It Sounds Crazy, but Federal Legalization Is ComingDear Outsider, When President Biden took office in January 2021, he made a lot of big promises. One of those promises, which can still be found on his campaign website, was to decriminalize cannabis use at the federal level:

He also said he wanted to reschedule the plant and expunge sentences for those convicted of federal possession of marijuana. And for the most part, he's made headway on those promises, something cannabis advocates have cheered. Last October, Biden announced a sweeping pardon for those with possession charges.

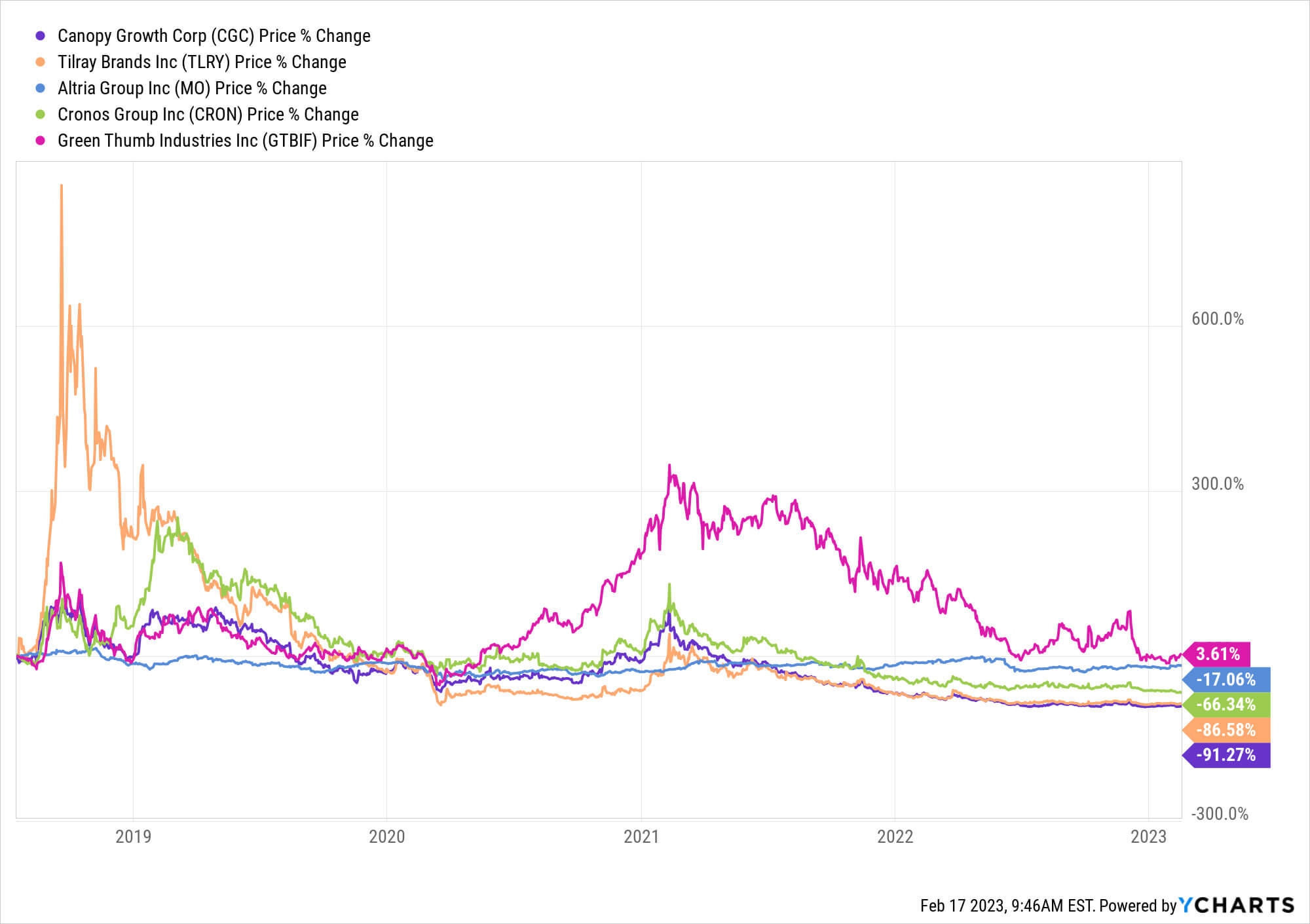

But investors in marijuana stocks haven't been so lucky. Last year, some of the biggest names in the industry were hit hard after post-pandemic sales slumped. At one point last year, Canopy Growth Corp. (NASDAQ: CGC) was down 65% year to date, Aurora Cannabis (NASDAQ: ACB) was down 35%, Tilray (NASDAQ: TLRY) was down 15%, and Cronos Group (NASDAQ: CRON) was down 45%. The AdvisorShares Pure U.S. Cannabis ETF (NYSEARCA: MSOS) — a marijuana ETF that tracks the industry — was down 52% at the start of 2023. With the industry floundering, the question on everyone's mind is this: Will weed be federally legalized? It's a bold prediction, but our sources are pointing to a resounding yes — and soon. So what does that mean for pot stocks? $6 Billion in Funding Going to a Single Company? Biden has been dishing out funding as if these are his last days on Earth. He's handed out more than $2 trillion in funding during his first few years in office. One of his biggest goals is to develop the future of energy. Shockingly, it has nothing to do with fossil fuels OR renewables. A full $6 billion is headed to an industry dominated by one tiny Virginia-based company. A few critical patent approvals means very few others are on the shortlist. And early investors in this game-changing technology could reap a massive windfall. What's the Buzz?The marijuana industry poses an interesting problem to lawmakers and investors alike. In theory, lawmakers want to pass legislation that aligns with their constituents' desires. A recent survey from Key Investment Partners — a Colorado-based company that provides institutional-level capital to private cannabis companies — a whopping 90% of U.S. adults say marijuana should not be illegal. Logically, it should follow that politicians will get behind the reefer. As for investors, the cannabis space represents a burgeoning industry. But the problem is it already experienced a massive boom-and-bust cycle from around 2016–2018. And a lot of investors lost their shirts in a frenzy akin to the dot-com bubble. It was magnified by the fact that younger and inexperienced investors were hopping on board looking to earn 10x their money. While some of them did, many were left holding the bag.

So now that valuations are depressed, pot stocks may look attractive to some. But there's one glaring problem here... Until weed is federally legalized or rescheduled from a Schedule I drug — the same classification as heroin — institutions won't touch the stocks. According to Key Investment Partners, less than 2% of pot stocks are owned by institutions. That's why there's such ridiculous volatility — there's no support base, just retail investors trying to get a good pump-and-dump. Lack of federal support is also why the weed industry is still operating using only cash and debit, no credit allowed. Banks won't touch the stuff. So until credit card companies come online, we're unlikely to see another pop in the stocks. This Pill Will "Define the Next Decade" A new medical breakthrough smaller than the size of your pinkie is about to reshape human history. Because believe it or not, this tiny pill can eradicate every single sign and symptom of aging and disease... Which leaves you looking and feeling forever young. Don't believe it? Check out this proof... Now, there's been proposed legislation, including the SAFE Banking Act, which would allow banks to take money from dispensaries. It was previously shut down in the Senate but has since been resurrected. Just this month, the Senate held its first hearing on the bill, and the prospects of it passing are looking good. And last July, Senate Majority Leader Chuck Schumer introduced the first-of-its-kind Cannabis Administration and Opportunity Act, which proposed to decriminalize the drug and let states set their own laws. But a secondary problem for cannabis stocks is lack of sales. Now, compared with the alcohol and tobacco industry, cannabis sales are increasing, but we've got to remember consumer spending habits... Especially in a recessionary environment in which consumers will be less likely to buy more expensive goods, including weed. So who in their right mind would buy pot stocks right now? Well, there's another huge catalyst coming... Legalization Is ComingAs I said, it's a bold prediction, but, by following the money, we can get a good idea of what's coming around the corner. Even though there's little institutional investment right now, the smart money is starting to move into the space. That includes the super-traders of the world, like our very own lawmakers and C-suite executives. The Income Play of the Decade Fortune 500 companies like Amazon, Kroger, Walmart, and many more are now being FORCED to pay three warehouse "landlords" millions... And they're sending a dedicated cut of this money directly to partners like you and me EVERY SINGLE MONTH! All you need to do is stake your claim and you could be receiving your first check within 30 days. Check this out... Doing a quick search on Capitol Trades — a site that tracks congressional buying — I found that House Democrat John Yarmuth bought $30,000 worth of Cronos, House Republican Brian Mast bought Tilray, House Republican Chris Jacobs bought Innovative Industrial Properties, and the list goes on. Digging deeper, I found insiders buying shares of their own companies. Village Farms International CEO Michael DeGiglio bought 10 million shares; the CFO, COO, and CEO of Corbus Pharmaceuticals all bought over 500,000 shares; Hydrofarm Holdings CEO and Chairman William Toler bought over 5 million shares; a director at Cronos bought millions of shares; and Innovative Industrial Properties Executive Chairman Alan Gold bought over 400,000 shares. Do they know something we don't? It's very likely. Not to mention our very own state of Maryland is legalizing recreational use in less than a month, like it or not. That means adults 21 and older can carry up to 1.5 ounces of the stuff and even grow a plant or two on their property. We think July 1 is the date cannabis stocks will start to gain momentum again. If you want my top pot pick (hint: it's still less than $1), just sign up for a risk-free trial to my premium newsletter. You'll get a full report on my No. 1 pot stock as well as some more goodies, including some undervalued energy and AI plays. You won't regret it. After all, as Muddy Waters sang in his famous "Champagne and Reefer," "You know there should be no law if people that want to smoke a little dope." Stay frosty,

Alexander Boulden After Alexander's passion for economics and investing drew him to one of the largest financial publishers in the world, where he rubbed elbows with former Chicago Board Options Exchange floor traders, Wall Street hedge fund managers, and International Monetary Fund analysts, he decided to take up the pen and guide others through this new age of investing. Check out his editor's page here. Want to hear more from Alexander? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on. |

Senin, 19 Juni 2023

It Sounds Crazy, but Federal Legalization Is Coming

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar