February 1, 2024

Here's the Winner of Intel's Bad Day

Dear Subscriber,

|

| By Jon Markman |

Last week, investors got a glimpse of the future … and the past of the semiconductor industry. A big opportunity is shaping up.

Shares of Intel (INTC) crashed 11% on Friday after executives at the legacy chip company said sales growth and profits would be challenging in the near term as the firm pivots toward a new business.

Intel shares have been under pressure after more than a decade of failed projects. The Santa Clara, California-based company lost the race to Qualcomm (QCOM) in the 2010s to dominate mobile computing chips.

In the years that followed, Intel has consistently ceded market share in personal computers to Advanced Micro Devices (AMD), the only company that currently licenses its x86 chip architecture.

Apple (AAPL) abandoned Intel x86 processors in 2023, when the iPhone maker fully transitioned its Mac computer lineup to processors designed in-house.

Hyperscale data centers customers — Amazon.com (AMZN), Alphabet (GOOGL), Microsoft (MSFT), Meta Platforms ( META) and others — have begun to develop bespoke processors that do not use x86.

The common denominator in all these shifts is Arm Holdings (ARM), a British designer of ultra-low power chip architectures. The threat Arm poses to Intel’s x86 chip dominance is existential.

Pat Gelsinger, chief executive officer of Intel, is extremely aware of that threat.

He was hired in 2021 to return Intel to its former glory. One of his first overt moves was to strengthen ties to Arm Holdings. Unlike many chip companies, Arm does not make processors. Instead, the company licenses its tech and receives a royalty for every chip produced.

This is integral to Gelsinger’s larger business strategy. He plans to leverage Intel’s considerable chip manufacturing scale to make processors designed by other companies, including competitors like AMD and possibly Apple.

Most chip companies today have no fabrication facilities of their own. Rather, they design processors in-house, then send an encrypted digital file to a foundry for manufacturing. The reason for this convoluted “fabless” process is because it is extremely capital-intensive to do everything in-house.

Cutting-edge foundries cost tens of billions to construct, and getting regulatory approval isn’t easy. Foundries consume a lot of resources such as fresh water and energy.

However, political fear about the concentration of foundries in Asia is leading to a wave of new investment in Japan, Europe, the Middle East and the United States. It’s a worry Intel executives are happy to exploit.

Gelsinger told Time Magazine in 2022 that Intel plans to spend $100 billion to build a total of eight new foundries globally. Much of that cost will be subsidized by taxpayers.

The CHIPS and Science Act, passed in 2022 in the United States, allocated $52 billion in incentives for the semiconductor industry. And Intel will receive nearly $11 billion in subsidies from the German government for a new fab complex in that country. The final details of a similar $25 billion investment in Israel have not been disclosed.

Taiwan Semiconductor Manufacturing (TSM) is the largest pure-play foundry in the world. TSM produces 60% of the world’s contract-made semiconductors … and 90% of the most advanced chips, according to a 2023 report from the Economist.

Scale and reputation are vital.

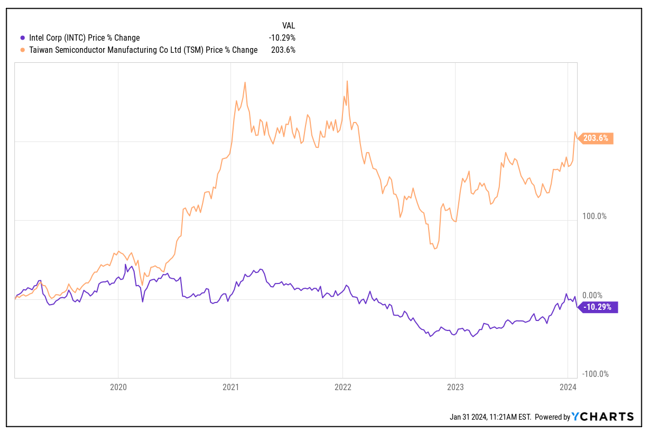

INTC vs. TSM 5-year performance chart.

Click here to see full-sized image.

TSM is the partner of choice for Apple, Qualcomm, Nvidia (NVDA), Broadcom (AVGO) and AMD because it can deliver a lot of processors on time and at the cutting edge of innovation.

The reality of semiconductor manufacturing is that smaller and faster is much better than larger and slower. Billions of transistors are crammed onto the tiniest of silicon wafers.

TSM developed the first 7 nanometer manufacturing process in 2016, ahead of Samsung and Intel, establishing a clear lead in high-end manufacturing. Since that time, TSM has moved to 3nm.

Intel can’t win over foundry clients because the company can’t make the most advanced chips with its current hardware. When questioned Friday about orders, Gensinger offered only a vague prepared comment that he had a line of sight on potential orders.

Earlier in the week, C. C. Wei, chief executive at TSM, raised guidance for the coming year on the back of robust orders from customers seeking the most advanced chips.

So, if semi foundries is where you want to put your money, the choice is clear. TSM offers a brighter future than Intel.

All the best,

Jon D. Markman

P.S. This fab versus fabless issue is only ramping up with the enormous demand for chips because of AI. In fact, it is a major part of a $200 trillion AI breakthrough we just discovered. We’ll be hosting a special presentation about this on Tuesday, Feb. 6, at 2 p.m. Click here to make sure you’re on the list.

Tidak ada komentar:

Posting Komentar