In This Issue:

• Nothing Eclipses Man's Rational Faculty

• The Best Time to Buy Gold

• ETF Talk: Another Golden Opportunity

• Arthur Jones Wisdom

| | Nothing Eclipses Man's Rational Faculty | | Sponsored Content A.I. Pioneer Warns: "I thought we had more time…" A radical new A.I. development is about to blindside millions of Americans.

This early A.I. pioneer just issued an urgent warning explaining everything.

Click here to see his new video for yourself. | | | Nothing Eclipses Man's Rational Faculty

Hey, did you see there was a solar eclipse on Monday? Of course you did, and that's because there was a deluge of media coverage of the eclipse, and rightly so, as these kinds of celestial events don't occur very often.

Now, as a one-time aspiring astrophysicist (it was my major at UCLA until I ran up against the impossibly tough graduate Physics classes), a love for astronomy, cosmology and the scientific method is part of my DNA. Indeed, I still marvel at the way we have been able to understand our world via our uniquely human attribute -- our highly developed rational faculty.

Yet, in Monday's coverage of the eclipse, I heard a lot of language that irritated my rational nerves.

The worst of this offending language centered around how "small" we should all feel in the presence of nature, and how "insignificant" we are in the grand scheme of the heavens.

Well, to that, I will borrow a term my friends in the British SAS always used, and I will respond with a hearty… bollocks!

I say that, because "small" and "insignificant" are terms used to demean mankind's status. They are used by countless demagogues and would-be heavenly dictators to make us feel like we require them to "save us" from ourselves and our very nature.

When I watched the eclipse, I marveled at how we know, with exacting precision, when and how the Sun and the Moon will interact to create this event, exactly which longitudes and latitudes will provide us with the best view of the "path of totality" and how to look at the Sun without damaging our eyes via the use of special glasses designed specifically for this purpose -- glasses that you can have delivered to your door overnight via a few taps on your Apple (AAPL) iPhone into your Amazon.com (AMZN) shopping cart.

For me, feelings of "smallness" and "insignificance" are the polar opposites of what I felt looking at the eclipse.

Instead, I felt an incredible sense of pride in humanity's ability to understand, as best we can, exactly how the universe operates, how celestial bodies move and the laws of motion that govern the cosmos. I also feel immense and important knowing that, through centuries of observation and rigorous study, humans have come to know all that we do.

Moreover, I have an even grander sense of significance knowing that every day, some of my fellow humans all over the world are working harder and smarter than ever to understand the universe in increasingly deeper and more intricate detail.

Think of all this in the following context. The ancient Chinese used to think that an eclipse was the Sun being eaten by a dragon. The Incas thought an eclipse was the sign of God's wrath, and to appease that God, they offered up human sacrifices. The Mayans thought the Sun was breaking and that the world was collapsing.

Humans fear what we don't know.

Conversely, humans can harness what we do know for our own betterment, and knowing how the cosmos works in service of this noble goal is one of the things we do best.

So, don't feel small or insignificant in the diminished light of the eclipse. The fact that you are a living member of an advanced primate species that understands why this happened should make you feel grand, sublime, significant and, most of all, grateful to be a part of it all. | | China's Global Conspiracy to Destroy the American Dollar China is nearing the end of its 40-year plan to dominate the world's economy. Only one obstacle remains: The U.S. dollar. But not for long... because China has enlisted many co-conspirators to sink the dollar: Russia, India, Brazil, Argentina, Germany, and even Canada. And – no surprise – the International Monetary Fund (IMF) wants to jump in to help China win.

This means China now has the power to crush the dollar almost overnight... and bankrupt America. But there's still time to protect the money and retirement of investors. Click here now to find out how... before it's too late. | | | The Best Time to Buy Gold

Gold is at an all-time high, and many readers have written to ask me if it's time to add to their holdings in the yellow metal. Well, the short answer is… "Yes." However, for a more comprehensive answer to any question related to precious metals, I always turn to my friend, former U.S. Army colleague and the very best mind I know in the golden arena, Rich Checkan, President and COO of Asset Strategies International (ASI).

ASI is a full-service tangible asset provider that deals in precious metals and rare U.S., world and ancient coins. Rich oversees the operations, administrative, sales and marketing departments, and serves as ASI's compliance officer. He also writes a monthly newsletter called Information Line, a publication that I am honored to be a regular contributor to.

Today, I asked Rich to contribute to The Deep Woods, as I want you to hear what a true gold expert has to say about this market, and why right now really is the best time to buy gold.

So, Rich, take it away…

The Best Time to Buy Gold

By Rich Checkan, Asset Strategies International

I am making it my personal mission to get investors off the fence… for their own good.

Help me succeed.

I know you have heard me say this multiple times over the past year…

"At all-time highs, gold is dirt cheap."

It was true a year ago. It is true today.

Take a look at this chart…

As I wrote to you last month, gold had just made new all-time highs. Over the past month, gold's surge has continued. This week, gold was $100 more per ounce than last month's record price.

It is easy to get caught up in the price action. Some investors see the new high as the destination. They believe (or more likely hope) that gold has hit its peak price and will pull back for them to acquire it more cost-effectively.

But they have it all wrong.

Aside from a brief spike in the gold price as a result of the Covid pandemic, gold has been consolidating for years between $1,800 and $2,100 per ounce. That is not the price action of a metal at its peak.

Rather, it is the price action of metal building a base of support for the next leg up. Gold has not been banging its head on the ceiling. Gold has been building the launching pad for the next bull market.

I hear a lot of investors bemoaning the fact they did not buy gold sooner. As a result, they feel they have missed out, and they are hoping for a pullback to acquire some.

This is not rational thinking. This is an emotional reaction.

Given the current environment, the absolute best time to buy gold was yesterday. The next best time is today.

Why do I say that?

Simple. Gold has been building up energy for this move for several years. It has a firm base of support. All it needs now are investors.

Up to this point, the gold price has been supported in this consolidation phase by purchases from high-net-worth investors and by central banks.

However, with the hint of interest rate cuts on the horizon, everyday investors are warming to gold… and they should.

No presidential candidate has the intestinal fortitude to cut entitlements. Nobody in Congress has the intestinal fortitude to cut spending and balance a budget.

Unless that changes, the gold price will go higher over time.

Let me say that again…

Unless that changes, the gold price will go higher over time.

We cannot afford the entitlements that are promised… Medicare, Medicaid, Social Security, pensions. We cannot afford to pay for the things Congress has agreed to buy in the budget. Heck, soon, we will not even be able to afford the interest on our $34 trillion national debt.

As a result, and so as not to have a currency default, they will expand the money supply. That will water down the value of every dollar in circulation. And, as a result, that will cause the cost of everything of any value whatsoever to move higher in price.

There is absolutely no alternative once Congress and the president overspend.

Gold's price will go higher.

The question for you is, "Do you want to buy gold now, or do you want to buy more expensive gold in the future?"

Now, what about silver, you ask?

Not surprisingly, the silver story is very similar to gold's story.

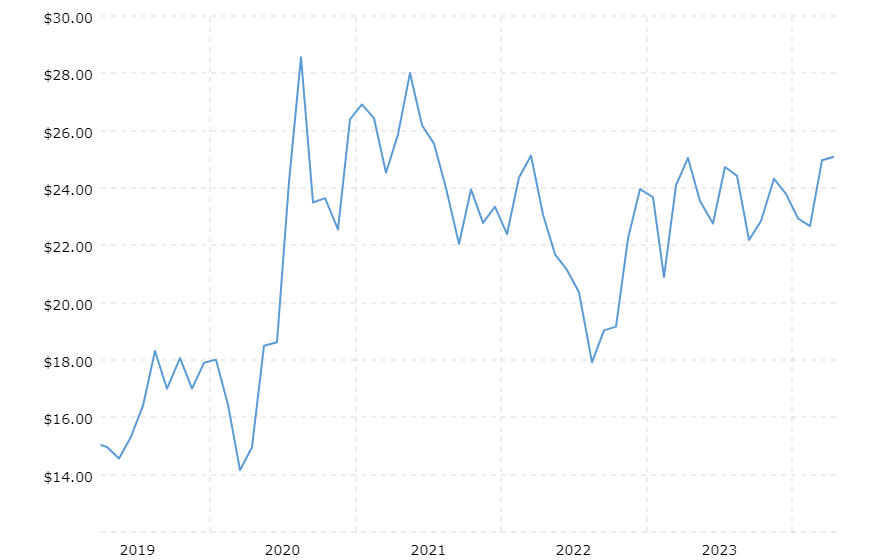

Take a look at this 5-year silver price chart…

The basic story is the same. After a short spike as a result of the Covid pandemic, silver has seen rangebound trading as well.

You would expect that. Silver follows gold in the trend (up or down) once gold establishes the trend. Then, historically, silver tends to outpace gold, whether the trend is up or down.

So, silver has been consolidating between $20 and $26 per ounce for the past few years as well.

But here is the big difference between gold and silver…

Gold's consolidation was just below its all-time highs. Silver's consolidation has been at 50% of its all-time highs. Which is why many believe the upward potential in silver is far greater than gold's upward potential… myself included.

That is why I love gold as wealth insurance, and I love silver for its profit potential.

I buy gold, and I never sell it… unless I have a financial crisis.

I buy silver, and I sell when the market switches from bull to bear.

Actions to Take…

Buy gold and silver today, while gold is cheap at all-time highs… and silver is even cheaper.

There is no better way I know to Keep What's Yours!

Buy on our website directly… www.assetstrategies.com. Call us at 800-831-0007. Or send us an email.

--Rich Checkan

Big thanks to Rich and the team at ASI for allowing me to bring his thoughts on gold and silver to you. And if you want to buy physical gold and/or silver, ASI is the ONLY team I can unequivocally vouch for, as they are men and women of the finest character, knowledge and experience. If you need gold or silver, you need ASI. | | 3 Steps for Surviving the "Perfect Storm" Market Crash Recent moves by the Fed could wipe out billions of dollars in the market…worse than the .com bubble, housing meltdown, or covid-crash combined.

Navigating this requires more than gut instinct; it calls for the sophisticated edge that artificial intelligence trading software provides.

Learn to Protect Your Money Ahead of Any disastrous Event for FREE > | | | ETF Talk: Another Golden Opportunity

"The desire for gold is not for gold. It is for the means of freedom and benefit." -- Ralph Waldo Emerson

Gold has long been used as currency and as a status symbol across human civilizations.

We find gold in the tombs of great kings from antiquity (like the Mask of Agamemnon or the coffin of Tutankhamun) and in our modern-day vaults. Gold is so valuable to us that we even use it as a standard for perfection and to describe ethical behavior -- the "golden rule," winning a gold medal as first prize.

I think it's safe to say that gold has long been an important part of human culture. Why gold, you may ask, and not some other metal as our all-important mineral?

Well, practically speaking, gold is chemically inactive and not susceptible to corrosion. Gold can be cast as coin, easily shaped or used to gild books, statues and all other kinds of metal, wood or stone objects without rusting or fading over time.

Gold stays glittering, then, for thousands of years, promising everlasting wealth. And you and I, dear readers, follow in a long line of men before us seeking to benefit from the stability and freedom that the yellow metal offers. So, this week, let's peer at another golden opportunity to capture freedom and benefit: SPDR MiniShares Gold Trust (NYSE: GLDM).

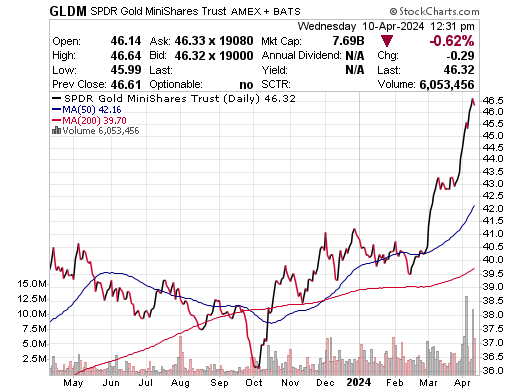

GLDM is a U.S.-listed, physically gold-backed exchange-traded fund (ETF). It represents fractional, undivided beneficial ownership interests in the Trust, which holds physical gold bullion. GLDM provides a convenient way for investors to access the gold market and is intended to provide a lower total cost of ownership over longer periods of time. Its objective is to reflect the performance of the spot price of gold bullion using gold bars held in London vaults.

Unlike its sibling, SPDR Gold Shares (NYSE: GLD), GLDM holds a fraction of the amount of gold per share (hence, "mini"), allowing investors to place smaller orders and diversify their portfolios.

The fund hit a 52-week high this week, up from a low of around $36 last October, reflecting investor sentiment regarding the reliability of the tangible precious metal. Expectations of a June rate cut by the Federal Reserve could see the fund driving even higher.

GLDM has $7.6 billion in assets under management, and it comes with one of the lowest expense ratios among the gold ETFs at just 0.10%.

Chart courtesy of Stockcharts.com

If you've been paying attention, you know that gold has been rallying since late last year, shooting up some 9% in March and continuing to reach new highs this month. The rally is the result of several factors, including geopolitical conflicts in the Middle East and Ukraine, inflation and buying by central banks -- and it continues to move up despite a strong U.S. dollar and job growth in March.

When gold trends, it trends well. And the latest new highs offer fresh evidence that supports the bull case for gold. Within gold trends, reactionary pullbacks are common. Those are not ideal for portfolio volatility; however, they do offer good opportunities to get into or add to long positions. And GLDM gives investors a golden opportunity to get long-term exposure to gold.

To quote another great writer (the golden playwright, William Shakespeare), "Gold -- what can it not do, and undo?"

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to email me. You may see your question answered in a future ETF Talk.

*****************************************************************

Arthur Jones Wisdom

"How old am I? Old enough to know it's impossible to change the thinking of fools, but young and foolish enough to keep on trying."

--Arthur Jones

The brilliant, eccentric and acerbic inventor of Nautilus exercise equipment (by far the greatest tools for muscle building ever devised) was a man who lived a legendary and Renaissance Man-worthy life. In the quote here, Jones expresses a sentiment that I can relate to, especially as I'm about to enter my sixth decade on this Pale Blue Dot.

So, if you ever meet me in person, at the MoneyShow, FreedomFest, an auto racing track, a rodeo, the shooting range, a music venue or just bouncing around in my hometown of Los Angeles, and you ask me how old I am, prepare to get the Arthur Jones reply.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you'd like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim. | | In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

| | About Jim Woods:

Jim Woods has more than 25 years experience in the markets, as a stock broker, hedge fund money manager, author, speaker and independent analyst. Today Jim serves as editor and investment director of the long-running newsletters Successful Investing, the Intelligence Report, Bullseye Stock Trader and a new Live Coaching service offered exclusively to his readers. Jim Woods has more than 25 years experience in the markets, as a stock broker, hedge fund money manager, author, speaker and independent analyst. Today Jim serves as editor and investment director of the long-running newsletters Successful Investing, the Intelligence Report, Bullseye Stock Trader and a new Live Coaching service offered exclusively to his readers.

His articles have appeared on many leading financial websites, including StockInvestor.com, InvestorPlace.com, Main Street Investor, MarketWatch, Street Authority, and many others. | | | | | |

Tidak ada komentar:

Posting Komentar