| What a week! | This week delivered more market-moving headlines than most investors see in a month. | Trump walked back his Greenland threats, Nvidia's CEO laid out Europe's AI roadmap, and Elon Musk finally showed up at Davos with timelines that matter. | Here's what happened and why it matters for your portfolio. | | | | | Trump's Greenland Deal: From Threats to Framework |  | President Trump addresses at the World Economic Forum 2026 in Davos (Evan Vucci / Associated Press) |

| After weeks of threatening tariffs on eight NATO allies and hinting at military force to acquire Greenland, Trump announced a "framework of a future deal" with NATO Secretary-General Mark Rutte. | The tariffs are off. The rhetoric cooled. Markets rallied. | | ❝ | | | "They're going to be involved in the Golden Dome, and they're going to be involved in mineral rights, and so are we." | | | | President Donald Trump |

|

| Key Points: | Strategic access, not territory. Trump's framework focuses on U.S. mineral rights and Golden Dome missile defense deployment in Greenland, with Denmark's sovereignty intact. Rare earth minerals drive the deal. Greenland holds massive deposits of materials critical to defense tech, and Trump made clear the U.S. needs them for national security. Golden Dome gets real. Trump's space-based missile defense system is now part of trilateral talks between Washington, Copenhagen, and Greenland, benefiting U.S. defense contractors specializing in radar, satellites, and interceptors.

| Do you want "Golden Dome" deployed in Greenland? | |

| |

| | |

| | | | | Caught on Camera: Tesla Cybercab Shocks Austin Streets | | No driver. No wheel. No human intervention. | While the world stares at the car, smart money is moving behind the scenes. Elon's "Physical AI" revolution relies on one critical stock that provides the horsepower for this $10 trillion shift. | Don't just watch the footage—own the engine driving it. | Watch it here >> | | *ad |

| |

| | |

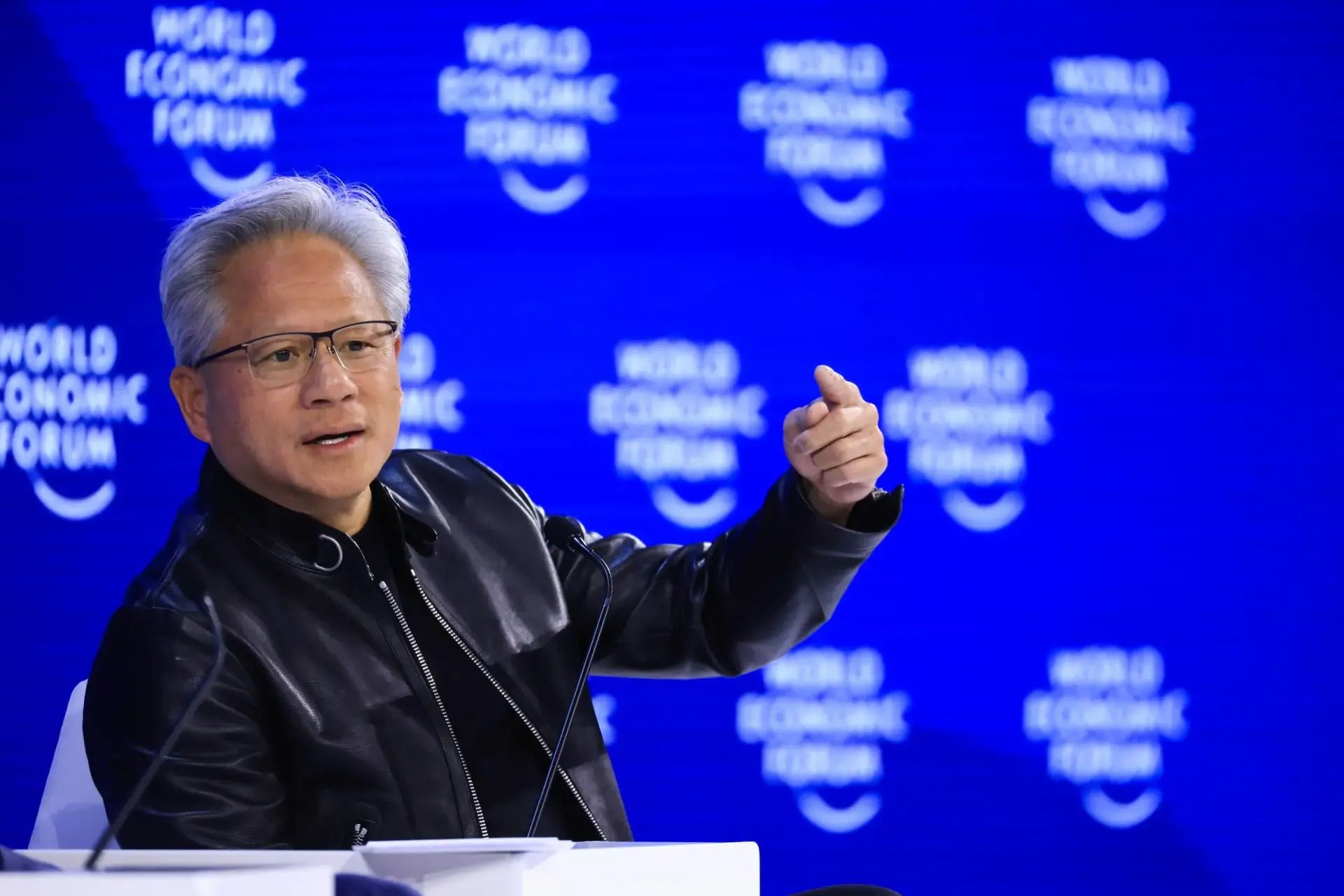

| | | | | | Jensen Huang's AI Robotics Push in Europe |  | Nvidia CEO Jensen Huang during the World Economic Forum in Davos (Krisztian Bocsi/Bloomberg) |

| Nvidia CEO Jensen Huang called AI robotics a "once-in-a-generation opportunity" for Europe at Davos. His pitch: Europe can skip the software race and jump straight to physical AI by fusing industrial manufacturing with AI. | Key Points: | Hardware over software. Huang argued Europe doesn't need to catch up on cloud computing. It can leapfrog straight to robotics, autonomous systems, and AI-driven manufacturing. Energy is the bottleneck. Europe faces some of the highest energy costs globally. Without fixing that, Huang warned, European companies will miss the AI robotics wave entirely. Defense tech implications. Autonomous drones, AI-guided missiles, cyber defense systems, and space-based surveillance all require the chips and infrastructure Nvidia supplies. If Huang's right, defense tech is entering a multi-year growth cycle.

|

| |

| | |

| | | | | | Elon Musk's Davos Debut |  | Elon Musk speaks during the World Economic Forum Annual Meeting in Davos (Harun Ozalp/Getty Images) |

| Elon Musk made his first-ever World Economic Forum appearance and dropped three specific timelines that investors should track. He's done calling Davos "boring." Now he's using the platform to signal where Tesla, SpaceX, and xAI are headed. | Key Points: | Optimus goes public by the end of 2027. Tesla's humanoid robot will be available for consumer purchase within 24 months. Musk predicts robots will eventually outnumber humans. AI surpasses human intelligence in 2027. Musk said AI will be "smarter than any human" by next year and "as smart as all of humanity combined" soon after. SpaceX achieves full rocket reusability soon. The big breakthrough SpaceX is chasing is complete reusability, bringing costs down dramatically and making Mars colonization economically viable.

| Do You Believe Elon? | |

| |

| | |

| | | | | Elon's UBI Warning: Your Job Is Doomed. Own the Solution. | Elon Musk said it: AI will wipe out most jobs, making Universal Basic Income (UBI) an inevitable necessity. | The problem? UBI is talk. This AI holding generates measurable results. | You have two choices: | wait for a government handout that may never come, or own the technology that is driving the disruption. | This AI holding is focused on profitability and known among marketers as the ROAS King. It is engineered to drive measurable ROI (per SEC filings), not abstract research — which is why it has: | A valuation increase from $4M to over $200M

Participation from institutional investors such as Fidelity Ventures

A reserved Nasdaq ticker ($RADI)

An active early-stage Reg A+ offering at $0.85/share

| This is your "Privatized UBI" — a focused-on-profitability position you can take today. | The investment window at the current price ($0.85) closes soon. | AI is coming — fast. | This is how you get paid for it. | Invest at $0.85/share. | | Ad. Short form: Nasdaq ticker is reserved. No future guarantees of a public listing. |

| |

| | |

| | | | | | WEF 2026: Cooperation Under Strain |  | US President Donald Trump holds a signed founding charter for the Board of Peace during WEF in Davos [AFP] |

| The World Economic Forum's 2026 annual meeting in Davos ran this week under the theme "A Spirit of Dialogue." Around 3,000 leaders from business, government, and civil society focused on growth, security, and the deployment of generative AI. | Key Points: | Geopolitical fragmentation took center stage. Sessions focused on renewing cooperation as norms and alliances face serious strain. AI deployment dominated discussions. Practical pathways to resilience and inclusive growth centered on responsible deployment of generative AI and new collaboration models. Defense and security got serious attention. Europe's security posture, tokenization-driven financial innovation, and managing economic shocks were key topics.

|

| |

| | |

| | | | | | Trump Sues JPMorgan and Jamie Dimon |  | Jamie Dimon, JPMorgan Chase CEO (Samuel Corum/Bloomberg) |

| Trump sued JPMorgan Chase and its CEO, Jamie Dimon, for at least $5 billion over allegations that the lender stopped offering him and his businesses banking services for political reasons. The complaint, filed Thursday in Miami-Dade County, Florida, accuses the bank of closing his accounts seven weeks after the January 6, 2021 Capitol riot. | Key Points: | Trade libel and breach of covenant claims. The complaint accuses the bank of trade libel and breach of implied covenant of good faith, and claims Dimon violated Florida's deceptive trade practices law. Florida bars financial institutions from ending banking relationships based on political opinions or affiliations. The alleged blacklist includes Trump family names. The complaint says Trump and the plaintiffs have recently learned that JPMorgan published their names on a blacklist accessible by federally regulated banks, which is composed of individuals and entities that have a history of malfeasant acts. The suit claims Trump has always complied with banking rules. JPMorgan denies merit, will fight in court. JPMorgan said in a statement that the suit has no merit, and noted "We do close accounts because they create legal or regulatory risk for the company," adding they've asked both this administration and prior ones to change rules that put them in this position. The bank disclosed in November its facing reviews and investigations tied to the Trump administration's fight against "debanking."

| Do you support Trump suing JPMorgan & Jamie Dimon over "debanking"? | |

| |

| | |

| | | | | | TikTok Deal Finalized: Oracle-Led Spinoff Closes |  | Getty Images |

| The yearlong saga just ended. The United States and China signed off on a deal that hands control of TikTok's U.S. operations to a group of investors backed by President Donald Trump. The new entity, TikTok USDS Joint Venture LLC, officially closed on January 22, avoiding the ban that was set to take effect. | Key Points: | Oracle, Silver Lake, and MGX own 45%. The investor group consists of Oracle, private equity firm Silver Lake, and investment firm MGX, collectively holding 45% of the U.S. operation, with ByteDance keeping nearly a 20% stake. The joint venture will be governed by a seven-member board. Adam Presser takes the CEO role. The new company will be led by Adam Presser, with TikTok CEO Shou Chew serving on the board of directors. Presser has worked at TikTok since 2022, previously heading operations and trust and safety. Congressional scrutiny ahead. GOP Rep. John Moolenaar of Michigan, chairman of the House Select Committee on the Chinese Communist Party, said the panel will have a public hearing "in the coming months" focused on two questions: Does it make sure the CCP does not have influence over the algorithm, and can we assure Americans that their data is secure. Lawmakers question whether the deal meets the separation threshold Congress intended.

|

| |

| | |

| | What This Means | This week showed how quickly geopolitical rhetoric can shift markets. Trump's Greenland framework removed one major overhang. But the broader themes, Arctic strategy, AI infrastructure buildout, and tariff uncertainty, aren't going away. | Defense contractors with Arctic and missile defense exposure got a boost. AI and robotics names saw renewed interest after Huang's speech. And Musk's timelines put specific dates on technologies that could reshape entire industries. | Energy remains the critical constraint for AI growth. Europe's high costs create opportunities for U.S. companies with energy-efficient systems and for nuclear and renewable energy suppliers to data centers. | The TikTok situation remains fluid. If a ban happens, Meta and Google are the obvious beneficiaries. If a sale goes through, watch who ends up with the asset and what data access they get. | Markets rallied on tariff de-escalation, but don't mistake a framework for a final deal. | Trump's negotiation style creates volatility. Position accordingly. | Bottom Line | Davos delivered clarity on some fronts and new uncertainty on others. The Greenland framework is progress. The AI roadmap is ambitious. The tariff risks are real but negotiable. And the TikTok clock is still ticking. | Stay focused on the sectors with clear tailwinds: defense tech, AI infrastructure, and energy. Watch the headlines, but trade the fundamentals. | | Need to Know | | Disclaimer: This analysis is for educational purposes only and should not be considered investment advice. Always do your own research before making investment decisions.

Items marked with an asterisk (*) are promotional and help support this newsletter at no cost to readers. |

|

Tidak ada komentar:

Posting Komentar