| Editor's Note: While Matt is enjoying an extended Thanksgiving vacation, we dug into the archives for today's feature story. Back in September, Matt walked through one of the most valuable (and powerful) tools we use every week here at Money & Markets. Read on… |

This 2022 Hotlist Was Chock-Full

of Winning Stocks |

Money & Markets Daily,

I'm a nerd.

I love looking at data and interpreting what it all means.

As a young sports reporter, I prided myself on keeping stats during games I covered, going back to the office and analyzing those numbers to show readers how they contributed to a big win or led to a catastrophic loss.

Now, data is part of my daily life. Data related to stock movement, company balance sheets, and everything else are included.

What I learned early on is that data can tell a compelling story. It can tell you where something has been (like a baseball player’s batting average) and even provide clues as to where something is going (like a quarterback’s past performance against a team they are facing next week).

Adam O’Dell's proprietary Green Zone Power Ratings system is similar. It allows us to tell where a stock has been (think the Value and Growth factors) and where it may be going (think Momentum).

The ratings system is one component of a weekly hotlist we compile for Adam’s Green Zone Fortunes readers.

It starts with an advanced stock screen that includes specified algorithms and actually ENDS with the Green Zone Power Ratings system.

In all of my nerdom, I was looking at the performance of our weekly hotlists and came across a week of extraordinary performance.

Today, I’ll look closer at that week and how that hotlist has performed to date.

But first…

| He bought Amazon when it was trading around $35... Netflix when it was around $2... And Apple when it was less than $1 a share... And now... Market millionaire Alexander Green says he's discovered the "Perfect Stock" that could be the key to boosting your retirement. Find out about this less than $5 stock before share prices go up. |

A Hotlist Primer

If you are a subscriber of Adam’s Green Zone Fortunes, you are likely familiar with our weekly hotlist. (If you’d like to know how to gain access to this weekly feature, click here.)

Here's what it boils down to…

It starts with Adam's simple trend-and-momentum algorithm, which has been underpinning every recommendation made in Adam’s options-trading Max Profit Alert service … which has been around for 12 years.

The algorithm is looking for stocks that check three different boxes:

- Stocks that are on the move NOW…

- Stocks in a six-month uptrend (or downtrend for bearish trades)…

- And, of those, stocks that are showing market-beating momentum over the past three months to a statistically significant degree.

In short, they trigger a “buy” signal on Adam’s Max Profit Alert system.

These stocks are poised to outperform the market over the next three months based on price action only.

The next layer is to further filter that list of “buy” signals based on the Green Zone Power Ratings system so that if you are looking for longer-term holdings, you can see which stocks rate the best.

That final Top 10 is our weekly hotlist.

Now, let's see how it can play out…

| The stock market is about to go on the most epic bull run in American history…

… and Trump’s victory could send these stocks to nosebleed heights.

Everyday investors could make 1000% in 4 years.

Don't miss your shot to claim your share of the boom and enjoy the ride up.

>> Click here to see how. |

Hotlist in Focus: September 28, 2022

As with every hotlist, stocks on the list on September 28, 2022, were varied in size, sector, industry and overall Green Zone Power Ratings:

(Click here to view larger image.)

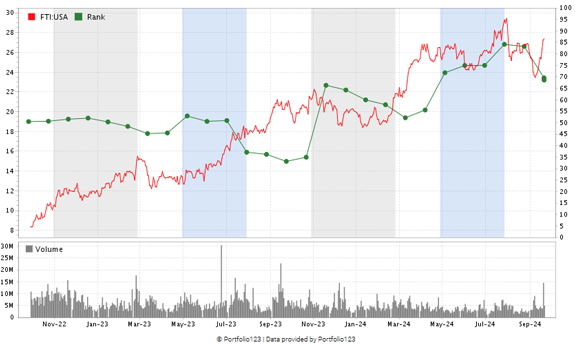

I’m going to focus on one stock from this list: TechnipFMC PLC (NYSE: FTI). This is a global oil and gas company that was formed in 2017 by a merger between U.S.-based FMC Technologies and Technip of France.

The first thing that should immediately stand out is that, at the time of the hotlist, FTI was rated a “Neutral” 50 out of 100 on the Green Zone Power Ratings system.

So, what gives? Why is a “Neutral” stock on the weekly hotlist?

In some cases, if you are looking for a growth opportunity, you can’t always wait for the perfect score.

Keep in mind that a stock's overall rating in Green Zone Power Ratings is a powerful tool, especially when looking for long-term investments, but it behooves you to look deeper at the individual metrics when contemplating a potential investment.

In the case of FTI, a few things stood out:

- Its lowest rating at the time was on Size. While smaller stocks tend to outperform their larger cousins, a Size score of 27 didn’t discount FTI’s opportunity to bring in larger gains.

- Its highest rating at the time was on Momentum (78). Not only did FTI pass our test of being in a six-month uptrend and showing market-beating momentum over three months, but Momentum turned out to be the driving force behind FTI’s overall rating.

- FTI also had “Bullish” ratings on Value (61) and Growth (63), which told us that its financials were growing and that the stock was still offered at a bargain price.

Considering those elements, we kept FTI on the hotlist, and the result was a solid payoff:

Since appearing on the September 28, 2022, hotlist, FTI has risen more than 226%, which is four times higher than the 54% return of the S&P 500 during the same time.

You can also see that FTI's overall rating has moved into “Bullish” territory since it was added to the hotlist. It currently rates a 74 out of 100 overall.

In case you were wondering, nine of the 10 stocks on that week’s hotlist have turned in positive gains — five of those gaining 80% or more.

What It All Means: There’s no question that the Green Zone Power Ratings system is a useful tool.

Like with any potential investment, it pays to examine all aspects of a stock. That’s precisely what the ratings system does: It takes the six major factors top Wall Street analysts use and boils them down into one simple, digestible format.

Taking it a step further, FTI landed on Adam's hotlist before things really took off.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar