September 23, 2024

This FAANG Still Has Bite

Dear Subscriber,

|

| By Gavin Magor |

First came telephones, computers and the internet.

Then came the device that sandwiched all these marvelous technologies into a kitchen sponge-sized device that now soaks up a third of most people’s waking day.

Steve Jobs was quite prescient when he chose to name what would become Apple’s (AAPL) most profitable product the iPhone.

In 2007, the “I” stood for internet, individual, instruct, inform and inspire.

Since then, the “I” has evolved to represent a seemingly infinite amount of dollar signs. There are more than 2.2 billion active iPhones right now.

Yet, after 17 years, Apple hasn’t made any huge technological advancements to its flagship product.

And that includes the addition of the year’s hottest tech: AI.

Certainly, there are better cameras, faster processors and bigger screens.

But ultimately, as evidenced by the uncharacteristically tepid response of Apple’s latest product release on Sept. 9 — with first-weekend preorders for the iPhone 16 series down almost 13% versus the 15 series — not much has changed.

While the iPhone is the company’s bread and apple butter, that’s only about 50% of the business.

I must say its brand-new product, the futuristic Apple Vision Pro, looks very cool. But at its steep price point of $3,499, I don’t see many consumers buying for the time being.

And that’s a strategic move by Apple. One that its founder would no doubt appreciate.

Under the days of CEO Steve Jobs, the company was far more focused on being a revolutionary product releaser than trying to gain market share.

Now, the company has that market share. And it’s all about pumping profits.

And this strategy is working.

I mean, just think of it, do you or someone you know have an iPhone? The answer is yes.

And will they upgrade to a newer version in the future?

You probably don’t even have to ask them to know that answer will be yes.

Money Grows on Apple Trees

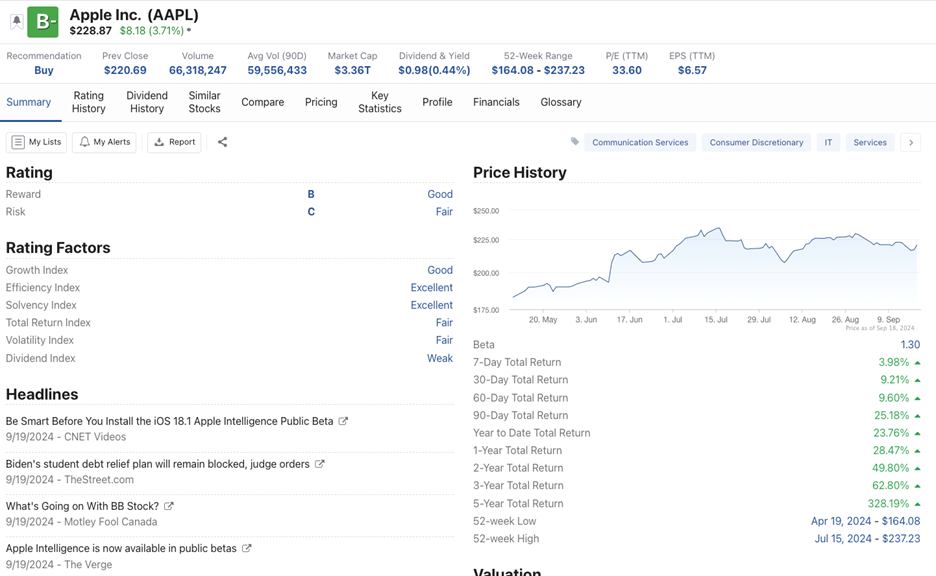

Over the past five years, Apple shares are up a blistering 319%, not even including dividends.

And it’s a luxury for a major tech stock to be dishing out a dividend, albeit a modest one currently yielding 0.44%.

Let’s take a look at its chart over the past few decades, and you will easily be able to see its mega run higher over recent years:

How’s business for Apple? Business is still booming.

And our ratings agree. In fact, aside from a few small blips into “C+” territory, we have rated it as a “Buy” for a long time.

Don’t just take my word for it. The Weiss Ratings first rated Apple as a “Buy” in September of 2004. Shares are up a volcano erupting 35,600% since then.

And we still see room for growth.

As evidenced by our “Buy” rating, we are still seeing consistent revenue growth, even higher profit margins and strong cash flow growth for Apple’s stock.

And all of this goes back to the company not releasing the latest and greatest technologies, which I am almost certain they have.

It’s about strategically dominating a thing called “planned obsolescence.”

Planned obsolescence is when a consumer goods product becomes obsolete. Just use the iPhone for example …

Battery life eventually decreases … software updates need the newer processors to run properly … you can’t update certain apps … the list goes on.

Apple’s pumping cash nonstop, and it is currently dominating its planned obsolescence strategy.

Click here to see full-sized image.

Now, Apple won’t come out and tell you this, but it’s a fact. We, as consumers, have to play the game. But as is pointed out by the company’s financial situation … it is certainly working.

How can you play this very enticing trend? Well, I would recommend considering buying Apple on pullbacks.

I would also take a gander at all of our highly rated names.

But another tremendous profit play is with my colleague Chris Graebe’s Deal Hunter Alliance. And that play is …

Literally Set for Blastoff

The company Chris is set to recommend is in its pre-IPO phase. So, the opportunity is ripe for the taking.

The company has discovered a way to send satellites into orbit for a fraction of the cost of other players in the industry such as SpaceX.

Here’s a bit behind the scenes on this play you might not hear about elsewhere. We use our data and analysis to vet whatever Chris finds. And we also love this one!

Of course, it’s up to you.

Buying Apple on the dips to take advantage of its planned obsolescence strategy is great for building wealth.

But grabbing a pre-IPO piece of this SpaceX beater is even more exciting.

We’ll be sending you more information about this unique opportunity soon. Be sure to open it when it arrives. Spots are limited.

Cheers!

Gavin

Tidak ada komentar:

Posting Komentar