The fundamentals suggest that stocks will keep going up, up, up͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

| |  | | February 29, 2024 |  | Luke Lango

Editor, Hypergrowth Investing | |

Despite investors’ lingering uncertainty, it’s clear to us that the stock market wants to rise. And today’s inflation report gave the market the exact excuse it needed to keep the party alive.

Now, there are a lot of reasons investors may doubt this rally. Inflation is still above 2%. The Federal Reserve isn’t yet cutting rates. The economy could still fall into a recession. National debt is out of control. Geopolitical risks are rising.

But guess what? Stocks are still going up.

And we think that now is a perfect time to get in on the action. | | | | SPONSORED  On April 22, 2024, a rare event will trigger one of the greatest money-making opportunities in our lifetimes. According to Luke Lango, there’s over $100 trillion of profits on the line. Find Out How to Position Yourself for 1,000% Gains | | | Why Inflation Has Us Bullish At the end of the day, stocks are rising because inflation is falling toward 2%. The Fed will cut rates this year. It’s likely that the economy isn’t going to fall into a recession. Government spending has slowed, and we believe geopolitical risks are pretty well-contained.

In other words, the things investors have been fearing are actually things to be hopeful about – because most are turning a corner for the better.

That’s why stocks just keep on pushing higher.

Case in point: Today’s inflation report.

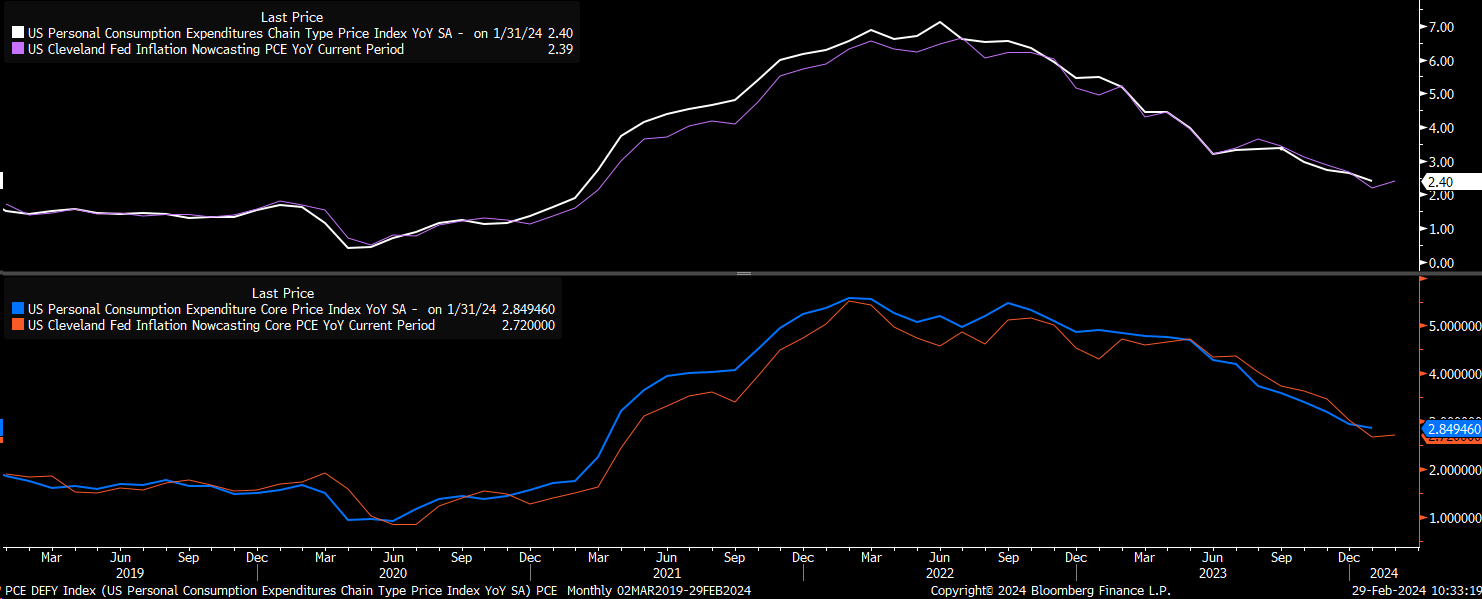

January’s Personal Consumption Expenditures (PCE) data was released this morning. And it showed that inflation in January rose just 2.4% year-over-year.

While that’s not 2%, it is nearly there. And we’re confident that it’s certainly “good enough.”

Just consider; in the summer of 2022, inflation was above 7%. It’s fallen immensely since then.

Furthermore, throughout the 2010s, inflation bounced between 1.5% and 2.5%. That means we’re now back to “normal” inflation levels.

| | | | SPONSORED  For the past decade, TradeSmith has spent $18 million and 50,000+ man-hours working on a secret A.I. project that could revolutionize the way you invest in the stock market.

On Wednesday, we showed a select group how it works. You weren’t there, but if you want to see how this A.I. system can be used to create backtested returns of 900% or more, the replay is available for a limited time. Watch It Here | | | The Final Word With inflation falling and back to “normal” levels, those risks have been mitigated. The inflation problem has been solved.

That means that the Fed can cut rates. And indeed, the central bank has already explicitly stated that it intends to cut rates once it’s confident inflation is heading back to 2% (which it is).

With the Fed on track to cut rates, the economy should avoid a recession. And as financing costs for cars, homes, and other big-ticket items decline, the economy may even strengthen this year.

In other words, the fundamentals suggest that stocks will keep going up, up, up.

This isn’t time to doubt this stock market rally. It’s time to join it.

But you’re probably thinking, what stocks should I be buying right now to maximize my returns in this powerful market rally?

We’ve got you covered.

Find out some of our favorite stocks to buy right now. Uncover Some Potential Winners |  | | Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. | | | | |

Tidak ada komentar:

Posting Komentar