These 5 stocks could move before Wall Street catches on (From TradingTips)

In Brief

- The robotics industry is growing quickly, but some companies remain relatively obscure to investors.

- Investors willing to take on some risk may find significant opportunity in companies gaining their footing in this space.

- Three names to watch in the new year include Stereotaxis, Knightscope, and PROCEPT BioRobotics.

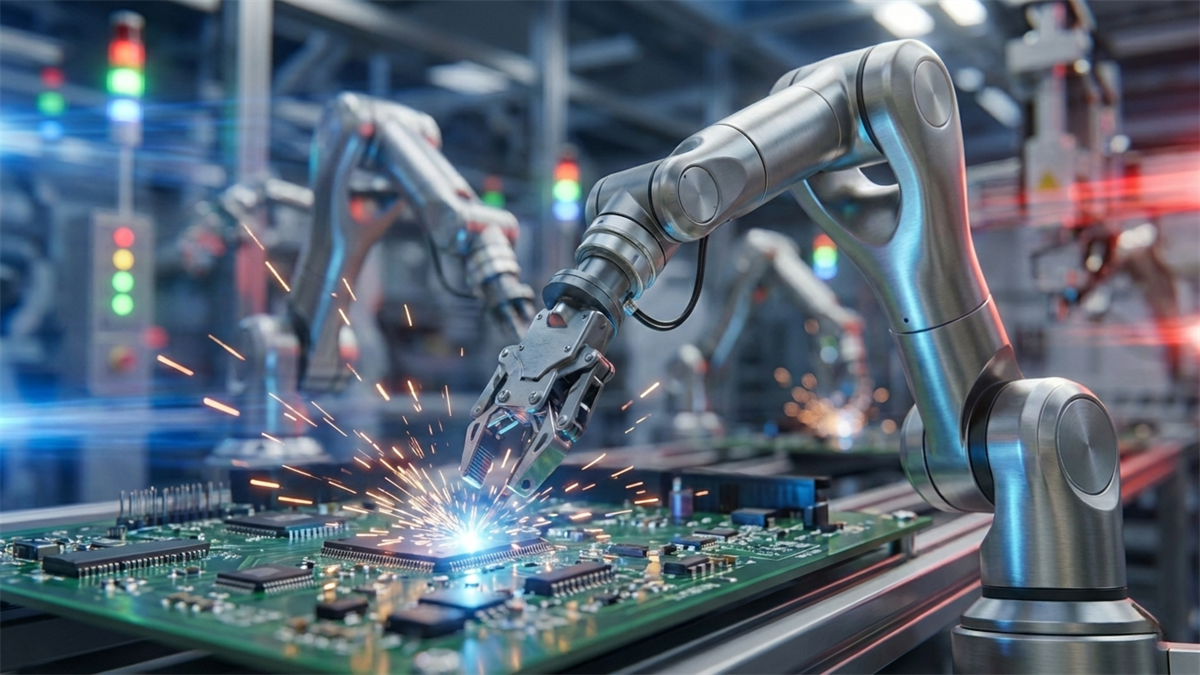

The global robotics industry is among the fastest-growing, with projections that it will expand from $50 billion worldwide in 2025 to $111 billion in just five years. Technology develops at a rapid pace, and the full extent of the applications of robotics and automation is still unclear. However, supporters of the industry believe robotics could play a part in making nearly every sector and industry more efficient, safe, and cost-effective.

With significant investor enthusiasm in artificial intelligence (AI) applications, robotics seems to have taken a back seat in the last year, although the two fields have the potential to be closely related. As such, there are a number of up-and-coming robotics companies available to investors that have been trading under the radar, noting promising developments and building up solid fundamentals without achieving their full potential as investments. We dig into three of them below.

Most investors won't touch stocks under $10.

They think "cheap" means "junk." They're wrong.

While the crowd chases the same overpriced tech giants, a handful of sub-$10 stocks just triggered massive catalysts that Wall Street hasn't fully priced in yet.

The smartest money always moves before the crowd realizes what's happening.

Click here to get your free copy of this report

Major Product Approval Could Boost Shares of Stereotaxis

With a market cap of just $226 million, Stereotaxis Inc. (NYSEAMERICAN: STXS) is a small medical device firm designing and making robotic magnetic navigation systems for use in electrophysiology applications. Part of the reason this penny stock may be overlooked is its recent earnings report, which saw revenue fall year-over-year (YOY) to $7.5 million as net losses widened. However, costs did include some unique items, including stock compensation, adjustments on acquisition, and amortization expenses.

In spite of this bit of discouraging news, there is an important bright spot for investors to consider as well. The company's latest surgical robotics system, GenesisX, received key FDA approval in November, paving the way for a major upgrade to the company's product offerings. As of November, the company had only done a limited launch of GenesisX in the United States and Europe; as it continues to expand its rollout, investors may expect sales to grow.

Analysts are optimistic that STXS shares will climb following the launch of GenesisX. The company received a Buy rating in November from Roth Capital and two recent price targets of $4 per share, almost two-thirds above its current price point. Of course, as a penny stock, Stereotaxis is likely to be particularly volatile.

Resolution of Manufacturing Issues Helps Knightscope Achieve Sizable Sales Gains

Knightscope Inc. (NASDAQ: KSCP) provides security robots and robots-as-a-service for incident detection and resolution. After falling by 58% year-to-date (YTD), investors are beginning to gain optimism, as short interest has improved by 13% in the last month. This may be related to a recent earnings report with some promising signs, including a top-line beat with revenue of $3.1 million, up 24% YOY.

The company is emerging from a period in which supply chain challenges interrupted its manufacturing capacity, but in the last quarter, product revenue climbed by 82% YOY as Knightscope was better able to address its production challenges. While the firm doesn't have substantial cash on hand, its position is improving: it ended the third quarter of 2025 with more than $20 million in reserves, up from just $5 million a year prior.

Perhaps most importantly, looking forward, Knightscope has recently revealed its latest and most advanced perimeter security robot model, the K7. Knightscope has stated that it is taking a "disciplined approach to market introduction," possibly as a result of its production issues in the past, as well as a recent inventory write-off. However, analysts see good things in Knightscope's future, predicting a share price that could roughly triple to $15.

They wrote silver off as a "boring metal," but its move above $33 has forced analysts to reconsider what's really driving this market. With AI hardware, EVs, solar, and next-gen electronics all dependent on silver — while global supply continues to lag — this quiet setup is starting to look like one of the most overlooked opportunities in the commodities space.

Most investors still haven't connected the dots, which is why this new silver forecast guide breaks down the fundamentals behind the move, the real pressure building beneath the surface, and the steps to consider before silver becomes front-page news.

Get the Silver Forecast Now

PROCEPT May Be Poised to Rebound After Big Drop This Year

The largest and best-established of these firms, PROCEPT BioRobotics Inc. (NASDAQ: PRCT), is also a medical device company, but with a focus on systems used in the treatment of benign prostatic hyperplasia.

The company recently noted strong earnings for the third quarter, including top- and bottom-line beats and revenue growth of an impressive 43% YOY.

That growth is despite less-than-ideal launch timing in the latest quarter, which might continue to impact utilization and sales through the end of the year.

Given PRCT's 57% YTD decline, this could present an opportunity for investors to get in before growth takes off again. Ten out of 13 analysts are bullish on PROCEPT, and Wall Street anticipates about 49% in upside potential.

Read this article online ›

Tidak ada komentar:

Posting Komentar