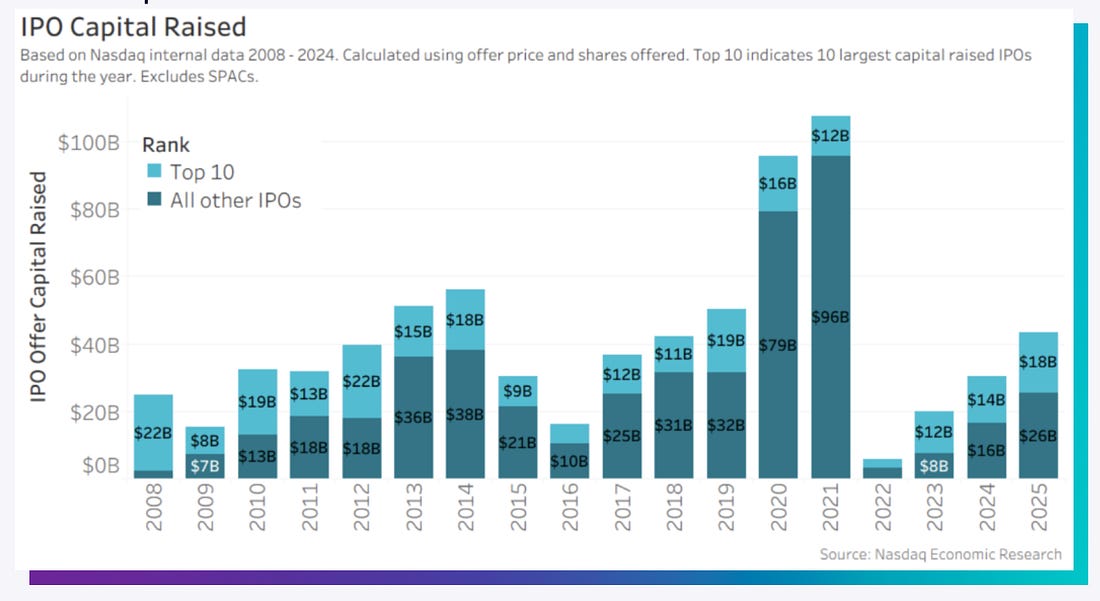

Empires come and empires go. The desire to build from the ground up and expand is as innate to man as quenching thirst for water and knowledge. History seems to be an endless repetition of ambitious men attempting to build massive empires that span the globe. Many notable empires have come close to dominating the globe, but one after another, they inevitably crumble. Interestingly, the Book of Daniel describes a mysterious empire that will be unique: “In the lifetime of those kings, the God of heaven will set up a kingdom that shall never be destroyed or delivered up to another people; rather, it shall break in pieces all these kingdoms and put an end to them, and it shall stand forever.” Thus whoever is at the top of this empire necessarily will be the King of Kings. The four empires described before this mysterious empire are widely interpreted to be Babylon, Persia, Greece, and Rome. So the question becomes which empire after Rome will be the chosen one? After the Western Roman empire fell and the Eastern Byzantines continued to reign, it seemed as if this was the everlasting kingdom. But the Ottomans had other ideas. The Holy Roman Empire sprung up centuries after the Western empire fell and utilized the name to cement legitimacy, but they too would eventually see their end. Seizing on the chaos and instability of the French Revolution, Napoleon usurped power from the republic and crowned himself King, defying the tradition of the Pope crowning Kings. Battle after battle, Napoleon emerged victorious and stretched the empire further and further. At the height of his power, the French empire spanned from the Iberian Peninsula to the border of Russia and from the North Sea to Southern Italy. The fifth kingdom had been identified. Or so it seemed. Along the years of consistent conquest, France had made many enemies, and it was only a matter of time before they bound together in the classic “the enemy of my enemy is my friend” maneuver. Russia, Austria, Prussia, The United Kingdom, Sweden, and Spain all joined forces to bring Napoleon’s vision for world conquest crashing down. After fleeing exile from the island of Elba, near Italy, he came back to the game like Wizards Jordan and tried to get his get back. He failed. This time, he was sent to St. Helena, an island between Africa and South America, with 1,000+ miles separating the island from either land mass. It was officially over. He spent six years there before eventually passing away. In the grand scheme of things, six years isn’t a long time. However, for a man whose whole life was dedicated towards constant expansion, leadership, and brutal competition, it begs the question: how can a man like that spend the rest of his life essentially doing nothing? This is the same question founders ask themselves when they step away from their company after a “successful exit.” From the outside looking in, the idea that there could be an agent-principal dilemma between founders and VCs can be confusing. After all, the alleged goal for the company is for the founder to come up with the idea, source capital from investors to build the product and scale, and then finally both enjoy the wealth that proceeds the exit, either through M&A or an IPO. But it’s not that simple because founders and investors unsurprisingly have different motivations. VCs have their own investors that they need to appease, so the liquidation event is always the end goal. In recent years, investors have grumbled over the lack of action surrounding these two mechanisms for liquidity, but things seem to be reversing course a bit. In 2025, there was a strong rebound in M&A, reaching a deal value of just under $5T, thanks in large part to the record level activity in Q3 and Q4. Mega transactions–exceeding $5B–saw a notable uptick, with 122 occurring, a sharp uptick from the 76 and 74 in 2024 and 2023 respectively. Strategic buyers through corporate M&A rose to $2.73T, representing roughly 60% of total deal value. The IPO market also improved from the past few years, as the 354 total new public offerings far surpassed the 218 and 145 in 2024 and 2023 respectively. $44B was raised by non-SPAC offerings, compared with $30B and $20B in the two previous years, with healthcare company Medline winning the gold medal after raising $6.26B in their IPO. Although the capital raised through public markets in 2025 don’t come close to 2021 figures, it was still significant enough to surpass every year between 2015 and 2018. Thus, investors seem to be a bit more optimistic based on this data and are hoping to see the trends continue on this trajectory. After all it is a simple equation: more exits leads to more money for the LPs and thus more money for the GPs. But with founders, it can be a bit more complicated than that. This complication occurs because many of the most successful founders build companies as a tool to do what they want to do. This seems obvious and cliche but still needs to be said nonetheless. For the rest of the founder population, the means is the company and the end is wealth and status, which is why there seems to be an imbalance between people building companies and truly revolutionary ideas. On the other hand, for the S-tier founders, the wealth is undeniably nice, but it is not the end goal; it is a mechanism for accelerating the increase in quality and/or quantity of either the existing product or the product that naturally proceeds the existing one. In other words, the true builders don’t simply take the cash from their previous exit and call it a day; they move on to the next goal / mission because the urge to expand is in their DNA. For VCs, being able to determine which companies are headed by these individuals is the game itself. After all, the founders with the lust for wealth and status at their end goal know they must conceal their true motivations, just as the precocious 20-year-old Ivy League Economics student must refrain from telling the Goldman VP interviewing him that he simply wants to leave after two years before exiting to private equity. Thus, these type B founders put on the type A mask, and it is the VC’s job to discern who is who because the wrong selection could be the difference between life and death. The easiest way to determine who is who is of course to use a retrospective lens to see who continued to build even after having the opportunity to kick back and relax into perpetuity. Many examples of repeat founders building multiple impressive companies exist. Jack Dorsey. Peter Thiel. Evan Wiliams. But the most notable of them all is of course Elon Musk. Rather than sell his companies for a payout, he essentially doing the opposite with the continuous merging of his companies, attempting to pull off one the most ambitious vertical integration schemes of the modern era through the acquisition of xAI by SpaceX just 10 months after xAI’s acquisition of X, formerly known as Twitter. The strategic consolidation is impressive:

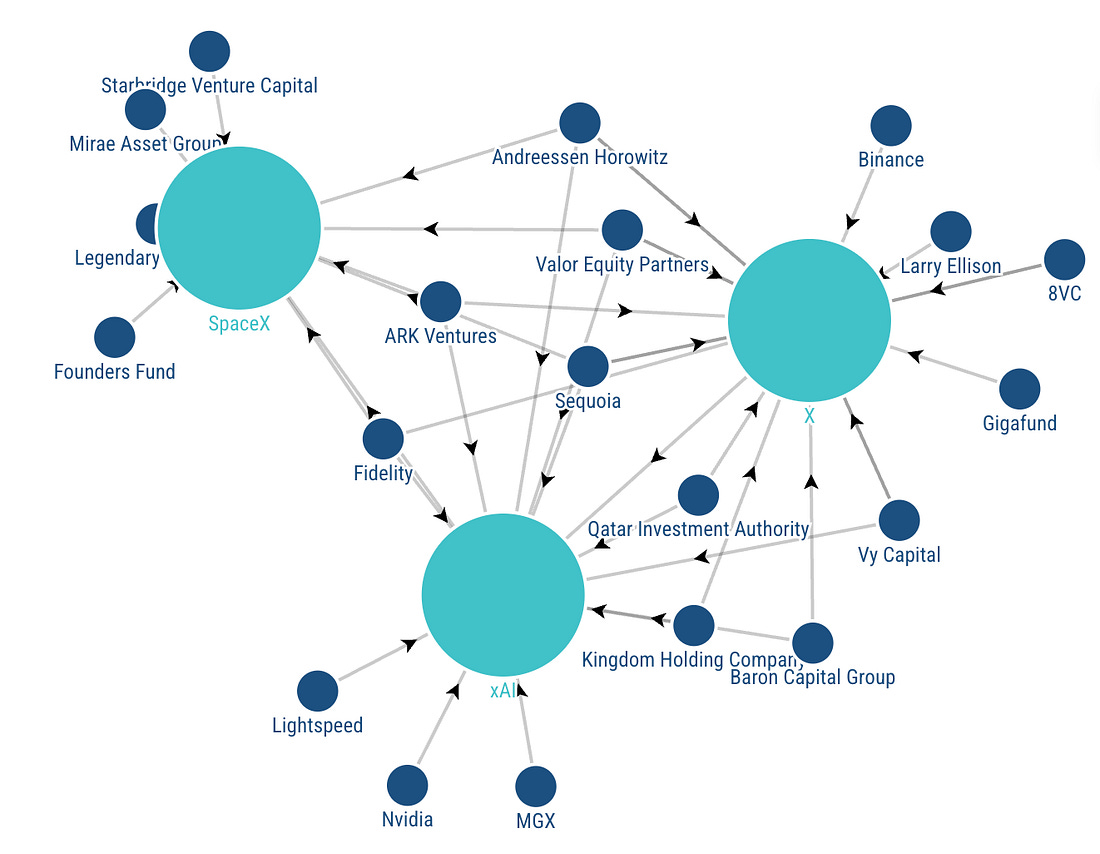

The two mergers within the past year have also converged three different groups of investor blocks to create possibly the most fascinating cap table a private company has ever composed. Arguably the two most notable VCs in Sequoia and a16z both see their private Elon holdings consolidated into one entity after investing in all three ventures at previous stages. Other notable mentions include Founders Fund investing in SpaceX, Larry Ellison’s and Qatar’s stake in X, and Lightspeed and Nvidia backing xAI. The SpaceX conglomerate is reportedly valued at $1.25T, qualifying for the largest merger of all time, and if an IPO materializes, it will be cinematic to a fault, likely sucking the air out of the room for OpenAI and Anthropic. No matter how you slice it, Musk’s run post-PayPal has been generational. His empire is now being brought under one roof, and the pieces fit together quite smugly. An IPO of this size would put him on the Mount Rushmore of founders, right next to Ford, Carnegie, and Rockefeller. This is Kobe against Boston in 2010. One last embrace of victory, oh how she shines when the night falls! All the greatest kings and emperors throughout history are connected to each other in some fashion. Swinging back to Napoleon, he was exiled to the island of Saint Helena, as previously mentioned. Who is Saint Helena exactly? None other than the virtuous mother of Constantine, the Roman emperor famous for legalizing Christianity with the Edict of Milan in 312 AD. This type of connection is a rare case. The connection is usually that of inspiration. Caesar wept before the statue of Alexander the Great because the latter had conquered the known world at the same age Caesar had achieved little politically. Vowing to follow in his footsteps, he became the first Roman emperor. Charlemagne was crowned the new “King of the Romans” in 800 AD by Pope Leo III, resurrecting the line of emperors created by Caesar himself. Napoleon, crowning himself as previously mentioned, visited Charlemagne’s tomb in Aachen, doing his best to mold the French empire into something akin to the Holy Roman Empire. So who is the King of Kings, the head of the everlasting empire? It is neither Alexander, Caesar, Charlemagne, Napoleon, nor Elon. Yet, Napoleon knew who it was. He explains: “Alexander, Caesar, Charlemagne, and myself founded great empires; but upon what did these creations of our genius depend? Upon force. [The King of Kings] alone founded His Empire upon love, and to this day millions would die for Him.” for your eyes only. |

Selasa, 10 Februari 2026

Of Crowns and Capital.

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar