December 16, 2025

Watch These 3 Fast-Rising 'Buys'

Dear Subscriber,

|

| By Gavin Magor |

When the Weiss stock ratings upgrade a company to a “Buy,” that’s a signal to pay close attention.

Our latest data run shows that EVERY stock rated “Buy” by Weiss Ratings has delivered an average return of 317% over the past 22 years.

Our ratings have also delivered 1,000%+ gains on 439 stocks over that period.

That’s because the best stocks can become even stronger “Buys.”

It’s no small feat to achieve even a “B-,” our lowest “Buy” rating.

After all, there are thousands of stocks that haven’t made it that high in the ranks.

Among the elite that do, many will never get a better grade. At least, not for long.

So when a stock enters “Buy” territory …

And goes on to rise even further in our ranks …

That’s something truly special!

Today, I want to share with you not one, not two, but three stocks that have accelerated to higher “Buy” ratings recently.

What’s notable about them all is they did so in a hurry.

This can mean one of two things:

- Either the company was recently upgraded to a “B-,” followed quickly by a second upgrade to a “B” or higher …

- Or a company leapfrogged its way into a “B” or better from a “C,” which is “Hold” territory.

I’ll show you what I mean by these in a moment.

First, here’s how I found these three rising “Buys” using the ultimate data-driven investment tool: Weiss Ratings Plus.

This data is behind a login screen. So today, I’m showing you something you might never have seen before.

Within Weiss Ratings Plus, there’s a Stock Ratings Analyst tool.

The Stock Ratings Analyst is your key to unlocking our vast financial database. With it, you can discover the best stocks for your portfolio.

Today, I fired up the Stock Ratings Analyst and entered the following filters.

- Investment Rating: “A+” to “B” (so, higher than “B-”)

- Days Since Upgraded to “Buy:” <60

- Market Cap: >= $1 billion

- Exchange: Major U.S. Exchanges

The investment rating parameter gives us only stocks that have gone higher than the lowest “Buy” rating of “B-.”

And, only within the past 60 days or less.

I added the market cap and exchange requirements to weed out small companies that can be more volatile or move between the ratings quickly.

We only want solid companies that have powered higher in the ratings of late.

Here’s what this screen shows:

These seven stocks — Brookfield Wealth Solutions, OR Royalties, Sapiens, Southwest Gas, Innoviva, Patria Investments, GSK plc and Centerra Gold — can serve as a great list you can use right now to add fast-rising stocks within our ratings.

But you might not be in the market to buy seven stocks today.

So, I drilled down a bit further into them to see if there were any unique situations.

I want to share three of those, which may represent even better individual opportunities.

The Leapfrog

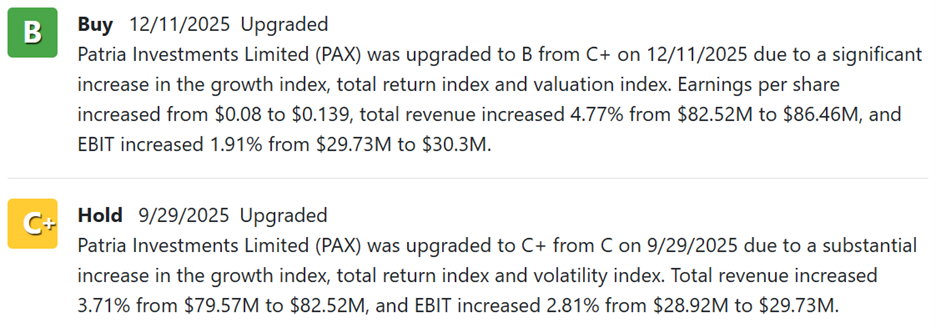

Let’s start with Patria Investments (PAX).

As you can see, it only became a “Buy” recently. That’s what initially caught my eye.

For it to become a “B” in just one day, that means it must have jumped over the “B-” rating.

Sure enough, that’s what happened:

Source: PAX’s Rating History page on Weiss Ratings.

You can see that earnings and total revenue growth were the catalysts for its upgrade from a top-tier “Hold” to a solid “B”-rated “Buy.”

That happened just last week.

The Mega-Riser

The second one I want to share here is the Big Pharma company, GSK (GSK).

You might know it by its former name, GlaxoSmithKline.

It is by far the largest to land on our shortlist.

So, it must have seen some great recent performance to bump it up so fast.

That’s an understatement:

In the past 45 days or so, it jumped from a “Hold” all the way to a “B.”

But GSK’s rise is even more remarkable.

In February, the Weiss stock ratings downgraded GSK to a “Sell.”

So, it’s climbed all the way back from a stock to avoid to one of our most promising companies.

Its path was straight up, too.

It didn’t leapfrog like Patria. But that steady rise — and relatively quick ascent through the ratings — is definitely a good sign.

Finally, I found one that did both …

Strong ‘Buy’ in Just 9 Months

Centerra Gold (CGAU) went from “Sell” to “Buy” in just nine months … AND skipped from “C” to “B” on Oct. 30, 2025.

Not only did it rise fast, but it also skyrocketed over two full ratings on the way.

Now, you might be thinking that I have access to some advanced tools that lead me to discoveries like this all the time.

I do, but …

This Stock Analyst tool is 100% accessible to anyone who wants it.

We have many new tools like this, and other behind-the-scenes development, going on all the time.

In fact, later today, I will sit down to unveil the largest upgrade of the Weiss Ratings in more than two decades.

It costs you nothing to see what I have to say at 2 p.m. Eastern today.

But you do need to click on this link before my brand-new video presentation begins.

In it, I’ll show you how we’re using some of the most cutting-edge AI technology on the planet to uncover what we believe are the market’s best buys … at the optimal time to buy them.

See what I mean here.

Cheers!

Gavin

Tidak ada komentar:

Posting Komentar