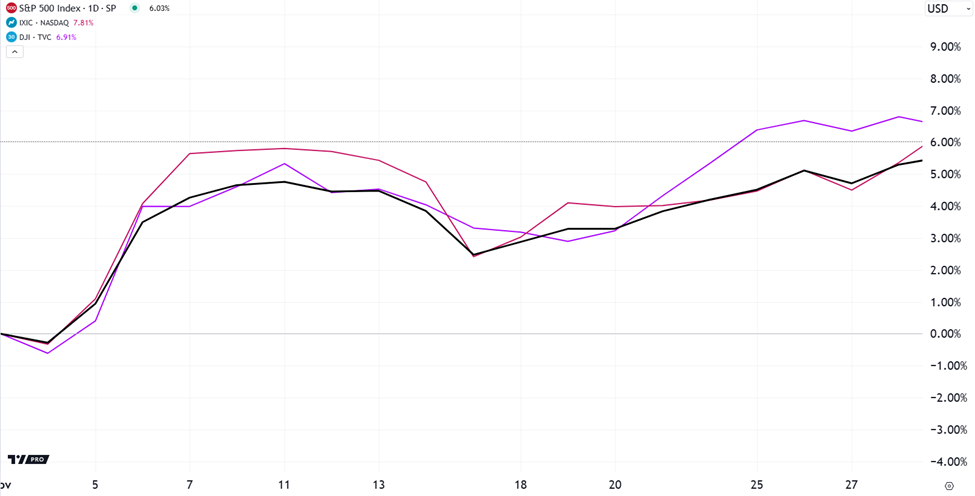

Why Luke Lango sees stocks rising in December … China bans exports to the U.S. of a key rare earth metal … pricing challenges at MCD … ADP jobs data … and Apple partners with Coinbase It was a blistering November for stocks. The S&P 500 rose 5.73% and the Dow jumped 7.54%, marking their best monthly performance of 2024. Meanwhile, the Nasdaq climbed 6.21% for its largest gain since May.

Source: Trading View Where does the market go next? According to our tech expert Luke Lango, the answer is “even higher.” Let’s quickly tour through his four reasons, the first of which is “bullish seasonality.” From Luke: Since 1950, the stock market has risen about 80% of the time between Thanksgiving and the New Year. And for the past five years, the market rallied from Dec. 2 into the end of the year all but once. The second is “a dovish Fed”: The Federal Reserve will likely play the part of Santa, not the Grinch, later this month… It is widely expected to cut interest rates by 25 basis points at that upcoming meeting. But more important than the actual rate-cut decision will be Fed Board Chair Jerome Powell's tone in the post-meeting press conference… [We think he will sound] dovish and signal that the cuts will keep coming. Third, Luke points toward “robust consumer spending”: It looks like this holiday shopping season will be quite a strong one. According to data from Mastercard (MA), Adobe Analytics, and Salesforce (CRM), the 2024 holiday shopping season is off to a record start… By some metrics, we're looking at potentially the best holiday shopping season since Covid emerged more than four years ago. Finally, Luke highlights “falling inflation:” Reinflation fears have, in our view, been the one obstacle holding the market back in recent weeks – and rightfully so. For a while there, real-time measures of inflation had been reheating… But [Truflation's U.S. Inflation Index] has slid to 2.7% over the past two weeks. This seems to suggest that the recent bout of reinflation has at least temporarily stalled. Put it altogether and Luke believes we’re in for a strong Santa Rally to end the year. This comes after what was an extraordinary November for Luke’s Innovation Investor subscribers. They locked in the following profits: - Palantir: 165%

- Intapp: 60%

- Q2 Holdings: 50%

- VanEck Digital Transformation ETF 40%

- AppLovin: 200%

- IonQ: 335%

- Zillow: 60%

- Axon: 365%

- Tempus: 30%

- Cava: 60%

- Zeta: 65%

- Wix: 25%

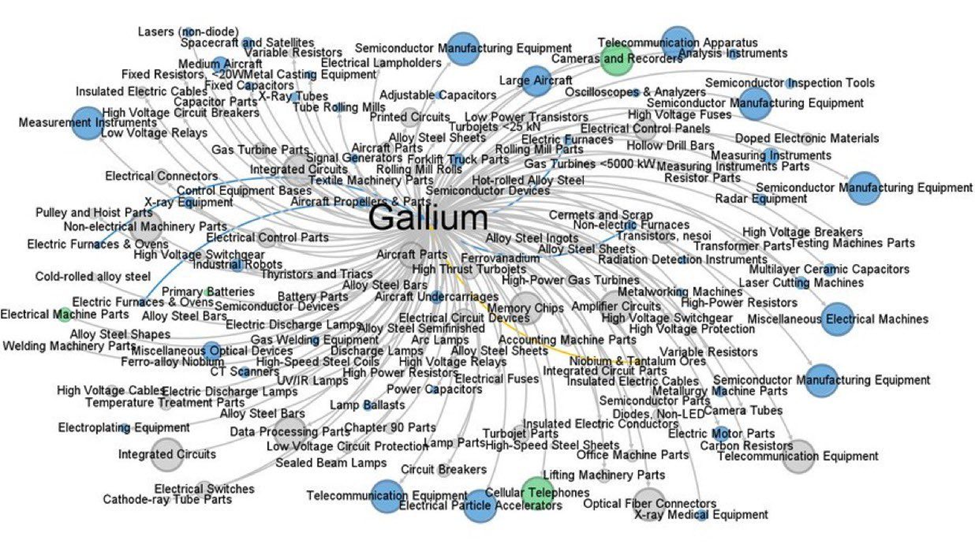

We’re thrilled to highlight these wins for subscribers and couldn’t be prouder of Luke. Better still, if he’s right, more profits are on the way as we round out the year. | Recommended Link | | | | In what Time magazine is calling “a winner-takes-all battle” in Silicon Valley, Mark Zuckerberg... Elon Musk… and Sam Altman of OpenAI are all racing to be the first to achieve Artificial General Intelligence (AGI). With more than $7 trillion potentially being funneled toward this goal, a world where AI surpasses human intelligence could become a reality within 24 months, according to Musk. The time to prepare your portfolio is NOW, not later. Learn how to do that here… |  | | One possible Scrooge to keep an eye on… Yesterday brought news that China has tightened its grip on two obscure yet indispensable elements that are cornerstones for next-gen technologies. Here’s Bloomberg with more: China ratcheted up trade tensions with the US with a ban on several materials with high-tech and military applications, in a tit-for-tat move after President Joe Biden’s government escalated technology curbs on Beijing. Gallium, germanium, antimony and superhard materials are no longer allowed to be shipped to America, the Ministry of Commerce said in a statement Tuesday. Beijing will also place tighter controls on sales of graphite, it added. This is important because these elements have a wide range of applications – from semiconductors, to satellites, to night-vision goggles, and beyond. Here’s a graphic illustrating how many industries rely on gallium. If you can’t see/read it, the takeaway is basically “all things tech.”

Source: DeepBlueCrypto After news broke yesterday, western-based rare-earth materials companies popped. For example, Las Vegas-based Mp Materials Corp (MP) shot up 11%, Canadian-based Ucore Rare Metals added 23%, and tiny Texas Mineral Resources Corp erupted 34% (and it’s up another 15% as I write Wednesday). This could serve as a preview of what’s on the way if Trump ratchets up the trade war with China. It risks putting upward pressure on inflation for related tech products in 2025 – a dynamic we’ve been warning about repeatedly here in the Digest. We’ll keep you updated as this story unfolds. Speaking of inflation, we’re seeing an interesting drama unfolding at McDonald’s thanks to higher prices In the wake of the pandemic and supply chain problems, McDonald’s raised prices as its input costs soared. You may recall last May when the president of McDonald’s U.S. business, Joe Erlinger penned an open letter, explaining why the average price of a Big Mac in the U.S. is 21% higher than in 2019. He pointed toward the company’s own higher costs. The problem is that these higher prices (which protected McDonald’s profit margins) have made the fast-food giant no longer affordable for a huge percentage of Americans. From Bloomberg: After decades of stagnant wages, depleted pandemic savings and the highest inflation since the disco era, many Americans are broke. So much so that in February, McDonald’s Chief Executive Officer Chris Kempczinski told investors that fewer “low-income consumers,” by which he means households earning $45,000 a year or less, are showing up for meals at McDonald’s. According to the latest Census Bureau data, roughly 28% of US households earn less than $45,000 a year. This translates into roughly 90 million Americans. Now, so far, this hasn’t made a dent in McDonald’s overall profitability. But at some point, the fast-food icon will have trouble passing along inflationary cost increases to protect its margins without kneecapping revenues. Back to Bloomberg: [If inflation rises], someone will have to pick up the tab. Companies shouldn’t assume it will be consumers, as McDonald’s has discovered… What is clear is that McDonald’s can no longer serve the broad public, as it always has, without absorbing some of the cost because a substantial portion of its customers have reached their spending limit. It’s a balance that many U.S. executives may have to navigate in 2025: Do you raise prices to protect margins, while risking raising them too high, resulting in fewer customers… or do you eat some of your higher input costs to keep customers happy, which means lower profit margins? At the end of the day, which will have the greatest positive impact on overall profitability? Keep in mind that analysts are projecting calendar year 2025 earnings growth of 15% and revenue growth of 5.7% for the S&P. That’s a lot. For context, for 2024, analysts project earnings growth of 12% and revenue growth of 4.7%. This is happening as the labor market tightens up, which could mean even tighter purse strings for some Americans, which brings us to our next story… This morning, private payrolls grew by less than expected in November ADP released its latest private payrolls report showing that U.S. businesses added 146,000 jobs on the month. That was shy of the downwardly revised 184,000 in October and less than the Dow Jones estimate for 163,000. In positive news, wage growth accelerated by 4.8%, which was faster than October’s increase. Here’s ADP’s chief economist, Nela Richardson: While overall growth for the month was healthy, industry performance was mixed. Manufacturing was the weakest we’ve seen since spring. Financial services and leisure and hospitality were also soft. The more closely watched labor report from the Bureau of Labor Statistics comes out Friday. You’ll recall that its October release showed an increase of just 12,000 jobs. This was artificially lowered by the Boeing strike and hurricanes in the south. The estimate for November is 214,000 jobs. You can be sure the Fed will be watching closely as it tries to thread the needle between maintaining a healthy labor market and taming inflation. | Recommended Link | | | | It’s responsible for the greatest achievements in stock market history. It helped Paul Tudor Jones pocket $100 million. It helped Jim Simons generate a return big enough to turn $1,000 into $22 million. And it helped Jeff Clark nail over 1,000 winners. Of course, these legends have kept silent about their secrets. But today, not only will Jeff offer a rare-glimpse at the “Magic Pattern” but he’ll also reveal how it could give you a shot at trades big enough to deliver 490% in the next 30 days. Go here now for all the details. |  | | Moving over to crypto, earlier this week brought a huge sign of adoption In what marks a momentous step into the mainstream, Apple announced that it’s partnering with crypto platform Coinbase to enable crypto purchases through Apple Pay in third-party apps. From CEO Today: The integration is part of Coinbase Onramp—a service designed to streamline the conversion of traditional currencies, such as USD, into digital assets like Bitcoin and Ethereum. The move signifies a turning point for the cryptocurrency ecosystem, as two major tech and financial players join forces to simplify the notoriously complex process of acquiring digital currencies. By leveraging Apple Pay’s widespread adoption and Coinbase’s crypto expertise, this partnership could redefine how consumers and developers interact with cryptocurrencies. Here's more from Coinbase’s CEO, Brian Armstrong: This partnership is a game-changer. It eliminates many of the barriers that have kept average consumers from exploring cryptocurrencies. By integrating with Apple Pay, we’re bringing crypto to the fingertips of millions of users. We continue to be bullish on Bitcoin and the emerging “altcoin season.” If you missed yesterday’s Digest on altcoins, click here to catch it. Bottom line: We believe a tremendous amount of wealth will be made in the crypto sector in 2025. This latest news from Apple and Coinbase only adds to that conviction. Coming full circle… We’ll end today by circling back to Luke’s bullishness at the start of the issue. Yes, there are reasons to maintain caution today, and we’ll continue highlighting them so that you’re not caught off-guard as we move into 2025. But we’re in a money-making market. So, until bullish momentum turns, stay invested. While it may or may not be a white Christmas, from the looks of it, it’ll be plenty green. Have a good evening, Jeff Remsburg |

Tidak ada komentar:

Posting Komentar