July 13, 2024

No One Studies Benjamin Graham Anymore

Dear Subscriber,

|

| By Jim Nelson |

What happened to value investors?

Unless this is the first time you’ve experienced a market that continues to grind to higher highs and unfathomable valuations, you are probably asking that same question.

There used to be two main types of investors: value investors and momentum investors. (We’ll exclude day traders from this, as that was highly specialized and expensive in the days of commissions)

Momentum investors are what you see all around you.

Can a company ever hit $1 trillion in market cap? Done.

Can several companies do the same? Done.

Can one hit $2 trillion … $3 trillion? Done and done.

Heck, Apple (AAPL) just hit $3.5 trillion earlier this week!

Today, six companies have market caps in the trillions.

And it seems that those six companies are only valued that high because they have momentum.

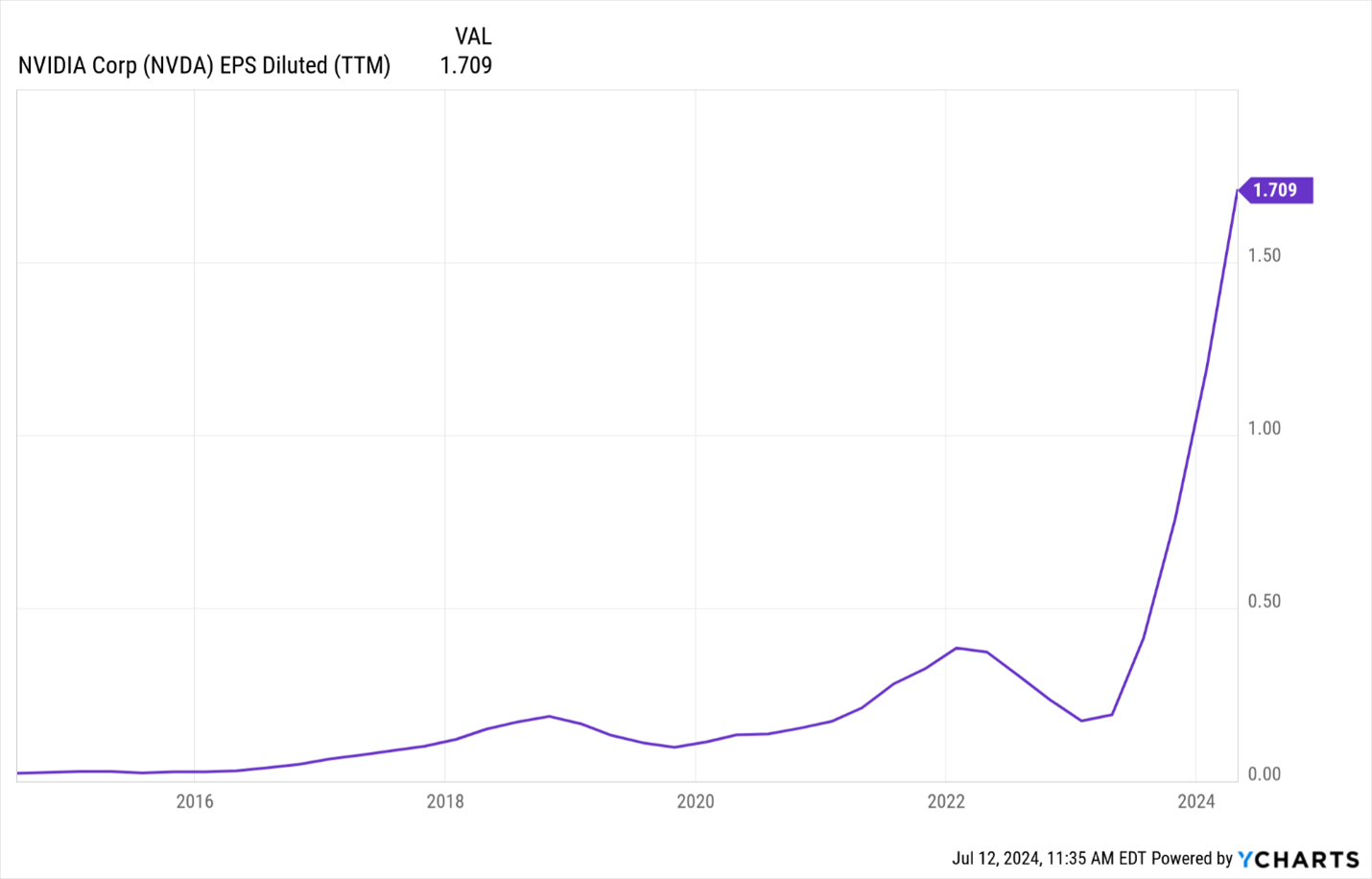

They are growing … and fast. No one will deny that. Nvidia (NVDA) is the prime example.

In the past three quarters, earnings per share jumped 1,274%, 769% and 629%, respectively.

Nvidia’s EPS over past 10 years.

Click here to see full-sized image.

That’s certainly a valid reason for someone to buy.

But ask an old-school value investor what they think of NVDA, and you’ll get one response: Its price-to-earnings ratio is 76!

Over the past 15 years, the average S&P 500 stock had a P/E of 19.4.

What are people thinking?

Does no one ever study Benjamin Graham anymore?

Well, maybe they don’t teach that as steadfastly as they used to. But you can see the argument on the other side.

Value investors love to quote their prophecies leading up to the Dot-Com Bust. That was the last time we saw the largest companies in the world valued at these levels.

BUT, momentum, tech, AI, growth, speculative or whatever you want to call mainstream investors now — will tell you that dot-com stocks weren’t profitable.

The ones that found profits and growth in the internet boom are today’s S&P 500 leaders.

They’re right, too ...

Apple and Microsoft (MSFT) are the largest. They raked in $381.6 billion and $236.6 billion, respectively, in net profits over the past 12 months.

But every great market rally needs corrections. This one is no different.

Though, who’s to say when? Could Thursday’s reversal of fortune from Big Tech to small-cap value stocks be the catalyst?

Time will tell.

One thing is clear ...

Tomorrow’s market leaders are starting to emerge. And Ben Graham would be disappointed if everyone remained too focused on techs to give small-cap value a second look.

Your editors certainly have opinions about all this. Here’s what they had to say this week …

Don’t Get Stiffed by Your Insurer

Your Director of Research & Ratings Gavin Magor recently discovered something chilling that’s affecting people across the country — insurance companies aren’t paying nearly half of their customers’ claims. Fortunately, he also has the solution to protect yourself.

AI Startup Leads to New Way to Trade

What can’t AI do? That’s a question your startup guru Chris Graebe has been asking. He dives into how one AI-driven startup wants to change the way we trade. Dr. Martin Weiss is already doing that with his own AI trading system. Learn more here.

A Robotic Hellscape Is Heading to the Taiwan Strait

There’s a new arms race sweeping defense departments across the globe. And the target for these new armaments is the Taiwan Strait. Megatrends analyst Sean Brodrick has the scoop.

I’ve Seen This Before … Here’s What to Do

Nilus Mattive helps me answer my question: What’s with these stock valuations? And he shares his own story of being at the center of the last time we saw all this play out.

How to Profit from Silicon Valley’s ‘Ice’

Your Tech & Biotech Investing Strategist Michael A. Robinson uncovers the next leap forward for semi chips. And it comes with plenty of “bling.”

That’s all for this week. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily

Tidak ada komentar:

Posting Komentar