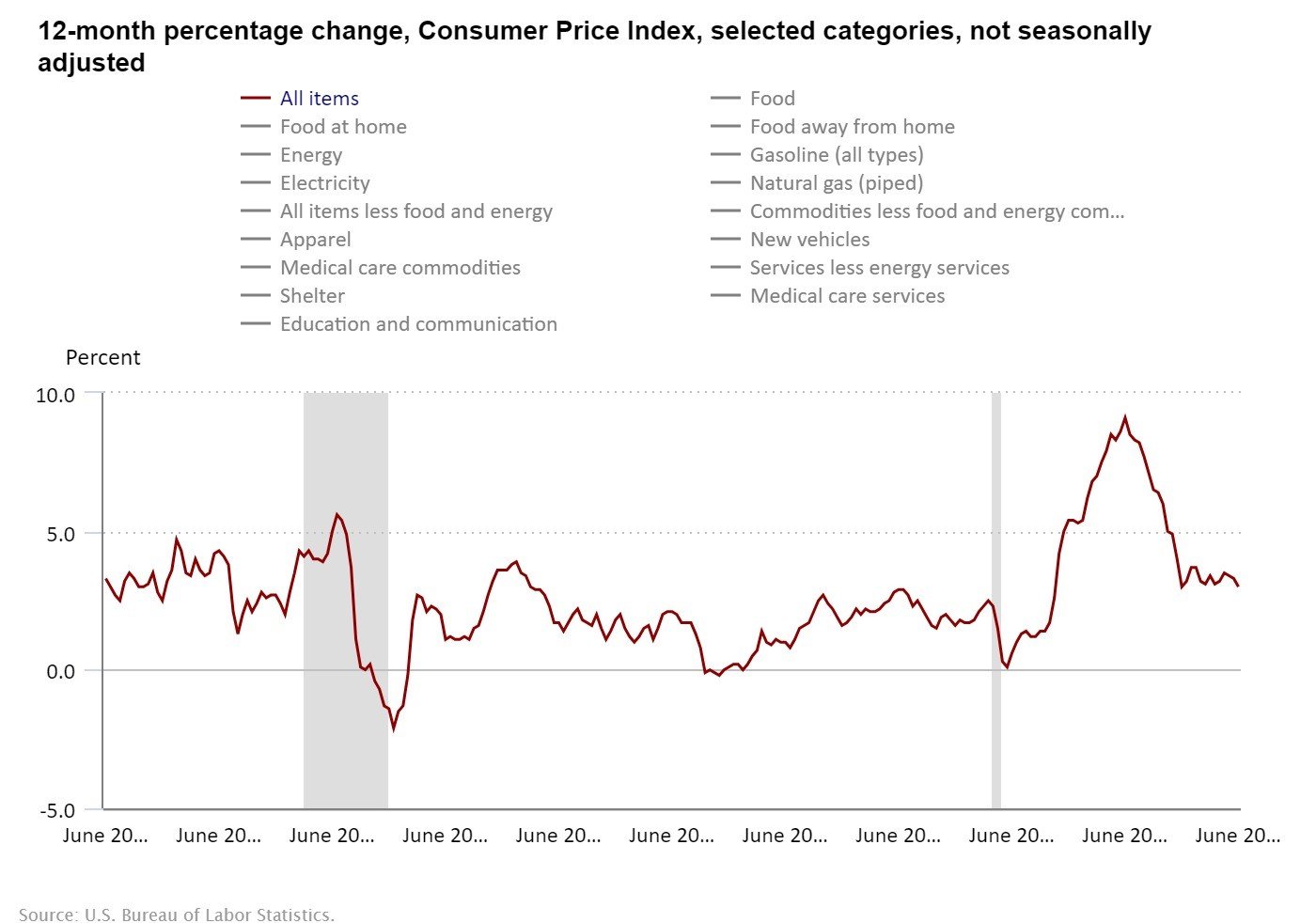

The Latest Inflation Reports Are In… Here’s What You Need to Know Dear Reader, Federal Reserve Chairman Jerome Powell has been in the news a lot lately. Last Tuesday, Powell attended a conference panel with other central bankers in Portugal. During the panel, he said he was pleased with how inflation had resumed a downtrend following the rebound at the start of the year. But also, in his best “Fedspeak,” Powell noted that it was too soon to comment on whether the Fed might be able to lower interest rates by the end of the summer. He proceeded to say, “We’ve made a lot of progress” and added that after severe labor shortages two years ago that sent wages up sharply, the labor market has “seen a pretty substantial move toward a better balance.” Then this week, Powell testified in front of Congress for two-straight days this week as part of his semiannual Monetary Policy report to discuss the current state of the U.S. economy. During his testimony, he said he was encouraged by evidence of cooler inflation and that more “good data” would help get the Fed to where it wants to be. Specifically, he said that “the most recent monthly [inflation] readings have shown modest further progress” after some hotter readings in the first quarter, “and more good data would strengthen our confidence that inflation is moving sustainably toward 2%.” Interestingly, Powell said “the most recent labor market data do send a pretty clear signal that labor market conditions have cooled considerably compared to where they were two years ago,” and then added that “this is no longer an overheated economy.” In addition, he cited that the “labor market conditions have cooled while remaining strong. Reflecting these developments, the risks to achieving our employment and inflation goals are coming into better balance.” Powell’s dovish comments were a welcome relief on Wall Street, sending the broader market higher on Wednesday. Following this week’s Consumer Price Index (CPI) and Producer Price Index (PPI) readings, the Fed should feel much more confident about the inflationary environment. So, in today’s Market 360, let’s review the details of the reports and what the latest readings could mean for key interest rate cuts. Then I will share the best way to “turbo boost” your portfolio in the current market environment – regardless of when the Fed implements its first rate cut. Breaking Down the Inflation Reports Consumer Price Index Both CPI and core CPI, which excludes food and energy, were substantially lower than economists’ expectations. The Labor Department reported on Thursday that CPI declined 0.1% in June and rose 3% in the past 12 months. That’s also better than the unchanged rate in May. Economists had forecast a 0.1% rise and a 3.1% year-over-year increase. As you can see in the chart below, this marked the first monthly decline for the CPI since May 2020.

Core CPI, which excludes food and energy, rose 0.1% in June and was up 3.3% over the last year. Expectations were calling for a 0.2% monthly rise and 3.4% yearly increase. (The core rate was actually 0.065%, so it was almost unchanged.) Digging a little deeper into the numbers, energy prices were up 2% in June, largely due to a 3.8% decline in gas prices. Food prices were up 0.2%. However, the big news was Owners’ Equivalent Rent (OER), or shelter costs, which was only up 0.2% – the smallest monthly increase since 2021. Not only that, but it was the last index to crack in the CPI. OER has been a sticky point for consumer inflation, but it’s clear now that real estate costs and rental costs are beginning to moderate. So, we’re finally getting some downward pressure on the CPI. Simply put, this was a stunning CPI report. Producer Price Index In comparison, this morning’s Producer Price Index (PPI) report was a bit of a disappointment. PPI rose 0.2% in June and is up 2.6% in the past 12 months. Economists were expecting a 0.1% increase in June. Core PPI, which excludes food, energy and trade margins, was unchanged in June. This was due to wholesale food prices declining 0.3%. Wholesale energy prices also decreased 2.6%. The culprit behind the June PPI increase was service costs, which soared 1.9%. In addition to the trade service surge, overall wholesale service costs rose 0.6% in June. Now, in May, they were only up 0.1%, and they have been pretty tame in recent months. So, unfortunately, that’s what hurt the PPI. The silver lining is that wholesale goods prices declined 0.2%. In May, they fell 1.4% and they’ve been falling most months due to the strong U.S. dollar. This causes anything we import to get cheaper, especially commodities. The bottom line: The headline numbers were bad, but the details were good. Does This Mean Rate Cuts Are Coming? Following the CPI report on Thursday, the 10-year Treasury yield dipped under 4.2% and the two-year Treasury yield rate fell to about 4.5%. And despite today’s weak PPI report, Treasury bond yields hung around 4.2%, which is very positive. The stock market also rallied strongly. The fact is, as market rates come down, it puts pressure on the Fed to cut rates. The federal funds rate currently stands at 5.25%-5.50%, well above both the two-year and 10-year Treasury yields. The reality is Fed rates cannot be above market rates for too long. So, the current market rates will lead the Fed lower, and they will have to cut key rates sooner rather than later. Now, if I was running the Federal Reserve, I'd cut rates on July 31st, but they're pretty stubborn at the Fed and move slower than a sloth. So, I expect a very dovish Federal Open Market Committee (FOMC) statement at the July meeting and then for the Fed to implement its first rate cut on September 18. Building a Portfolio Set to Prosper Year-Round The Fed cuts are essentially the turbo boost that Wall Street has been waiting for. Unfortunately, investors will likely have to wait two more months for the Fed to cut rates. However, that doesn’t mean we can’t turbo boost our portfolios now. The second-quarter earnings season is officially upon us, and strong earnings results should dropkick and drive stocks higher. We’ll talk more about the second-quarter earnings season in tomorrow’s Market 360, but let me say now that this earnings season should be great. FactSet currently projects the S&P 500 will achieve earnings growth of 9.3% in the second quarter. Now, the second quarter will represent the last quarter of easier year-over-year comparisons – but that won’t stop earnings growth from continuing to accelerate in the second half of the year. So, now is the time to fill your portfolio with fundamentally superior stocks. Now, if you’re not sure where to find them, then you’ll want to check out my Growth Investor Buy Lists. Currently, my Growth Investor stocks are characterized by 120.4% average forecasted earnings growth. Not to mention that for the first half of the year, my High-Growth Investments Buy List was up 23% which outpaced both the S&P 500 and Dow which posted 14.5% and 18% gains, respectively. Given this, I am confident that they will post wave-after-wave of positive earnings results, which, in turn, should propel them higher. Click here to learn more about Growth Investor and how to become a member today. (Already a Growth Investor subscriber? Click here to log in to the members-only website now.) Sincerely, |

Tidak ada komentar:

Posting Komentar