Market News: |

U.S. futures stall near record highs as investors weigh fresh economic data. Bitcoin briefly topped $70K before pulling back; volatility remains elevated. Gold climbs as the dollar softens ahead of key labor numbers. Retail crypto trading cools, pressuring brokerage stocks. Oil ticks higher on renewed geopolitical tension. Tesla Proved AI Can Move Cars. This Company Proves It Can Move Markets* (ad)

|

|

Meta told investors they're going to spend up to $135 billion on AI in 2026, nearly doubling the $72 billion spent in 2025. |

And you know what? Wall Street loved it. $META ( ▼ 0.96% ) jumped 10% after the earnings call. |

Why would investors celebrate a company announcing it's about to burn through more cash than some countries make in a year? Because Meta's AI spending is already paying off—in real dollars, not promises. |

|

The Numbers Don't Lie |

|

Let's talk about what Meta actually delivered in 2025. |

Revenue hit $201 billion, up 22% from the year before. Q4 alone brought in $59.89 billion, which beat expectations by a solid margin. |

But here's the thing that matters: their AI-powered ad targeting is working. Like, really working. |

Ad prices went up 9% for the full year. Ad impressions grew 12%. That's not just growth, that's the kind of growth that shows their system is getting smarter at matching ads to people who'll actually buy something. |

Think about it like this: if you're selling baseball gloves, would you rather show your ad to 1,000 random people or 100 people who just searched "how to break in a new glove?" |

Meta's AI is getting better at finding those 100 people. And advertisers are paying more for that precision. |

| | Billionaires & Congress Are Quietly Piling Into This One Sector | What do Buffett, Griffin, Koch, and 100+ members of Congress have in common? | They're all betting on one overlooked $20 stock. | It's in a sector set to impact $85 trillion globally. | Click here to get the ticker >>> | *ad |

| | |

|

|

The Super Bowl Connection |

You probably saw Meta's Super Bowl ads featuring their Oakley smart glasses with built-in AI. Those weren't just flashy commercials. They were Mark Zuckerberg's way of showing investors where all that money is going. |

He's betting the farm that AI-powered hardware and "personal superintelligence" (his words, not mine) will be the next big thing. The ads cost millions, sure. But they got people talking about Meta as an AI company, not just a social media company. |

That shift in perception? That's worth billions in market cap. |

| | | | Would you personally buy AI-powered smart glasses? | |

| |

| | |

|

|

Where the Money's Really Going |

|

Meta's not spending $135 billion on cool gadgets alone. Most of it's going into three buckets: |

Data centers: Massive warehouses filled with computers that process AI workloads. These things are expensive to build and even more expensive to run. We're talking millions in electricity bills alone. |

Tech talent: Engineers who know how to build AI systems don't come cheap. Meta's hiring aggressively and paying top dollar to compete with Google, Amazon, and every startup trying to be the next OpenAI. |

Infrastructure: Servers, networking equipment, storage systems. All the hardware that keeps the AI running 24/7. |

The majority of their 2026 expense growth will be infrastructure. That's actually a good sign. It means they're building something real, not just throwing money at research projects that might never pan out. |

|

Why This Is Different |

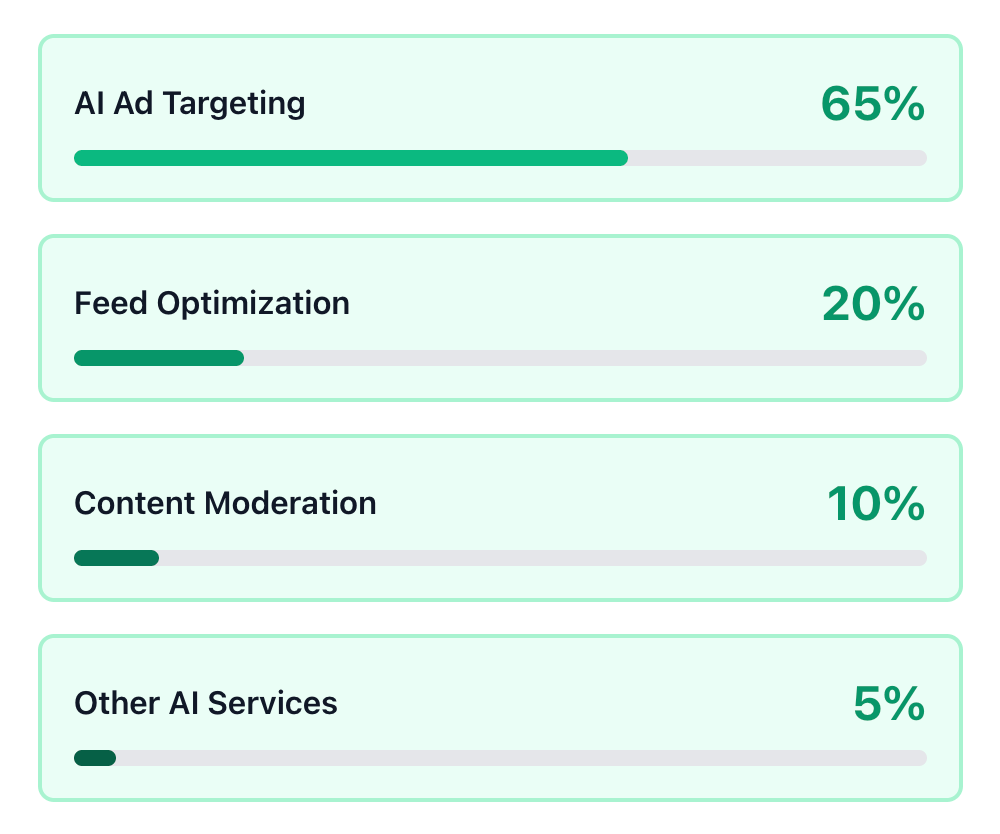

| How Meta's AI Generates Revenue |

|

Q1 2026 revenue is projected between $53.5 billion and $56.5 billion. That's roughly 30% YoY growth. You don't get that kind of growth by accident. The AI they've already deployed is working. |

Compare that to some other tech giants who are spending big on AI but haven't really shown how it'll make money yet. Meta's connecting the dots between spending and revenue in real time. |

|

The Reality Labs Problem |

Not everything's perfect. Meta's Reality Labs division, the part making VR headsets and smart glasses, lost $19.2 billion in 2025. That's... a lot of money to lose. |

But here's the nuance: Meta says those losses will stay "similar to 2025 levels" in 2026. They're not growing. The company's profitable business (Facebook, Instagram, WhatsApp) is covering these bets. |

Think of it like this: if you're making $200,000 a year and spending $20,000 on a side project that might become something huge, that's manageable. That's basically what Meta's doing, just with a few more zeros. |

|

What This Means |

If you're looking at $META right now, you've got two ways to think about it: |

The bull case: AI-driven ad revenue is already growing faster than expenses. The smart glasses could become the next iPhone-level product. Meta's getting ahead of competitors who are still figuring out how to monetize AI. |

The bear case: $135 billion is a lot of money to spend on unproven technology. If the hardware push fails like the metaverse did, that's a huge problem. |

$META current P/E ratio of around 28 suggests investors are pricing in continued growth. That's reasonable if the AI momentum continues. It's expensive if growth slows. |

| | Nervous about the stock market? Read this | If you have any kind of money in the stock market ... | You MUST watch this urgent broadcast to understand what's happening ... | Because our research shows we're in for a very turbulent 2026. | And people who are ignoring the signs risk total financial ruin ... | Because it could erase years of gains from investors' portfolios. | Consider yourself warned. | Click here to watch this urgent message - before it's too late. | *ad |

| | |

|

|

The Bigger Picture |

Here's what nobody's really talking about: Meta might be showing us the blueprint for how AI actually makes money. |

It's not about selling AI tools to businesses (though they're doing that too). It's about using AI to make your existing business work better. Meta's using AI to show better ads, keep people scrolling longer, and understand what content will go viral. |

That's happening right now. |

Compare that to companies building AI models and hoping someone figures out how to monetize them later. Meta's monetizing first and improving the AI as a result. |

|

What to Watch Going Forward |

A few things will tell us if Meta's strategy is working: |

Revenue growth in Q2-Q3 2026: If they maintain that 20%+ growth rate, the spending is justified Operating margin: They're promising it'll exceed 2025 levels despite higher expenses. That's the key metric Smart glasses adoption: If nobody buys the Oakley Meta glasses, that's a red flag

|

Competition response: What do Google and Amazon do? If they start copying Meta's playbook, that validates the approach |

|

Bottom Line |

Meta's spending $135 billion on AI because they've already seen it work. Their ad business is growing faster because AI makes ads more effective. Their user engagement is up because AI shows people content they actually want to see. |

This isn't a moonshot. It's a company doubling down on something that's already making them money. |

Is it risky? Sure. $135 billion is never not risky. But it's a calculated risk backed by two years of data showing AI investments drive real revenue growth. |

For investors, the question isn't whether Meta should spend on AI. It's whether they can maintain the growth rate that justifies this level of spending. |

Based on Q4 results and Q1 guidance, they're on track.

|

|

| | | | Quick ratingHow was this one? | |

| |

| | |

|

Disclaimer: This analysis is for educational purposes only and should not be considered investment advice. Always do your own research before making investment decisions. |

Items marked with an asterisk (*) are promotional and help support this newsletter at no cost to readers. |

Tidak ada komentar:

Posting Komentar