January 31, 2024

Bet On Crypto's Multilayered Blockchain Approach

Dear Subscriber,

|

| By Beth Canova |

My colleague Dr. Bruce mentioned the Layer-1 narrative in his Weiss Crypto Daily yesterday. And for good reason.

Layer-1 blockchains are shaping up to be key players in the upcoming bull market.

As a reminder, a Layer-1 blockchain is a distributed ledger that verifies, records and executes transactions.

But from the earliest days, developers had to balance three contradictory goals that fought each other like the hand game “rock, paper, scissors.”

They needed decentralization to make sure the blockchain was not controlled by any one person, institution or group.

But they also needed security to protect against hacks by the masses.

They needed scalability to grow. But this could not be easily achieved without proper management and some central control.

Indeed, to achieve any two of these benefits requires effectively sacrificing the third.

It’s often like the proverbial sign in the mom-and-pop grocery store: “Good, fast and cheap. Pick two.”

Bitcoin (BTC, “A-”) and Ethereum (ETH, “B+”) put security and decentralization first, and both paid the price. Bitcoin can only process about seven transactions per second (tps). Ethereum, despite numerous upgrades, can only reach a still lethargic 15 tps or so.

By contrast, credit card giant Visa’s (V) network can do 45,000 tps.

That shows how far crypto technology still has to go before it can compete with the big boys.

So, what are crypto developers to do?

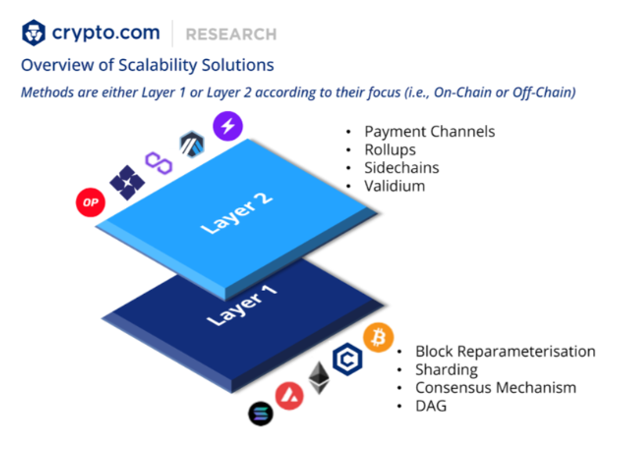

One solution to this has been the advent of Layer-2 solutions — sidechains that roll up transactions into bundles and settle them in batches on the base layer at set intervals.

Source: crypto.com.

Click here to see full-sized image.

This allows Layer-2 solutions to be a lot faster with lower fees than base chains can manage.

And indeed, Layer-2 solutions are incredibly popular in the current climate. It was a leading narrative of the last bull market, and the sector weathered the bear market well.

Analysts and investors still stand by Layer-2’s ability to offer notable investment opportunities.

Trouble is, with transactions moved off-chain, these Layer-2s are exposed to additional security risks.

That’s why we’re seeing a resurgence in Layer-1 popularity. Because both have the ability to succeed in this market.

Even better, there will likely be multiple winners from both narratives.

Just look at the two leading Layer-1 smart-contract blockchains at the moment: Ethereum and Solana (SOL, “B”).

If you think Solana is going to replace Ethereum, think again. We’ve already had hype around “Ethereum killers” fade away several bull markets ago.

Instead, you should think about these leading Layer-1 blockchains like the giants of the smart phone industry.

Solana is like Apple.

Its methodology mirrors Apple's approach by integrating hardware with software to achieve excellence. This emphasis on precision — exquisitely fine-tuning the hardware to enhance software performance — leads to efficient, high-quality output.

Solana also demands technical sophistication to ensure alignment with the company's vision of a high-performing exclusive network. But this means running a validator node on the network, which requires significant technical expertise.

On the other hand, Ethereum's strategy resonates more with Android's ethos. It favors a universally accessible, software-centric approach.

Spearheaded by cofounder Vitalik Buterin, Ethereum envisions a platform where anyone, anywhere, can participate as a validator with nothing more than a smartphone.

This inclusivity parallels Android's flexibility. In both cases, the software is designed to operate across a wide range of hardware, prioritizing accessibility and widespread adoption.

Just as the smart phone market can support both Apple and Android because of their differences, the crypto market is likely to recognize value in diverse approaches.

Ethereum’s and Solana’s contrasting strategies underline this diversity. And each is carving out a unique niche in the blockchain ecosystem.

Our team’s experience trading on Solana has been insightful. Transactions are incredibly fast — 400 milliseconds fast!

But it’s far from clear that the single blockchain approach won’t eventually become a bottleneck.

It’s hard to remember now, but Ethereum once boasted fast and cheap transactions, too. As popularity surged, however, transaction times lengthened, and costs soared.

So much so that, in the last bull market, Juan Villaverde had to pay as much as $500 for a single Ethereum transaction during a period of peak trading volume.

This is a critical point: A single-layer solution, no matter how efficient initially, can still become a victim of its own success. As more users flock to a network, it will struggle to maintain performance levels, leading to slower and more expensive transactions.

To sustain fast growth without negative impact on performance, Solana someday might need to consider a multilayered approach similar to Ethereum’s.

This doesn't just maintain the network's efficiency — it actually enhances it.

That’s because each Layer-2 solution operates independently. It removes bottlenecks and is practically infinitely scalable as you can stack Layer-2s as needed.

Indeed, my trading experience with Ethereum's Layer-2 solutions has been nothing short of impressive.

As the industry evolves, it's becoming clear that a multilayered approach might be the key to managing the ever-growing demands on blockchain networks.

For investors, this is amazing news. It means the potential for more success through several blockchains.

So, when setting up your portfolio for the next big bull market rally, don’t limit yourself to only following one narrative. Or only picking one crypto to play that sector.

If a diverse, multilayered approach is key to crypto’s success, then it just might have a place in your portfolio strategy, as well.

Best,

Beth Canova

Tidak ada komentar:

Posting Komentar