal

Gold corrected. The thesis did not.

Price moved. Behavior did not.

Narratives shifted. Flows did not.

- Central banks are still buying.

- Big banks are still bullish.

- Tokenized gold is seeing record inflows.

- Infrastructure is being built.

MoneyQuake is not peaking. It is rounding its first turn.

And the investors who understand what's happening are not trading this…

They are positioning for it.

Through gold.

Through digital gold.

Through owning the mint.

Through owning the rails.

That is the NatGold thesis.

That is the Paxos proof.

That is the MoneyQuake future.

And this is not a one-year story.

It is a multi-decade one.

Get to the good, green grass first…

The Prophet of Profit,

Tidak ada komentar:

Posting Komentar