April 2, 2024

These Narratives Don't Need Altcoin Season to Soar

Dear Subscriber,

|

| By Bruce Ng |

It’s tough to remember that sometimes, volatility is the name of the game in crypto.

Bitcoin (BTC, “A”) has dipped once again below $70,000. At the time of writing, it’s sitting just under $66,000.

But I’ll let you in on a secret: I believe this is a short-lived correction.

Just look at its historical pattern. In previous cycles, when BTC was flirting with a previous all-time high — as it is now — there was strong resistance and lots of volatility.

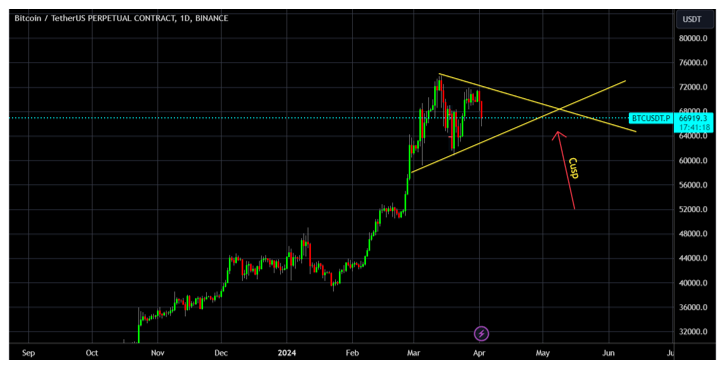

Typically, the price action when BTC tries to bust previous all-time high goes through the following dance:

- The first breakthrough to a new all-time high occurs with strength. In this latest cycle, we saw this when BTC cut through $69,000 like a knife through butter to hit $74,000.

- BTC then trades around ATH in a volatile way. This is what we’ve been seeing for the past few weeks. Since the ATH break, BTC has been trading in a volatile range between $61,000 and $74,000.

- The volatility narrows. The trading range gets narrower until the two lines in the chart meet to form cusp. That’s the point of transition, so to speak.

Figure 1: BTC/USDT price action at ATH.

Click here to see full-sized image.

- BTC then explodes upward violently. In Dec 2020, BTC shot from $20,000 to around $40,000 in just about one month.

That’s why I believe that this current volatility is just the middle of this dance. And the next step — an upward explosion in trading price — should be next.

How high can it go when that happens?

No one can say for sure. But there is evidence to suggest there could be enough momentum for Bitcoin to break $100,000 in the coming months.

That evidence includes …

- Post-halving momentum. The halving is estimated to occur around April 20, which is really soon. Post-halving, BTC usually rallies in an explosive way.

- The spot BTC ETF inflows continue to be strong and net positive.

- The first Ethereum (ETH, “B+”) ETF approval deadline is in May. As we saw from the BTC ETFs, hype around whether or not an approval is coming can drum up additional interest.

- Interest rate cuts are looming in H2 2024.

All in all, BTC, looks very bullish here … no matter what the short-term volatility may present.

But I’ve been saying quite a bit that Bitcoin is not going to be the biggest winner this cycle. That opportunity will be found mixed in the smaller crypto projects.

Which brings me to …

How Altcoins Will Weather This Volatility

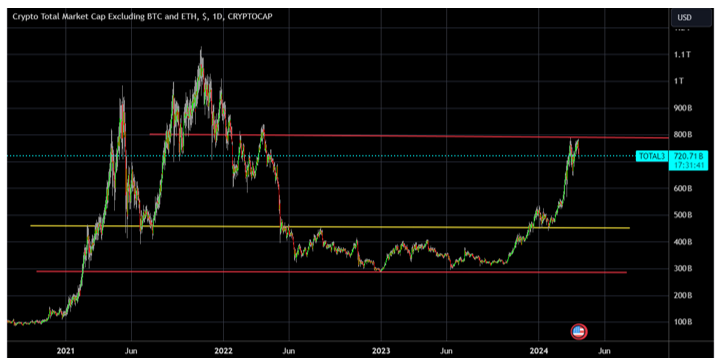

To gauge altcoin strength, we need to look at TOTAL3 — that’s the crypto market’s total market cap minus market leaders Bitcoin and Ethereum.

Figure 2: TOTAL3 in USD.

Click here to see full-sized image.

As you can see, TOTAL3 has been very strong in recent months. It rallied with strength from the yellow line near $500 billion to previous all-time high resistance marked by the red line near $800 billion earlier this year.

But Bitcoin’s recent correction has pulled enough altcoins down with it, causing TOTAL3 to dip … but only slightly. It’s still very near that overhead resistance.

If the broad altcoin market can hold out — and recent strength shows that is likely — then it won’t take much for TOTAL3 to be able to break $800 billion and then some.

Once that happens, I believe we’ll be able to ring in this bull market’s altcoin season in full force.

But here’s the cool part: You don’t have to wait for the start of altcoin season to get in on the wild gains that can be found in crypto.

That’s because …

Narratives Do Not Require Altcoin Season to Soar

Many different crypto experts will say that we have been in an altcoin season since October 2023. But that’s just when some altcoins gained strength and momentum after the bear market.

But my definition of an altcoin season is that all sectors pump at the same time. And that hasn’t happened yet.

So, what gives?

Well, while we do need altcoin season to see the broad market take off, individual sectors may not need altcoin season to give them an additional boost if they have compelling and enticing narratives.

Remember, narratives are the real force behind understanding how liquidity rotates through the crypto market.

That’s why I’m adamant that altcoin season is still ahead … along with the altcoin’s parabolic rally.

But as I said, that doesn’t mean you have to wait for the true altcoin season to benefit. In fact, I’d say waiting is an amateur’s moves. After all, by the time altcoin season gets rung in, retail mania will be at a peak and you’ll likely miss out on the best entry prices.

Prices that promising projects are currently trading at.

And the best place to look for those projects is in the sectors that have been outperforming without altcoin season. So far, this includes …

- Popular Layer-1 Blockchains

That’s why I’ve written so much about memecoins lately. It is undoubtedly one of the leading narratives this cycle and I believe it will continue to perform well throughout this bull market.

Memecoin investing and trading can be incredibly volatile, however. So before you jump in with both feet, I suggest you read up on how to minimize risk exposure with memecoins first.

But there’s another sector I haven’t listed above with a huge upcoming catalyst that will explode soon.

And there’s already one opportunity in this sector that’s caught my eye. It’s a smaller project, what my colleague Juan Villaverde and I have been calling “new crypto wonders.”

These “crypto wonders” feature heavily in our “backdoor” buying strategy that helps us maximize potential returns to turn 2x, 9x and 10x crypto opportunities into 20x, 344x and even 816x winners.

Juan actually sat down with Weiss Ratings founder Dr. Martin Weiss to break down exactly how this strategy works earlier today.

I urge you to watch that briefing now so you know how to get in on the best altcoin opportunities well before altcoin season sends them to the moon.

Best,

Dr. Bruce Ng

Tidak ada komentar:

Posting Komentar