Despite the market's troubles this week, we're confident that stocks are actually preparing for a big summer rally͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

| |  | | May 31, 2024 |  | Luke Lango

Editor, Hypergrowth Investing | |

Stocks’ red-hot rally hit choppy waters this week, with the S&P 500 dropping ~2% over the past several days. But brand-new inflation data suggests the rally should resume in June.

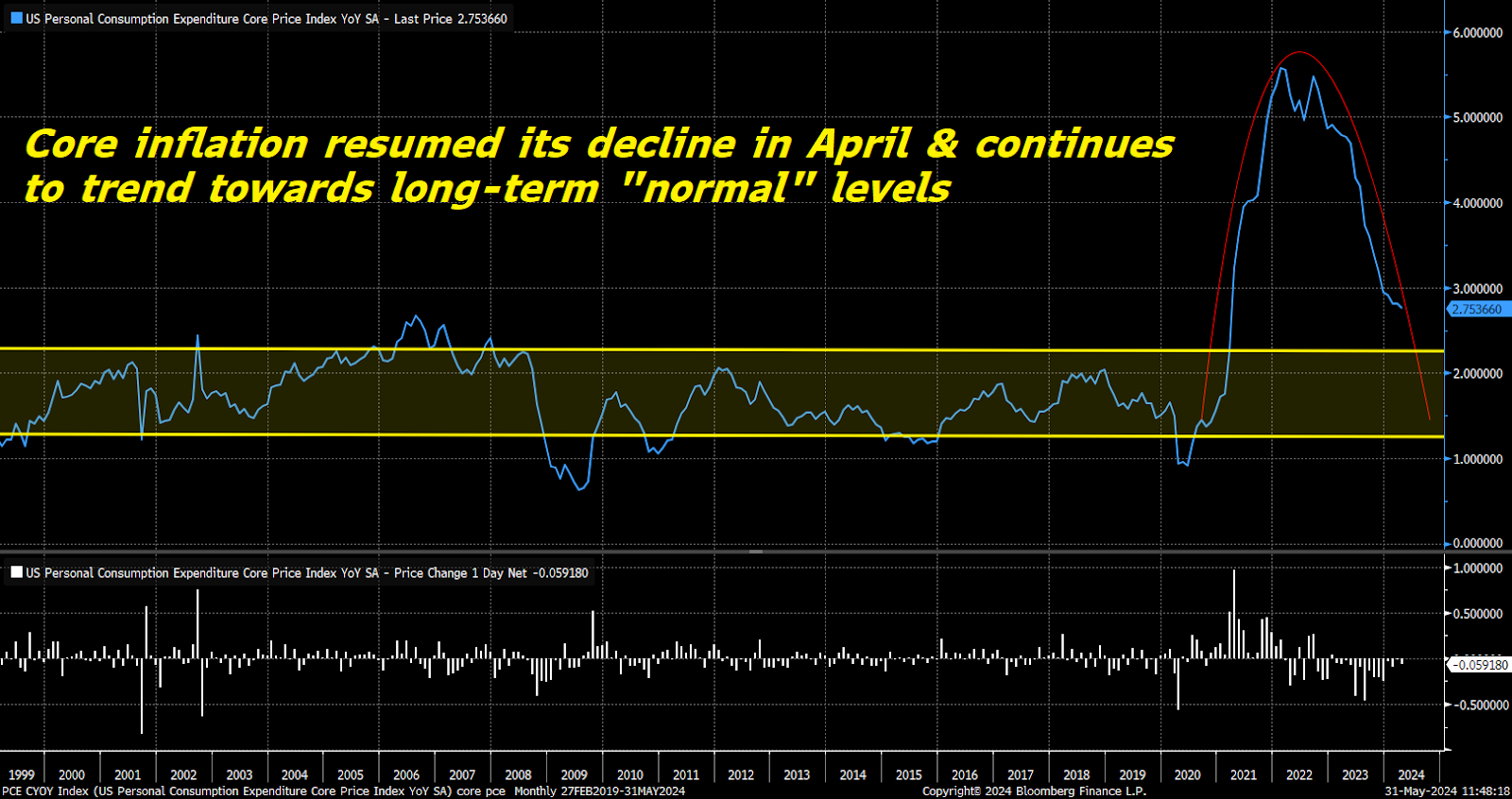

This morning, April’s official Personal Consumption Expenditures (PCE) report was released. And it showed that the U.S. Federal Reserve’s preferred inflation metric resumed its decline last month.

Specifically, core PCE – the inflation rate excluding volatile food and energy prices – dropped from 2.8% to 2.75% in April.

This latest batch of data shows that last month, core inflation rates resumed their decline after flatlining in March.  And that’s a bullish development because it adds further support for the Fed’s first rate cut. | | | | SPONSORED  One TradeSmith service has delivered a 95% success rate going back to 2021…

Giving readers the chance to collect consistent payouts in all markets.

And now, Keith believes it could help those with large portfolios make six figures in 6-12 months – starting immediately.

Right now, you can join for 60% off the retail price.

The only catch: You must hurry. This deal expires June 4th at midnight.

Details here | | | | | | Inflation Vs. Stocks: What to Expect As Summer Nears Recall: Ever since the central bank stopped hiking rates in the summer of 2023, the stock market has see-sawed on expectations for the Fed’s next interest rate move.

Indeed, throughout 2023’s third quarter, the market crashed on fears that reinflation trends would force the Fed to hike rates again. Then, from late 2023 into early 2024, stocks soared as inflation resumed its decline and investors became hopeful about rate cuts.

Though, thanks to resurging reinflation trends, those rate-cut hopes turned back into rate-hike fears last month. And as a result, stocks crashed.

But over the past few weeks, reinflation trends have eased. And instead, inflation has resumed its decline, as evidenced by the renewed drop in the core PCE rate reported just this morning.

So, if stocks follow the same pattern they have been – and we expect they will – this renewed disinflation should lead stocks to keep on rallying throughout the summer.

| | | | SPONSORED  A Silicon Valley insider reveals five early stage stocks that he believes have the potential to completely replace the FAANG stocks that run the tech world as we know it.

His proprietary “early stage stock” investment targeting system has already discovered companies which have soared 1,700%, 3,100% and even 10,000% over the past few years.

And now, he’s back with his next HUGE prediction for 2024. Click here to discover the top five early stage stocks for 2024 | | | The Final Word We believe inflation rates should keep dropping for the next few months.

As they do, investors will likely grow more hopeful about future rate cuts – and stocks should soar.

So, despite the market’s troubles this week, we’re confident that stocks are actually preparing for a big summer rally.

And that means it’s time to get positioned for those incoming gains.

But how do you know which stocks are primed to soar the most?

If you want to cover all your bases, check out some of the stocks we’re recommending ahead of this big summer surge. Brace for the Boom |  | | Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. | | | | |

Tidak ada komentar:

Posting Komentar