Intel's "Road to Zero" in 2025 |

Money & Markets Daily,

I’ll admit, this is a bit geeky…

But the greatest thrill in the life of a systematic investor comes when you least expect it — when one of your own systems surprises even you.

Because let’s face it, that’s the whole point of all the hard work.

With Green Zone Power Ratings, we’re building a system that can process more data, project more accurately, and come to more balanced conclusions than any individual investor ever could.

If that means the results are surprising? So be it.

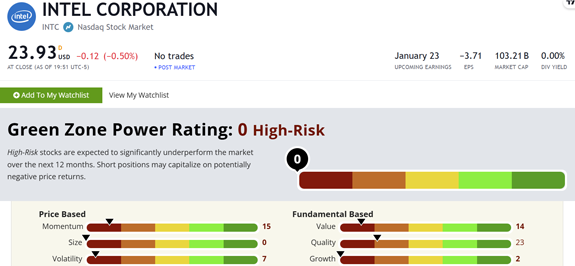

And right now, my ratings system offers no greater surprise than Intel Corp. (Nasdaq: INTC). Titan of the semiconductor world, with a 78% market share in the PC world … Intel scores a big, fat ZERO in Green Zone Power Ratings:

I’ll admit — such a low rating for a dominant tech company surprises even me. And I couldn’t be happier about it!

After all, my Green Zone Power Ratings system isn’t designed around companies. It’s designed around the investor. And time after time, we keep finding that the "best" companies in the world aren’t the best investments for folks like you and me.

The score above reflects the company as an investment. It tells you how shares of INTC are likely to perform and whether you should buy them.

Obviously, you shouldn’t.

But in Intel’s case, we should zoom out to take a look at the bigger picture with INTC … and see whether the stock's rating is a bad omen for INTC's share price from here…

| The U.S. government just sold this seemingly worthless piece of land for $27 million.

Click to see the full story because what’s about to take place here will kick off one of the biggest tech projects in U.S. history…

And it could spark a projected $2 trillion boom.

One company in particular is flying under the radar that could end up with a huge chunk of that money.

And while most investors don’t know about this company, Wall Street just poured $13 billion into it, in the last quarter.

Click here to see all the details. |

Intel’s Tragic Dominance

I really cannot stress enough how Intel was practically the “Golden Boy” of the first big computer boom.

Intel’s founders were a group of defectors from Fairchild Semiconductor — including none other than Gordon Moore, father of “Moore’s Law.” These men were visionaries who could see the future of computing decades in advance.

Intel delivered the world’s first commercial microprocessor back in 1971, developed a lasting partnership with IBM, and became a shoo-in to dominate early personal computing in the 1990s.

Intel had it all. For decades, it maintained a dominant market share across most sectors.

But at the same time, Intel has never really innovated beyond that core vision of producing cutting-edge CPUs.

Indeed, my Green Zone Power Ratings system identified this with Intel very early on. INTC’s rating first fell out of bullish territory in 1999, dropping to 59 out of 100.

Intel’s share price soon followed suit, sinking 83% from Sept. 2000 to Sept 2002.

After its stock crashed during the dot-com era, Intel made multiple forays into mobile devices — each time delivering unimpressive results.

After spending $10 billion on a new mobile division back in 2020, Intel ultimately sold its 5G business off to Apple.

More recently, Intel completely missed the bus on artificial intelligence (AI). Despite the company’s unequivocal dominance in the CPU space, it never joined the “Magnificent Seven” stock rally. Instead, INTC shares sank 43% over the last year.

Finally, we come to what is arguably the greatest financial disaster in Intel’s long and storied history…

Back in 2005, Intel CEO Paul Otellini pushed the company to buy an upstart competitor named Nvidia Corp. (Nasdaq: NVDA) for $20 billion.

At the time, Nvidia was still primarily manufacturing graphics cards (GPUs) for video game consoles and PCs.

For some reason, the greatest CPU innovator in history didn’t see the value in buying Nvidia for $20 billion.

It’s one of the great “What If” moments in modern tech history.

Because over the last 19 years, Nvidia’s value has shot up from $20 billion to more than $3.36 trillion.

You could argue that Intel’s failure to follow through on an Nvidia acquisition is the single worst blunder in the company’s history.

But once again, we’re investing in the stock, not just the company.

And even with that missed opportunity, Intel stock did eventually stage an epic comeback.

Just a few years later, in 2009, Intel’s rating once again turned "Bullish" — and shares rallied a staggering 475% over the next decade!

| A former CIA and Pentagon insider just discovered a shocking plan he’s calling Trump’s “Project Independence”…

Which could be a windfall for American patriots.

Thanks to President Trump’s plan, anyone who knows the truth NOW could potentially turn a $10K investment…

Into $265,000 or more…

By the morning of Trump’s inauguration.

Click here to discover the critical details NOW. |

A Tale of Two Intels

As you can see, there’s a vast difference between the Intel you read about in the headlines … and the way Intel’s shares perform inside your stock portfolio…

At any given time, mainstream financial media might be heaping praise on Intel’s newest generation of cutting-edge chips. Meanwhile, INTC’s shares are plunging.

This disconnect comes up more often than you might realize. And it can cost unwary investors a fortune.

That’s the whole reason I created my Green Zone Power Ratings system in the first place … to help you cut through the hype and discern whether a given stock is actually worth your time and investment.

And right now, Intel is showing our lowest possible rating at 0 out of 100. That’s as clear an indication as we could get to steer clear of INTC in the coming year.

Headed into 2025, we’re going to keep a close eye on Intel stock here in Money & Markets Daily.

Partly due to our own morbid curiosity but also because the company’s rock-bottom score seems to indicate a potential disaster ahead for at least one major tech giant…

To good profits,

Adam O'Dell

Editor, Money & Markets Daily

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar