| Federal Reserve Chair Jerome Powell came out guns blazing last week when he told the world he’d keep raising rates “until the job was done.”

Rate hikes at 0.75%, rather than a shock-and-awe tactic, might just become the new normal.

We entered a recession by technical measures in the second quarter, as gross domestic product (GDP) contracted for two consecutive quarters.

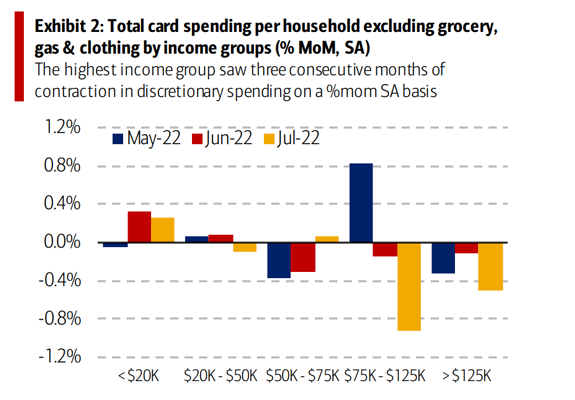

But it doesn’t quite look like a true economic downturn yet. The labor market is still tight, and Americans are spending (they’re just being a little smarter about where their dollars land).

Of course, with the Fed now making it clear that it’s nowhere near done tightening, the risk that we slide into a real recession grows by the day.

This pipeline stock is OK with that.

Suggested Stories: Fed’s Inflation Fight Helps 97-Rated Regional Bank Stock

6.6% Dividend Is on a Rare “Discount Sale” (but Not for Long)

| The next big crisis in America is NOT going to be a “banking crisis” like we had in 2007 … and it certainly won’t be like what we saw in 2020. Expert who predicted Black Monday and the dot-com crash says we will experience a “new” crisis of epic proportions. | |

Chart of the Day Data continues to suggest we aren’t in a recession.

This may be difficult to believe.

A recent survey by The Conference Board showed that 41% of respondents think we are already in one.

Even those who don’t believe we’re there yet are worried — 33% of respondents believe we will be in a recession within six months.

The latter group may be correct.

Check out today’s chart to see why.  Suggested Stories: Inverted Yield Curve Signals Bad News: We’ve Seen This Before

Inflation Reduction Act May Boost TSLA and F — but There’s a Bigger Play

| Experts believe this new tech will create more wealth than all the fortunes of the last 150 years combined. That’s why the world’s richest men and even the United States Senate approved throwing hundreds of BILLIONS of dollars into this new technology… And right now, there’s a little-known stock at the center of all the action.

In fact, this small-cap stock is still trading for less than it costs to buy a tank of gas. | |

|

1976: John Bogle, founder of The Vanguard Group, launched the "Vanguard First Index Investment Trust," the first index fund for retail investors. The fund tracked the S&P 500 and started with $11.3 million in assets — far from Vanguard's desired $150 million. The Vanguard 500 Index Fund, as it is known today, has now surpassed $490 billion. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Tidak ada komentar:

Posting Komentar