AI-Powered Espionage? 1 Company Makes It Possible |

Money & Markets Daily,

Hackers have stolen an incredible amount of personal information over the years.

According to Wired, hackers associated with China have the personnel records of about 21 million civilian employees of the U.S. government.

This includes forms called SF-86s, which are used for security clearances. Details about drug and alcohol use — or even financial problems — are included on the form.

That data breach occurred in 2015. Since then, Chinese hackers have obtained health insurance information for nearly 80 million people from the health care company Anthem and Equifax credit reports of 147 million people. Marriott’s records have also been hacked.

But why am I bringing this up now?

Imagine you could obtain government records showing who worked in sensitive positions…

Assuming all the hacked information is in one place, you could look up their credit records to see if they are facing financial strains. Maybe they sought treatment for addiction. Or, for some reason, they check into a local hotel for one-day stays a few times a month.

This information could help identify potential espionage agents. An offer of assistance as someone struggles could be leveraged into blackmail later on.

The point is … stolen personal data could lead to a national security nightmare.

This isn’t a spy novel. It’s the situation that exists today. And it’s giving us a timely investment opportunity…

| One secretive company’s new technology is poised to disrupt the AI market – a market that is projected to grow from roughly $500 billion to $200 trillion.

That’s a surge of 39,900% over the next six years.

Today, you can invest in this one-of-a-kind company for just $25 a share.

Click here for all the details. |

Powerful Partner of Modern Espionage

Nearly 10 years ago, when the personnel files were stolen, using records like this didn’t seem possible. I remember a conversation with an intelligence officer at the time who said it would take tens of millions of hours to make sense of the millions (or even billions) of lines of code and data.

Today, it would take less than a week. Some programmers can just format the data and feed it into an artificial intelligence (AI) algorithm.

Within days, Chinese intelligence could have a list of people with top-secret security clearances who like to drink, run up large credit card bills, or might be guilty of infidelity.

Of course, it’s not just China that has access to detailed and voluminous data. U.S. agencies have likely hacked foreign countries for similar information.

We even have a company in the U.S. with the ability to develop AI programs to use that data.

It could glean patterns from the more subtle information available to intelligence agencies — such as studying traffic patterns at foreign government offices or spotting fuel convoys on their way to missile launch sites.

This company has been awarded billions of dollars in government contracts. We know it’s working with the Department of Defense on at least 685 different AI-related projects. Secret budgets probably contain additional contracts and projects.

With a weapons-grade advantage in terms of AI, it’s likely to take over the AI Revolution before most investors even realize it.

One of tech’s leading visionaries is even calling it “The Next Google.”

That's why my colleague Adam O’Dell is urging his readers to invest in this business before May 5.

You can find all the details right here.

Until next time,

Michael Carr

Editor, Money & Markets Daily

Are You Paying Wall Street 5.8X Too Much?

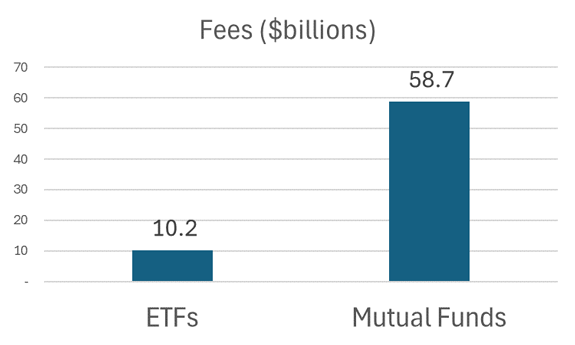

Investors have choices. To invest in broad stock market averages, they can buy low-cost exchange-traded funds (ETFs) … or they can buy more expensive mutual funds.

The right choice might seem obvious — buy an ETF with an average expense ratio of 0.15% — instead of a mutual fund, which charges an average fee of 0.42%.

Surprisingly, equity investors hold $14 trillion in mutual funds and just $7 trillion in ETFs. This means they pay fund managers $58.7 billion annually to manage mutual funds and just $10.2 billion to hold ETFs.

The difference means investors are giving billions of dollars to Wall Street that they might not need to. If you're holding a mutual fund, ask yourself why, and consider changing now.

— Mike Carr, Chief Market Technician, Money & Markets

(Click here to view larger image.)

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar