| | | Good morning. | The Fast Five → Gold hits another record high, Musk is now officially Austin's largest private employer, US manufacturing grows at fastest rate since 2022, Trump Media plunges 25% after reporting big loss, and the Magnificent Seven is now the Fab Four… | Calendar: (all times ET) | Today: | Job openings, 10am | WED 4/3: | Fed Chair Powell, 10am | THU 4/4: | Jobless claims, 8:30am | FRI 4/5: | Unemployment rate, 8:30am |

| | Your 5-minute briefing for Tuesday, April 2: | | BEFORE THE OPEN |  | As of market close 4/1/2024. |

| Pre-Market: | | |

|

| US Investor % Bullish Sentiment:

50.00% for Wk of Mar 28 2024 (Last week: 43.20%) |

|

| | | Market Recap: | Stock futures slip: S&P 500 and Dow down. Dow futures -0.3%, S&P 500 -0.1%, Nasdaq -0.2%. Health insurers tumble on Medicare rate news. Dow falls 0.6%, S&P 500 -0.2%, Nasdaq edges higher. Strong manufacturing data raises rate cut doubts. Fed funds futures: 58% chance of June rate cut. Today: Job Openings, Durable Orders; Friday - March payrolls.

|

|

| | | What we're watching this week: | Today: Cal-Maine Foods (CALM) Wednesday: Levi Strauss (LEVI) Thursday: Lindsay (LNN), Simply Good Foods (SMPL)

| Full earnings calendar here |

|

| | | |  | Gold prices scaled to another record high Monday, propelled by U.S. interest rate cut expectations and the metal's appeal as a safe haven asset. |

| |  | Elon Musk boosts headcount by 86% at biggest site of his Texas empire |

| US manufacturing activity grows at fastest rate since 2022 (more) Citadel's Griffin expects US economic landscape to be challenging, more favorable for fixed income (more) Oil gains on potential for rising demand, wider middle east war (more) US manufacturing on the mend; rising raw material prices pose obstacle (more) Xi's cryptic bond comments hint at PBOC becoming more like Fed (more) Fed bank borrowing program was 'too good to pass up,' data show (more) Stocks join losses in bonds as Fed-cut wagers fade (more) Trump Media plunges more than 25% after company reports big loss for 2023 (more) Google to destroy browsing data to settle consumer privacy lawsuit (more) Rubrik files to go public as tech companies see thawing of IPO market (more) Microsoft to separate Teams and Office globally amid antitrust scrutiny (more) United asks pilots to take unpaid time off as Boeing issues persist (more) Tesla has Wall Street worried about how many cars it just sold (more) T.Rowe Price backs Disney directors in boardroom challenge with hedge funds (more) Tiger Global VC fund closes 63% below target with $2.2 Billion (more)

|

|

| | A MESSAGE FROM GOLDENCREST METALS |

|

| Don't be fooled by the mainstream media | We're raising the alarm – Jamie Dimon of JPMorgan has just forecast a colossal economic disaster for 2024-2025. We're facing a potential collapse, with chaos from Ukraine to the Middle East, and the Federal Reserve gambling with our financial future. | Make no mistake – this is a battle for your survival. The U.S. debt is skyrocketing, posing an unprecedented threat. Even Wall Street giants are scared. The "booming" stock market? It's a bubble on the brink of bursting, and the media is painting a rosy picture – don't buy it! | Take control now. Our No-Cost Wealth Management Guide isn't just advice – it's your survival kit in this economic battlefield. | | Inside, you'll find: | Strategies to safeguard your wealth against the rising national debt crisis. Insights on why gold is essential in your investment portfolio. Crucial actions to secure your retirement. Powerful anti-inflation investments. Why central banks are stockpiling gold. And much more!

|

| |

| Don't be a spectator in this economic showdown. When the economy plummets, only the prepared will thrive. Get your no-cost guide NOW for survival and prosperity! | To your unshakeable prosperity,

GoldenCrest Metals | - please support our sponsors - |

|

| | | M+A | Investments | Formula 1 owner Liberty to buy MotoGP in $3.8 Billion deal (more) Advent in advanced talks to buy Ryan Reynolds-backed Nuvei (more) Capital One-Discover merger deal termination fee set at $1.38 Billion (more) Abrigo, a provider of compliance, credit risk, and lending solutions, acquired TPG Software, a company specializing in investment solutions (more) One Equity Partners, a private equity firm, acquired Acteon Group, a marine energy and infrastructure solutions company (more) Novacap-backed Cadent buys AdTheorent (more) Littlejohn purchases UAT (more) PE-backed Juniper buys Rip's and Elegant (more)

| VC | Aeovian Pharmaceuticals, a clinical-stage biopharmaceutical company, raised $50M in funding (more) Zafran, a risk and mitigation company, raised over $30M in funding (more) Skyflow, a data privacy vault company, raised $30M in Extended Series B funding (more) Confetti, a provider of a platform to handle team-building activities for companies, raised $16m in Series A funding (more) Terragia, a technology startup specializing in biofuels, raised $6M in Seed funding (more) Orchard Robotics, a company enabling precision crop management with robots and AI, raised $3.8M in seed and pre-seed funding (more) Kidsy, an online retailer for baby and kids products, raised over $1M in funding (more)

|

|

| | | | | Crypto exchange Binance names its first board of directors (more) Bitcoin becomes more volatile than Ether as halving approaches (more) Tether added bearly 8.9K Bitcoin to holdings in first quarter (more)

|

|

| | | | | | | | | DAILY SHARES |  | gaut is doing nothing @0xgaut |  |

| |

Whenever you feel fomo it doesn't mean you should buy it means you should do nothing Thank me later | | | Apr 2, 2024 | | |  | | | 39 Likes 1 Retweet 5 Replies |

|

|  | Autism Capital 🧩 @AutismCapital |  |

| |

Find someone who loves you like Bitcoin loves $70k. | | | Apr 1, 2024 | | |  | | | 178 Likes 5 Retweets 14 Replies |

|

|  | Not Jerome Powell @alifarhat79 |  |

| |

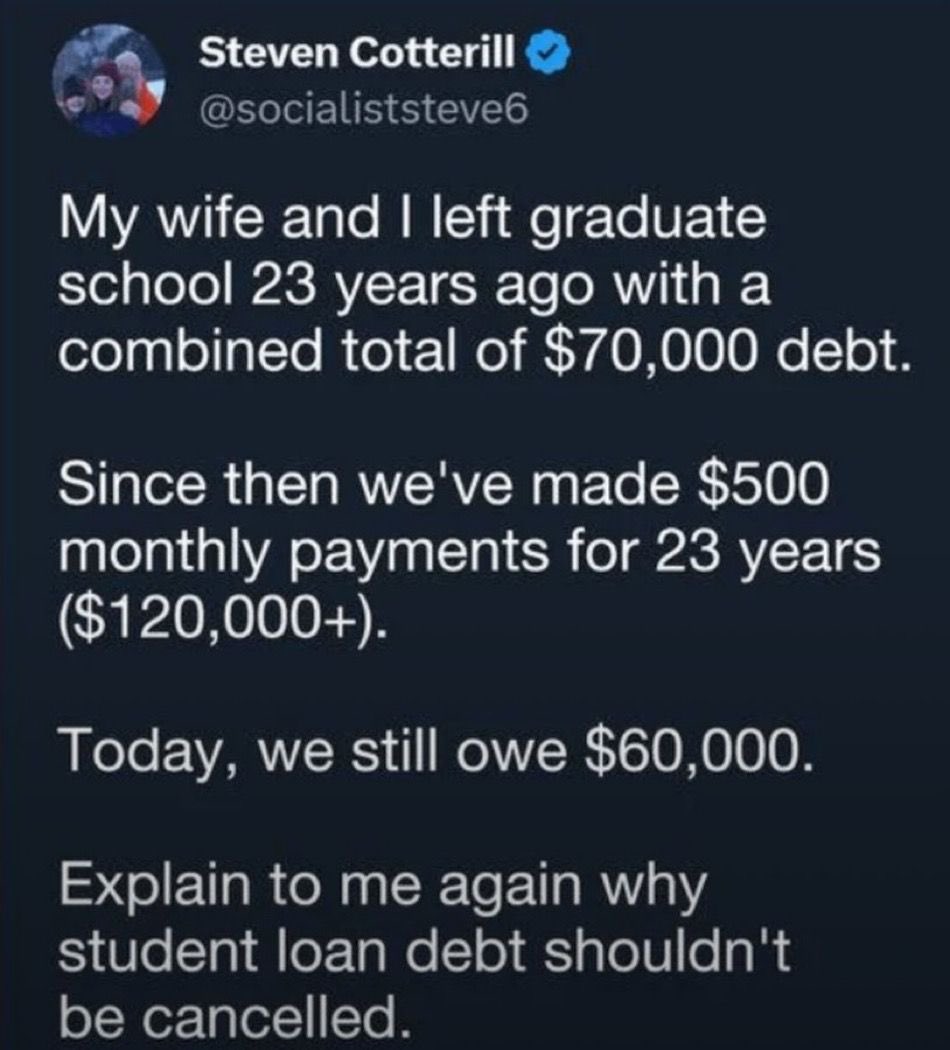

This is insane |  | | | Apr 2, 2024 | | |  | | | 53 Likes 8 Retweets 30 Replies |

|

|  | Giga Based Dad @GigaBasedDad |  |

| |

|  | | | Apr 2, 2024 | | |  | | | 200 Likes 10 Retweets 2 Replies |

|

|

| |

| | |

| Know someone who would enjoy this? |

|

| | | What did you think about today's briefing? | |

|

| | | *from our sponsors | Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.2 |

|

Tidak ada komentar:

Posting Komentar