May 1, 2024

Buy the Metal That's Outshining Gold

Dear Subscriber,

|

| By Sean Brodrick |

Gold is red-hot … zigzagging its way higher on a combination of central bank purchases, Chinese buying, inflation fears and a good ol’ fashioned supply/demand squeeze.

Everyone probably wishes they owned more gold. Well, how would you like to buy a metal that’s not only outshining gold, but also has plenty more upside?

I’m talking about copper. In January, I wrote, “I expect big things from copper in 2024.” That turned out to be a great bet because copper is ramping up. It’s easily outpacing the S&P 500, and it’s even leaving gold in the dust, too.

So far this year, the S&P 500 is up 7.26%. Not bad.

Gold is up 13.8%, or nearly double the S&P 500’s gain. Great!

And copper is up more than 20% since the start of the year. Outstanding.

Copper can go much higher, too. Analysts at Citi said in a research note that copper could rise by ANOTHER 66%: “Explosive price upside is possible over the next two-three years, if a strong cyclical recovery occurs at any time, with prices potentially rising more.”

Longer term, Citi believes copper demand could add an extra 4.2 million metric tonnes by 2030.

So, why is copper so hot?

Well, I’ve explained before that copper is the most useful of industrial metals, used in everything from wiring to electronics to building construction to coins.

Demand is getting more heated because copper is critically important to the “energy transition,” away from fossil fuels to electric vehicles, wind and solar. The metal is integral to manufacturing EVs, power grids and wind turbines.

Part of copper’s move is speculation, as big players make bets that a global recovery in manufacturing will spark long-term demand, supercharged by demand from green-energy applications.

A lot of speculation in copper is predicated on more Chinese buying as that nation’s economy recovers.

China imported 1.38 million tons of raw copper in the first quarter, up 6.9% from the same period a year ago. And imports of copper concentrate came in at 2.3 million tonnes for March, up 15.3% over March 2023.

Now, not everything is rosy. So, what’s the problem? In April, China slowed its copper purchases drastically and even boosted exports.

This worries a lot of market players, and the resulting stress knocked copper prices down a peg. But I can tell you from long experience that China LOVES to mess with the copper market.

The Chinese will typically let their orders dry up, then go in and make big purchases in the ensuing selling panic.

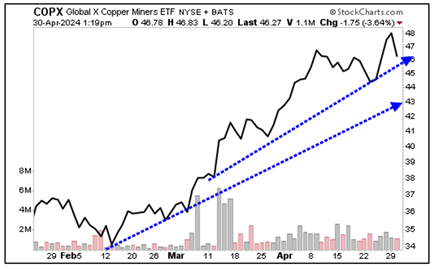

In January, I recommended you play this potentially massive copper rally with the Global X Copper Miners ETF (COPX). This fund holds a basket of copper miners. It has a Weiss rating of “C,” an expense ratio of 0.65% and a dividend yield of 1.98%.

Since I talked about it in January, copper is up 23.28%, and COPX is up 36.19%. Nice.

COPX price chart.

Click here to see full-sized image.

No matter how you draw the uptrend, COPX is on a bullish rampage. In fact, COPX still looks like a good buy to me, and pullbacks can be bought.

While I’m sure that gold is going to zig-zag higher, copper is a metal with the potential to outperform gold … and deliver tremendous returns.

All the best,

Sean

P.S. Speaking of outperforming, how does beating the S&P 500 by 51-to-1 sound? In a special presentation next week, you can see how. Just click here to make sure you have your exclusive free ticket.

Tidak ada komentar:

Posting Komentar