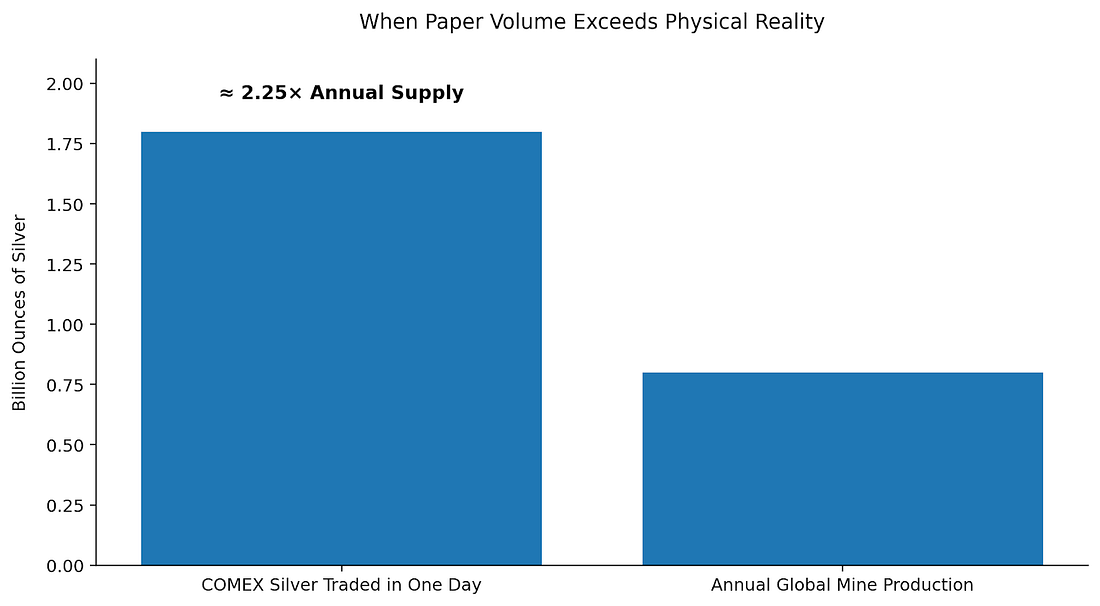

Is Now the Time to Buy Silver?Understanding the gap between paper stress and physical demand offers a roadmap through the current chaos.Most people think “price” is the truth. In markets, price is often just the last print in a much bigger fight. And on Friday, that fight got loud. Because while silver’s paper price was getting crushed, something else happened quietly in the background that should make you stop and think: Physical buyers did not panic. They stampeded. The result was one of the clearest tell signals you will ever see when markets are stressed. Not a normal selloff. Not a normal dip. A forced event. And those events always leave fingerprints. The Number That Should Not ExistStart here. A reported 1.8 billion ounces of silver traded on COMEX in a single day. Annual global mine production is commonly estimated around 800 million ounces. Even if you do nothing else with those numbers, you should feel the problem. How does “more than a year’s worth of global output” change hands in hours without the physical market instantly reflecting it? Simple. Because it did not. That volume was not about people buying silver. It was about positioning, leverage, and paper. The Retail Signal That Matters More Than a ChartNow compare that paper storm to what happened at the street level. One major precious metals dealer reported that physical silver demand surged to roughly 2.5 times its prior all-time record on the same day silver was smashed. That prior record, according to the same narrative, was set during the Silicon Valley Bank panic. Think about what that implies. When fear hit the tape, retail did not run away. Retail treated it like a fire sale. That is not how a normal “bubble top” behaves. At tops, buyers vanish. Dealers get stuck with inventory. Premiums collapse. Here, the opposite behavior showed up. The market dropped, and buyers showed up in force. That is a very specific kind of signal. It often appears when price is being set by liquidations, not by fundamentals. Why “Massive Volume” Can Be a Red FlagMost investors see huge volume and assume “real interest.” Sometimes that is true. But sometimes huge volume is exactly what it looks like when a market is being used as a pressure valve. Here is the mechanic. In a leverage-driven unwind, big players do not sell what they want to sell. They sell what they can sell. They hit the most liquid venues. They trigger stops. They force weak hands out. They create a cascade. Then, once the cascade does its job, they flatten out. What matters is not just the volume. It is what happens to open interest and positioning after the volume hits. When enormous paper turnover shows up and positions are closed rapidly into the same session, that is not long-term conviction. That is a hit-and-run. It is the footprint of a market being used to raise cash, manage exposure, or slam price through thin liquidity. And when it happens near a delivery month, it draws even more attention because delivery risk becomes part of the backdrop. The Physical Bottleneck That Price Does Not SolveHere is the part most people miss. Paper can move instantly. Physical cannot. You can trade billions of ounces of paper claims in a day. You cannot mint, ship, and restock real product on that schedule. That is why, in stress events, you get this strange phenomenon: Spot price down hard. That is the disconnect. And it is exactly what you see when the paper market is doing the work of clearing leverage while the physical market is doing the work of revealing scarcity. The Mint Backlog StoryAnother detail in the narrative matters, even if you set aside the drama and treat it as a simple supply-chain signal. Delivery timelines reportedly pushed from a few weeks to multiple weeks, with some sovereign mint products quoted further out than they were a month earlier. That is not a prediction. That is a lagging indicator of demand meeting limited production capacity. Mints do not scale output overnight. Blanks do not appear by magic. Refining capacity is not infinite. So when retail demand spikes right when paper prices drop, the pipeline gets stressed immediately. That is how “cheap spot” can coexist with “hard-to-get product.” Two Competing Stories, One Coming ResolutionAt this point, you have two stories running at the same time. Story one: The paper market says “risk-off, liquidations, get out.” Story two: The physical market says “discount, buy it, inventory is tight.” Those stories can coexist for a while. But they do not coexist forever. Eventually one side forces the other to adjust. And this is the part that should keep your attention. When a market’s paper volume can dwarf real-world production, the system is stable only as long as most participants treat the contract as a trading chip, not as a claim. When too many people want the claim to behave like a claim, the structure gets tested. That does not mean a breakout is guaranteed tomorrow. It means the pressure is building in the one place that cannot be faked: availability. What I’m Watching NextIf you want to approach this like a professional and not like a social media spectator, focus on a few simple tells... Keep reading with a 7-day free trialSubscribe to Market Traders Daily to keep reading this post and get 7 days of free access to the full post archives. A subscription gets you:

|

Rabu, 04 Februari 2026

Is Now the Time to Buy Silver?

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar