Last week's pullback in gold rattled some nerves. It always does. Corrections feel scary in the moment because they show up suddenly and erase a few weeks of gains in a matter of days. But in real bull markets, pullbacks are not the enemy — they are the fuel.

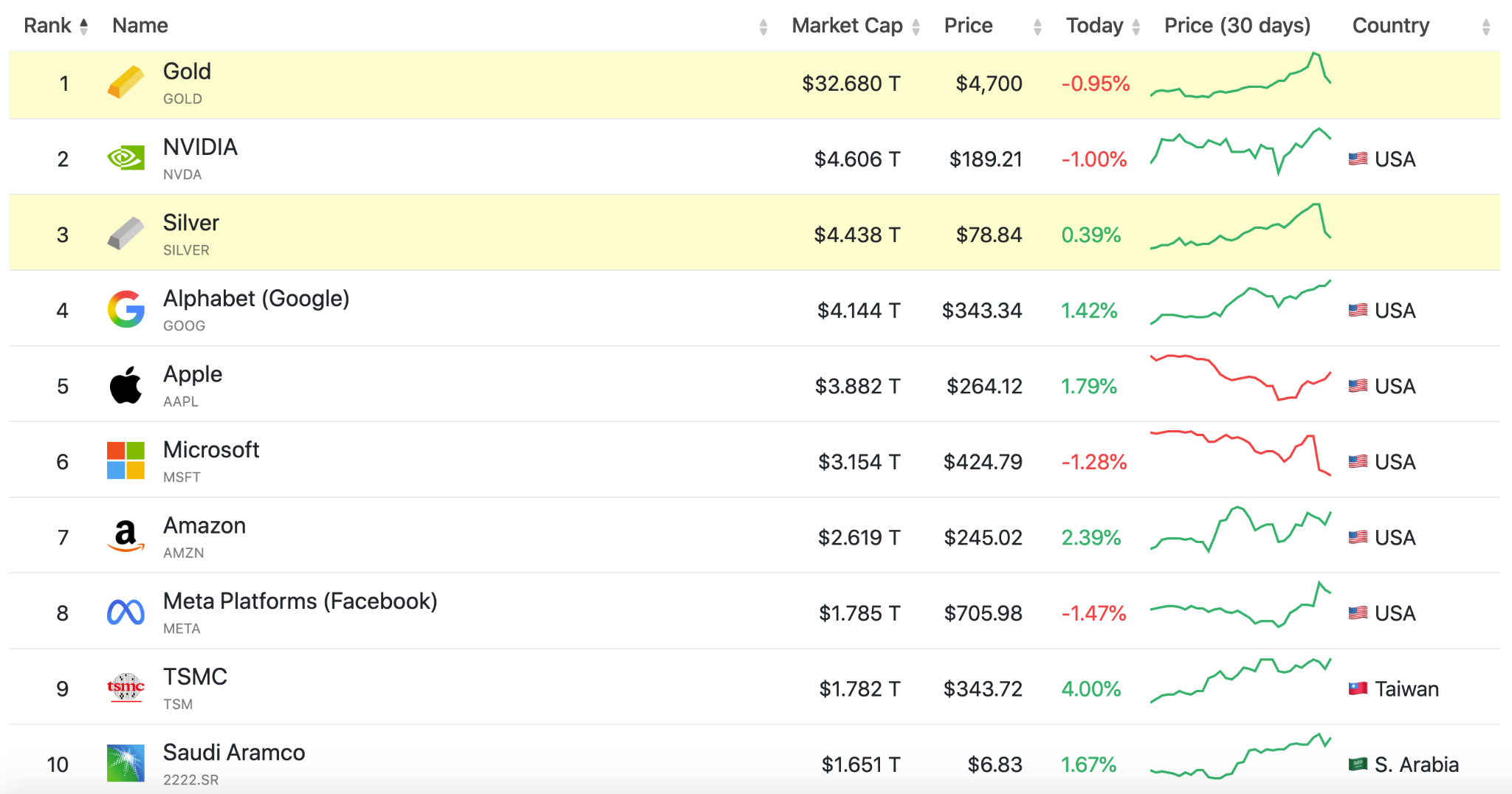

In fact, at the start of last week, silver was the No. 2 most valuable asset on the planet.

But by the end of last Friday, both gold and silver lost an estimated $5 trillion in market capitalization.

Although it's not an apples to apples comparison, both gold and silver lost the equivalent of Germany and Japan's annual GDP, respectively:

I've been telling you as far back as last September to expect a correction in February 2026. But we got the correction in mid-October.

I love corrections because it gives us a chance to add to positions that are in long-term bull markets.

They are the release valves that keep the advance alive. And what makes last week's correction especially important is not what happened on the chart… but what happened geopolitically right after it. Because while traders were focused on candles and moving averages, China was busy lighting a fuse under the entire global monetary system.

President Xi Jinping and China's central planners are no longer speaking in coded language about the yuan's role in the world.

They are openly accelerating their push to make it a global reserve currency — through trade settlement agreements, commodity pricing deals, and financial alliances that bypass the dollar system entirely. This is not symbolic. This is not theoretical. This is a direct challenge to the monetary architecture that has governed global trade since World War II.

And here's the part Wall Street still refuses to say out loud: China is still a communist nation. A command economy. A capital-controlled system. A country where property rights exist only as long as they align with Party interests. And now that system wants the world to hold its currency as a store of value.

That isn't just a challenge to the dollar.

It's a challenge to fiat money itself.

Because when the reserve currency question becomes geopolitical instead of economic, trust becomes the real currency — and trust is exactly what fiat systems cannot manufacture.

Elon's Out. Trump's DOGE Payouts Are Just Beginning.

Musk may be gone, but DOGE is now freeing up billions in government waste — payouts that flow straight to taxpayers like you.

- Up to $8,276 every 3 months

Secure your spot today before the next round hits.

In GO(L)D We Trust

For 80 years, the world operated under one assumption: The U.S. dollar was as good as gold.

First literally, when it was convertible into metal.

Then psychologically, when it was backed by American power, stability, and law.

But that psychological contract is fraying. Debt levels are exploding. Political polarization is intensifying. Sanctions are weaponizing payment systems.

And now China is offering an alternative — not because it is safer but because it is different. That alone is enough to destabilize confidence in the existing system. And once confidence erodes, capital does not migrate to another paper promise. It migrates to something that does not require belief.

Gold.

Silver.

And increasingly, digital gold.

China has been preparing for this moment for years. It has quietly built parallel payment rails. It has signed bilateral trade agreements outside the dollar system. It has encouraged commodity exporters to settle in yuan.

And all the while, it has been accumulating physical gold at a pace that makes Western central banks look passive. This is not an inflation hedge for China. It is a strategic stockpile. A monetary backstop. A signal that even as it promotes the yuan, it does not trust fiat currencies either — including its own.

That's the contradiction at the heart of China's strategy. It wants the yuan to be a reserve currency, but it knows reserve currencies eventually fail. So it prepares with metal. And that tells you exactly what smart money should be doing.

Even Commies Love Gold

Gold is not breaking out because of CPI prints or interest rate cuts. It is breaking out because central banks are losing faith in each other's money.

The dollar is bloated with debt.

The euro is trapped by politics.

The yen is trapped by demographics. And now the yuan is trapped by authoritarian control. In that environment, gold does not compete with currencies. It arbitrates between them. It becomes neutral money again. That is why central banks are buying it. That is why sovereign funds are accumulating it. And that is why retail investors are starting to feel like they are late — even though, structurally, this bull market is still in its early phase.

This is not 2011.

This is not the final blow-off.

This is the foundation phase.

Bull markets do not die because of news. They die because everyone owns them. And we are nowhere near that condition. What we are seeing now is the smart-money phase — repositioning, hedging, migrating. Pullbacks like last week are not signs of exhaustion. They are pressure releases that reset sentiment and set the stage for the next leg higher.

Corrections are not bearish.

They are bullish events in disguise.

Look Behind the Yuan

Here is the fatal flaw in China's yuan campaign: You cannot make a reserve currency without trust. And trust requires free capital movement, independent courts, transparent markets, and political predictability.

China offers none of those.

Capital controls remain strict.

Legal outcomes are political.

Markets are managed.

And policy changes are opaque.

That means the yuan cannot truly replace the dollar. But it does not need to. All it has to do is weaken confidence in the dollar system enough to fracture the old order. And when that happens, the fight is no longer about which currency wins. It becomes about escaping currencies altogether.

That is why this is so bullish for gold.

And doubly bullish for silver.

Gold becomes monetary protection.

Silver becomes monetary leverage.

Silver is cheaper. Silver is smaller. Silver is more volatile. And silver is also an industrial metal — essential for solar, electronics, AI, and electrification.

So when monetary fear collides with industrial scarcity, silver does not climb slowly. It surges. That is the historical pattern. That is the structural setup. And that is why China's currency ambitions matter so much more than most investors realize. They are not just a political story. They are a metal story.

The NatGold Train Is Leaving the Station

Now here is where the macro story turns into a specific opportunity. Because gold is no longer confined to vaults and bars. It is going digital. Not in the synthetic ETF sense. Not in the leveraged paper sense. But in the tokenized, asset-backed sense — where gold becomes programmable money on blockchain rails. That is the bridge between old-world value and new-world finance. And that is exactly where NatGold Digital sits.

NatGold is not trying to invent gold. It is unlocking gold that already exists but cannot be mined economically or politically. Certified, unmined reserves become financial assets without destroying land, poisoning water, or fighting permit wars. In other words, it is gold adapted for the ESG age and the digital age at the same time. And that makes its timing almost uncanny. Just as central banks are hoarding physical gold and currencies are losing credibility, NatGold is preparing to issue tokens backed by real metal in the ground.

This is not a crypto story. This is a monetary infrastructure story.

It connects physical scarcity to digital liquidity. It connects environmental pressure to financial innovation. And it connects geopolitical instability to personal sovereignty.

Trump Devises the Death of the IRS

He just signed a historic order to abolish the IRS as we know it — and replace it with a $1 trillion National Fund that PAYS YOU.

Everyday Americans could soon collect checks worth up to $21,307...

But only if they act before the first wave goes out.

Click here to claim your share.

Invest NOW!

Right now there are only two ways to get positioned in NatGold before it goes public: the private placement and the token reservation program.

Both are still open. Both are still priced for early participants. And both are approaching their closing window. Once tokens go live, this stops being about access and becomes about price discovery.

And price discovery in new monetary systems rarely moves slowly.

That is the golden thread running through everything we have written about NatGold. This is not a side bet. It is the digital expression of the same thesis driving gold and silver higher: distrust in fiat systems and migration toward tangible value. The train has not left the station yet — but the doors are closing.

Last few weeks.

Last early window.

Last cheap access.

Silver deserves its own emphasis because it is the accelerant. Gold moves first because it is held by institutions and central banks. Silver moves second because it is held by the public. That is when bull markets turn from orderly into explosive. And this time, silver also carries an industrial kicker. AI data centers, solar arrays, EVs, military electronics — all of them consume silver. So silver sits at the intersection of monetary fear and industrial demand. That is rare. And it is powerful.

This is why China's move is so important. It is not just a political provocation. It is a structural shock to the idea of neutral money. And once neutrality is questioned, gold becomes the default answer. Silver becomes the multiplier. And digital gold becomes the rail system for the next generation of money.

Most investors think gold's move feels "late." That is always how it feels at the beginning. In 2003, gold looked expensive at $400. In 2006, it looked stretched at $700. In 2009, it looked overbought at $1,000. In every case, those levels became laughably cheap later. What matters is not where gold is. What matters is why gold is moving. And this time, the reason is not cyclical. It is structural. It is geopolitical. It is monetary.

China's saber-rattling about the yuan is not bullish for China.

It is bullish for gold.

It is bullish for silver.

And it is bullish for the infrastructure that connects gold to the digital world.

That includes NatGold.

This is not a trade.

It is a migration.

Out of fiat.

Into metal.

Into tokenized metal.

Final Word

China just lit a fuse under the global currency system. That fuse runs straight through gold, silver, and digital gold platforms. NatGold sits directly in the blast zone of that shift. That is why we have been early. That is why the reservation window matters. And that is why last week's pullback was not a warning — it was an opportunity.

You do not prepare for regime shifts after they arrive.

You prepare while everyone else is still arguing about whether they matter.

Gold is telling you they matter.

Silver is about to confirm it.

And NatGold is building the rails for what comes next.

The train is still in the station.

But not for long.

Get to the good, green grass first…

The Prophet of Profit,

Tidak ada komentar:

Posting Komentar