Follow the Big Money Into Big Tech? |

Money & Markets Daily,

I was all set to talk about sports betting stocks this week…

Charles Leclerc just won his first home grand prix in Monaco, my Florida Panthers are on another deep playoff run and Angel Hernandez just "retired" from his decades-long stint as a notorious MLB umpire.

It was the perfect setup until this Bloomberg headline crossed my newsfeed:

Goldman Sachs found that hedge funds are placing their bets on Big Tech. A breakdown showed that stocks in the so-called "Magnificent Seven" currently make up 20.7% of total net exposure to U.S. single stocks for hedge funds.

It makes sense…

The Magnificent Seven was the story of 2023 as the current bull market took off. By December 31, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla had gained an average of 112% in 2023!

Of course, the big money on Wall Street is going to want in on that action…

But even as this small handful of stocks has contributed massively to the broader bull market, some are outperforming at a much stronger pace than others.

And just because massive hedge funds managing millions (or billions) of dollars are scooping up shares at a record-breaking clip doesn't mean you have to follow suit.

That's when Green Zone Power Ratings come in handy.

"Sell in May" Status Report

Tell me if you've heard this one before:

"Sell in May and go away."

It's a famous anecdote that describes how Wall Street sells in spring, takes it easy over the summer months and gets back into action when temperatures cool.

But it's not happening in 2024. If anything, it's the opposite. Despite some bearish streaks, major U.S. indexes are up since May 1. The Dow Jones Industrial Average is up 1.6%, the S&P 500 has gained almost 5% and the tech-heavy Nasdaq is up 8.4%!

That tells me Wall Street isn't taking a summer break, and this is a market worth participating in.

The biggest of Big Tech is a strong place to start.

Here's how each of these Nasdaq stocks rates out of 100 on Green Zone Power Ratings and how much each has gained over the last year:

- Alphabet Inc. (GOOGL): Rates a "Bullish" 77 and has gained 42%.

- Amazon.com Inc. (AMZN): Rates a "Bullish" 72 and has gained 49%.

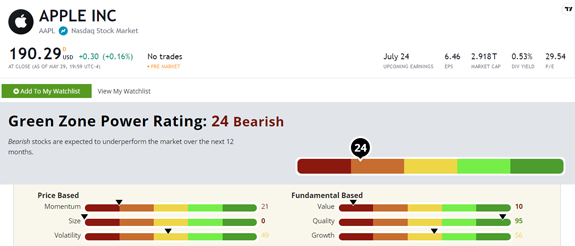

- Apple Inc. (AAPL): Rates a "Bearish" 22 and has gained 7%.

- Meta Platforms (META): Rates a "Bullish" 75 and has gained 80%.

- Microsoft Corp. (MSFT): Rates a "Bullish" 65 and has gained 29%.

- Nvidia Corp. (NVDA): Rates a "Bullish" 67 and has gained 186%.

- Tesla Inc. (TSLA): Rates a "High-Risk" 12 out of 100 and has lost -12%.

NVDA has led the pack with its role in the artificial intelligence (AI) mega trend, and most of these stocks have crushed the broader market (the S&P 500 gained 11% over the same period).

At the same time, TSLA was a massive laggard despite its status as a tech darling.

But I'm most curious about one that's stuck in the middle.

A closer look at AAPL should tell more of the story…

| Discover a company at the forefront of the AI revolution, with up to $1 billion in government-backed contracts and 1,372 patent applications. Trading at just $25 a share… |

Apple Stock Is Bearish … for Now

"Bearish" stocks in the Green Zone Power Ratings are set to underperform the broader S&P 500 over the next 12 months.

Apple stock is getting killed on Growth at 56 and Momentum at 21. While the AI mega trend has been a massive tailwind for some tech stocks, Apple hasn’t revealed much about its strategy for this transformative tech. That's hurting revenue and scaring investors away…

Of course, that all could change soon. There's chatter that the iPhone maker is working on its own AI-enabled "intelliphone." If Apple pulls off another tech breakthrough like it did with the original iPhone — watch out!

Earlier this week, Chief Research Analyst Matt Clark showed you how NVDA's AI innovations drove its Green Zone Power Ratings higher alongside its share price.

While our system isn't saying AAPL is a buy quite yet, I could see that rating improving rapidly if it joins the AI revolution in earnest.

Now, back to stressing about a small market hockey team in South Florida…

Until next time,

Chad Stone

Managing Editor, Money & Markets Daily

P.S. Adam just released his latest stock recommendation for his Green Zone Fortunes subscribers. It's NOT an innovative tech stock, but it still boasts a perfect 100 out of 100 in Green Zone Power Ratings. If you want to see how to gain access to this ticker and so many more, click here.

Homes Are in a Long-Term Bull Market

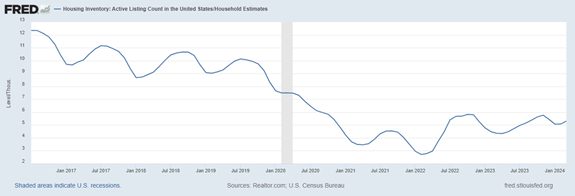

Supply and demand determine home prices. One way to look at supply is the ratio of listings to households in the country, as shown in the Federal Reserve chart below.

While this measure of supply has been in a long-term downtrend, the current level is less than half of what it was when the Federal Reserve began publishing the data in 2016. In the long run, home prices will likely continue moving higher until supply increases. However, it seems unlikely that supply will increase soon.

— Mike Carr, Chief Market Technician, Money & Markets

Housing Inventory: Ratio of Home Listings to Households in U.S.

(Click here to view larger image.)

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar