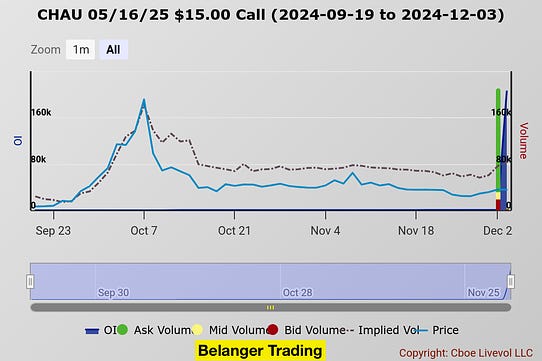

What would you do if you saw someone lay $55 million on a single trade? Would you brush it off? Or would you pay very close attention—and maybe follow along? Because that’s exactly what just happened. Yesterday, an institution—likely a hedge fund—placed a massive, calculated bet on CHAU, the Direxion Daily CSI 300 China A Share Bull 2X ETF. Here’s what they did:

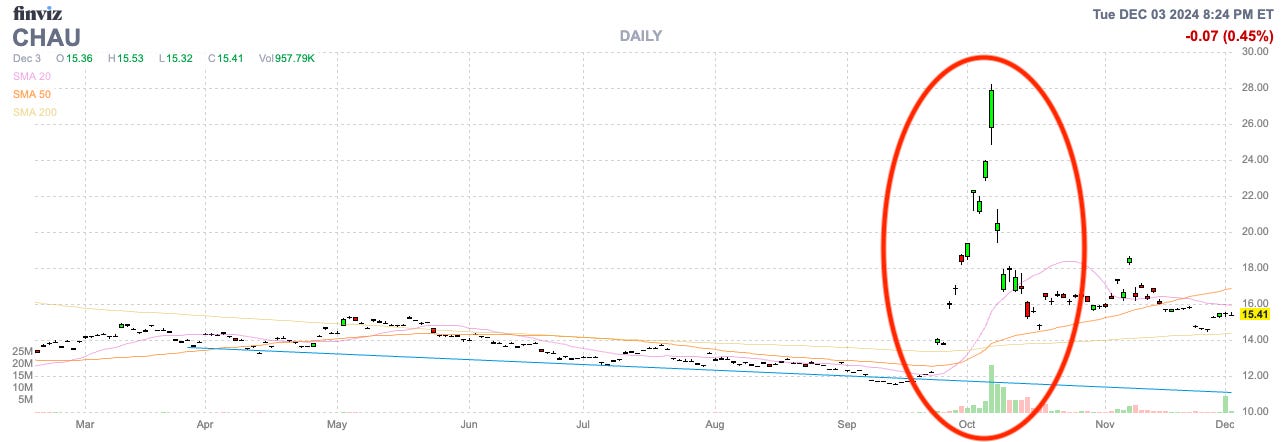

This adds up to an astounding $55 million trade. But here’s the kicker: if this trade plays out—and CHAU spikes like it did last October—these options could hit $9 or more. That’s $184.5 million in potential profits. This isn’t a small retail trader hoping for a lucky break. This institutional player is betting big—likely backed by data and research—and they aren’t in this to stop out. Why CHAU—And Why Now?Let’s rewind to last October. From September 11 to October 7, Chinese equities rallied 45% off the back of a larger-than-expected economic stimulus package from Beijing. CHAU—a leveraged ETF that amplifies the daily moves of the CSI 300 Index—saw even bigger gains. For traders who timed it right, those weeks delivered triple-digit returns faster than anyone expected. Now, institutions are betting on CHAU again. What’s changed? Recent signs point to China recovering from deflationary pressures and further pro-growth movement from the People's Bank of China (PBOC). Institutions don’t lay down $55 million without good reason—and this is a high-conviction play for what could come next. What You Should Know About Leveraged ETFsCHAU isn’t your run-of-the-mill ETF. It’s a 2x leveraged ETF, meaning it doubles the movement of Chinese blue-chip stocks on any given day.

This means CHAU is not for long-term holding. It’s a specialized tool for traders who know when to time a big move. And options like the ones in this trade let institutions amplify that leverage even further while managing risk. Why Use Options on CHAU?Here’s why this $55 million bet used options instead of just buying CHAU outright:

This is how big players structure trades for outsized returns: less downside risk, more upside leverage. So Why Does This Matter for You?Because this kind of trade—this $55 million bet—is a crystal-clear signal. Institutions make these moves because they know something. They have the resources, data, and conviction to time their entries. Most traders? They never even hear about these trades until it’s too late. But here’s the good news: You don’t have to be left behind. Follow the Smart Money—Don’t Miss OutIn Hot Money Trader, we track trades like these in real time. Massive institutional bets that could move the market—and how you can position yourself alongside them confidently. In just a few days, I’ll be opening new spots for Hot Money Trader. But for those of you who are ready to act NOW and want to skip the line, I’ve got something special: 👉 Reply "VIP" to this email, and I’ll send you the next steps immediately to secure your spot before anyone else. The window is small, the opportunity is big. Let me put it this way: when smart money makes a $55 million bet, they’re not guessing—you shouldn’t be either. Trade smart, Josh Belanger You're reading a preview of Belanger's premium insights. Imagine having access to exclusive reports and high-conviction trade ideas every week, like 'The #1 Trade to Make Before Election Day' and 'Congress' Secret Stock Playbook: The Top 5 Power Picks Revealed.' Don’t miss out—upgrade to unlock the full experience and take your trading to the next level. |

Selasa, 03 Desember 2024

$55 Million Says This Could Be Huge

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar