April 30, 2024

These 3 Sectors Are Leading the Crypto Market

Dear Subscriber,

|

| By Bruce Ng |

Crypto sectors are often called “narratives” because much of the force propelling prices higher is based off the investor sentiment and what narratives are circulating.

See, the way liquidity in crypto works is a bit like a trickle-down system.

Bitcoin (BTC, “A”) generally gets the lion’s share of new liquidity first. Then, as Bitcoin gets overbought, liquidity flows to other blue-chip cryptos, then mid-sized altcoins before finally getting to the small-cap projects.

But with so many cryptos out there, it’s hard to pick the winners from those that’ll get left in the dust.

That’s why investors need to be aware of the narratives propelling crypto sentiment. Especially in a bull market like this. Those trends will lead you at least to the right sector. From there, specific opportunities are easier to find.

I first discussed the top three altcoin narratives for 2024 in this January article here.

At least, those were my predictions. We all know crypto moves fast, so let’s take a look at how well my predictions panned out. The top narratives I mentioned in January were:

- Crypto AI

- ETH Liquid Restaking

- Layer-1 blockchains

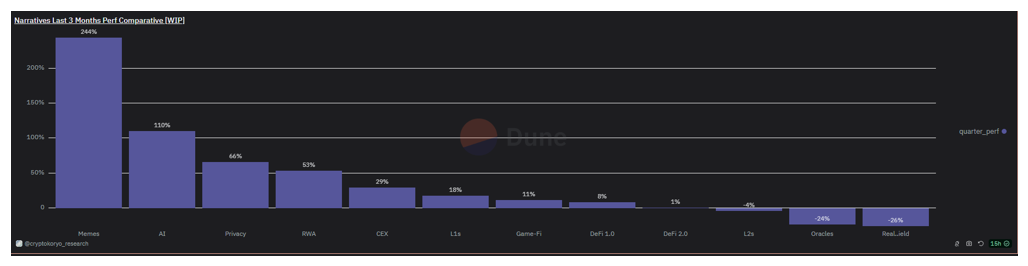

Let’s see how we I did by looking at the performance of altcoin sectors over the past three months:

Figure 1: Narrative performance past three months.

Source: cryptokoryo.

Click here to see full-sized image.

Crypto AI has certainly been a top performer, reaching the No. 2 rank among crypto narratives. Layer-1 blockchains hit No. 6 spot.

The only narrative yet to have its time in the spotlight so far is ETH Liquid Restaking. That’s OK, though. This sector is still in its early days. I believe we’ll see more action there in the next phase of the bull market.

In the meantime, I want to take a deeper look at the two sectors I pointed out in January to see how they’ve developed since. And we’ll take a new look at the top sector leading the market, memecoins.

This way, you’ll know what to look for when considering what projects to invest in.

Narrative 1: Memecoins

Memecoins rise alongside everything else in a bull market. And without fundamentals underpinning price action, how high they go is entirely dependent on the communities and narratives around them.

Naturally, this makes it hard to say in advance whether memecoins will take off in a big way. But based what I’ve seen thus far, I think memecoins will continue to outperform.

The big narrative supporting this is the most tried and true crypto sentiment — average investors being tired of insiders getting a sweeter deal.

See, there are countless examples in crypto — and more in TradFi — of “serious” or “proper” projects launching with skewed token allocations. This is to the benefit of early investors — such as venture capitalists, influencers and development teams — getting more tokens for cheaper.

In contrast, some memecoins have fairer distribution strategies. The dev team for dogwifhat (WIF, Not Yet Rated) — a top-performing memecoin on the Solana (SOL, “B+”) network — sold most of their tokens in its early stages for $29,000, for example. Their allocation is now worth $693 million.

WIF now has one of the fairest distributions in crypto where most tokens are community owned. And this is reflected in its three-month price action, during which time it soared to a new all-time high.

I think this new angle — of memecoins allowing the little guy an edge in the fight for financial freedom — will continue through this bull cycle.

But, as I said, memecoins don’t have anything upholding their trading prices. As such, they are much more susceptible to market volatility.

If you have a higher risk/reward tolerance and want to consider a memecoin investment, here are the top three trends within the memecoin sector to help you narrow down your selection:

- Dog-themed memecoins, such as Dogecoin (DOGE, “C+”), Shiba Inu (SHIB, “C+”) or dogwifhat (WIF, Not Yet Rated).

- Cat-themed memecoins, like Keyboard Cat (KEYCAT, Not Yet Rated), Popcat (POPCAT, Not Yet Rated) or MichiCoin (MICHI, Not Yet Rated).

- Political-themed memecoins like DEDPRZ (USA, Not Yet Rated) and Jeo Boden (BODEN, Not Yet Rated). The strong recent performance of political memecoins indicates this subsector will likely continue leading memecoins as we get closer to the U.S. presidential election this November.

Narrative 2: Crypto AI

In my opinion, there are two main pillars of AI:

First is its data set. Large datasets are needed to train AI models. The larger the data set the more predictive it becomes.

Second is its computing power. To train on large datasets, you will need lots of computing power. This means lots of GPUs, typically.

As my colleague Jurica Dujmovic has said previously, the combination of AI functionality and blockchain technology has the potential to bring about opportunities neither can achieve on its own.

Figure 2: AI and blockchain synergies.

Source: Shawred.

Click here to see full-sized image.

And I have to agree. In fact, here are three benefits to crypto AI, and why I believe this trend will persist:

- Benefit 1: Cost. When it comes to computing power, blockchain solutions like Render Network (RNDR, “B”) can be potentially cheaper than centralized incumbents like Amazon Web Services according to this news article. By making graphics processing more accessible, a wider array of projects can be supported.

- Benefit 2: Decentralization. Decentralization of data allows for network participants to own their data, maintaining data privacy principles. This is great for operations in certain countries where privacy laws are strong. It’s also good in general because privacy for the average user should be a right, not a privilege.

- Benefit 3: No Middlemen. Blockchain enables peer-to-peer incentivization of all network participants. This means service providers and consumers can engage in free trade without going through a centralized intermediary, which usually means increased overheads.

In fact, the one potential detriment I can think of is that training a decentralized dataset could increase overhead. But the lack of middlemen and cheaper processing should offset those costs.

Simply put, crypto makes AI better.

But the industry is still nascent. Which means actual working products will take time to develop.

But one more great thing about crypto AI is that the average investor can buy AI coins without having to buy stocks in large AI-related companies like Nvidia, Microsoft and Google.

In other words, the retail investor can buy a larger piece of a speculative pie than a small piece of a giant pie.

But if you’re looking for a cool way to use AI in your investing, I urge you to sign up for Weiss Rating’s biggest reveal yet: an AI trading system which beats the S&P 500 Index by 51x.

It’s the first and only stock trading system in existence that combines the proven power of artificial intelligence with the proven accuracy of our 100% independent ratings.

Its ability to beat the market nearly 51-to-1 is backed by 10 years of data, including three years of real-time testing.

Its inaugural grand opening — exclusively for Weiss VIP Members — will take place on Tuesday, May 7, at 2 p.m. Eastern.

If you want to be there and learn more about this exciting new opportunity, just click here to save your seat.

Narrative 3: Layer-1 Blockchains

When Ethereum kicked off in 2014, there was only one way to make a blockchain. But now, advancements and evolution have given developers a multitude of options, which fall into one of two subsectors:

- Monolithic or integrated architecture. These are the Layer-1 blockchains you’re likely familiar with, such as Ethereum and Solana. They do everything that a blockchain can do.

- Modular: These blockchains specialize on only one or two core functionalities. Examples include Near Protocol (NEAR, “C-”), Celestia (TIA, “B+”) and the recently launched EigenLayer.

Every bull market is a sucker for new tech and new stories … and new funding. That’s why I believe both types of blockchains will do well, though I do expect the narrative to shift back and forth between which one will sit in the spotlight.

We have already seen Solana climb from $20 in mid-2023 to now $136. And I believe it will maintain that lead in the next leg up.

That said, there will likely be other outperformers, as well. New challengers, like Monad or Berachain, are poised to do well upon their upcoming launches.

Being part of leading sectors doesn’t guarantee that these projects will all outperform this bull cycle. But finding potential opportunities based on what narratives are driving the market is a smart way to narrow down projects with promise from ones more likely to be left behind.

And since crypto is a fast-moving market, I urge you to check in on investor sentiment regularly to see which narrative is currently on top.

Or you can always just check in with us here at Weiss Crypto Daily.

Best,

Dr. Bruce Ng

Tidak ada komentar:

Posting Komentar