How Bullish Are Companies on AI Now? |

Money & Markets Daily,

Artificial intelligence (AI) is everywhere.

For example, I have an Amazon Echo in my office and another two at home. I can ask Alexa — Amazon’s voice assistant — for the latest weather, stock news and sports scores.

More importantly, at least to my wife, is that she can video call me from one of our devices at home and talk to me on the Echo in the office.

I shouldn’t forget Siri on my iPhone, iPad and laptop, which can perform all the functions Alexa can. I can ask Siri to make a call, schedule an appointment and pull up the latest on any stocks I’m tracking.

In short, I am surrounded by AI. And you probably are too…

That’s not surprising, considering that AI has been on everyone's minds since ChatGPT was released to the general public almost two years ago.

Stocks directly related to AI have also seen dramatic rises since late 2022:

Here are the gains of six of the seven “Magnificent 7” stocks — all with ties back to AI — since that day:

- Nvidia Corp. (NVDA) — +520%

- Meta Platforms (META) — +292%.

- Amazon.com Inc. (AMZN) — +88%.

- Alphabet Inc. (GOOGL) — +68%.

- Microsoft Corp. (MSFT) — +65%.

- Apple Inc. (AAPL) — +47%.

While these stocks have been selling off at a decent clip in recent days, all six have crushed the broader S&P 500 Index, which is up 34% over the same time.

AI is now one of the hottest investment trends of our lifetime. Businesses are sinking billions of dollars to implement AI and machine learning into standard practices.

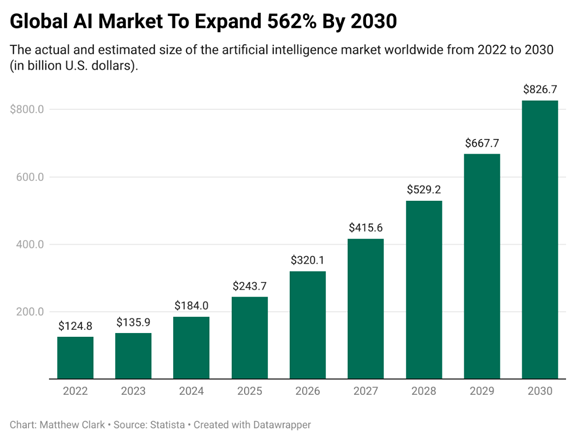

By 2030, some estimates expect the global AI market will be worth more than $826 billion — a 526% increase from actual spending in 2022.

And while we've already seen a massive influx of money into the AI mega trend, the latest data tells us this trend is really starting to build up steam.

| From our partners at Paradigm Press. We’re counting down to a huge paradigm shift in the market.

TODAY, an announcement from the U.S. government will kick off a second, epic new wave of the bull market.

And send a new generation of tiny “SUPERSTOCKS” to the front of the line.

The last time this happened, we saw these stocks rise 1,000% … 2,000% … and even 5,000%.

But this is the biggest setup in 50 years.

I can’t explain everything here. Go here to get the full details now. |

AI Spending on the Rise

The Tech Demand Indicator (TDI) measures the intent of businesses to spend money on technology.

Think of it as manufacturing’s Purchase Manager’s Index, only dedicated to the technology sector.

The most recent reading of the indicator was 51.6, which suggests spending in the technology sector among businesses will continue to grow — despite the reading being slightly less in the second quarter of 2024 compared to the first.

To put things in perspective, this index read 46.4 just after ChatGPT was released to the general public, and it’s been on the rise ever since. Any reading above 50 indicates more bullish spending tendencies.

While this is good news for the broader tech industry, diving deeper into the data shows exactly where businesses plan to spend their money.

In the fourth quarter of 2023, cloud infrastructure, services, and information security were the technology sectors with the highest spending sentiment.

This means that businesses were more inclined to build out their cloud infrastructure while also shoring up their technology security measures.

However, in the second quarter of this year, spending sentiment on AI technology (i.e., AI chatbots, language models and facial recognition) pulled even with cloud and security, manufacturing and software/IT services sectors driving that demand.

Sentiment for AI technology spending went from 60.3 to 61.2, while cloud infrastructure dipped from 62.7 to 61.3, and information security fell from 67.3 to 62.8.

Even CEO’s Are Talking About It

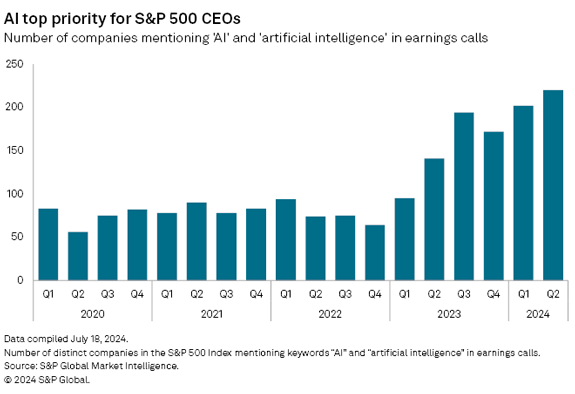

For further evidence that businesses are looking for ways to invest in various AI technologies, we can look at something you might not expect… earnings.

More specifically, quarterly earnings calls management conducts with analysts.

The number of S&P 500 companies mentioning AI in their earnings calls reached a record in the second quarter of this year:

More than one-third of S&P 500 companies mentioned AI in their earnings calls in the most recent quarter.

This speaks to the importance AI has in the broader business community. More and more companies are highlighting AI than ever before.

What this all means: Investing in AI stocks has carried much of this bull market since late 2022.

The bigger question is whether this is a fad or whether the AI mega trend has legs.

Judging by the fact that businesses remain bullish on technology spending despite uncertainty in the U.S. economic environment, it looks like more money will pile into technology in the near future.

Company sentiment toward spending on AI tech continues to grow while other, more popular segments, like cloud infrastructure and information security, have declined.

This AI trend isn’t over by a long shot … in fact, companies are talking about it more and looking for the best (and most profitable) ways to implement it into their day-to-day operations.

That's a great sign for AI-related stocks ahead.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar