A Little-Known Energy Stock That Could Break Out Any Day We’re not huge oil or natural gas bulls. Anyone who knows my work knows this to be true. That said, we do like to make money. And in the current inflationary market, and with the Russia-Ukraine war ongoing, oil prices are positioned to move higher (potentially).

If that occurs, most of the stock market will likely struggle — but oil and natural gas stocks could surge.

On the one hand, there’s a strong correlation between oil prices and inflation – this was seen during the massive inflation of the 1970s. And higher oil prices tend to directly contribute to higher inflation as the cost of economic inputs increase.

On the other hand, if the Federal Reserve continues on its hawkish path to tamp down inflation, it could cause a recession, weakening E&P stocks as a result.

Which brings me to my final potential Stage-2 stock breakout – Vermillion Energy (VET). Is Vermillion Energy a Buy? Vermillion Energy is a Canadian based E&P company that operates in North America, Europe, and Australia. Its business model is one that emphasizes free cash flow generation over everything else, and yet it’s only trading at 4.45X free cash flow. That’s nearly half what the index is trading at.

To understand why VET stock may be able to climb higher, we need a quick history lesson. Do you recall the “Nifty Fifty” ? The Nifty Fifty comprised growth stocks that were trading at super-high valuations for the time (around 40X earnings). And the market absolutely adored this group of stocks in the 1970s. But as inflation continued to soar throughout the decade, the Nifty Fifty took it on the chin (with its stocks dropping around 60% on average) along with pretty much everything else… except commodity stocks.

Commodities outperformed amid the Arab oil embargo, which led to an oil supply shock, and outperformed throughout the Vietnam War. Add in rampant inflation, and the macro-economic situation isn’t much different from today. Which means commodity equities – like Vermillion Energy – could outperform should oil continue to rise and inflation stagnate.

On the other hand, should peace break out between Ukraine and Russia, oil prices could stabilize. Continued oil supply could also put a lid on crude prices. Considering how 26% of Vermillion’s EBITDA is generated from natural gas prices in Europe, that’s a huge risk . Similarly, Fed Board Chair Jerome Powell is sounding more hawkish than ever, and it seems like he’s ready to do whatever to stomp out inflation… even if it plunges the economy into a recession. Therefore, consumers may opt to spend less on big-ticket items, including vacations, concerts, cruises, etc., which would impact demand for oil and gas.

I’ll get to my stage analysis in a bit, but right now, there are a few other signals I’m tracking for Vermillion stock. For one, hedge fund buying has been on an upswing since January. The more hedge funds have splurged on the stock, the more VET has increased in price. Usually, hedge fund managers want to buy when they believe a stock is undervalued, so the fact that buying has increased along with the price of VET is a solid sign that hedge fund managers expect Vermillion’s stock to go higher.

The “undervalued” thesis is corroborated by VET’s price-to-earnings ratio, which stands at 7.75 versus the S&P 500’s 20.14. Indeed, most analysts agree. Vermillion has seen six “buy” ratings over the past three months. Raymond James analyst Jeremy McCrea increased his firm’s price target on VET from $38 CAD to $40 CAD, keeping an “Outperform” rating on the stock.

But remember, the only thing that matters for us here is a meaningful price breakout.

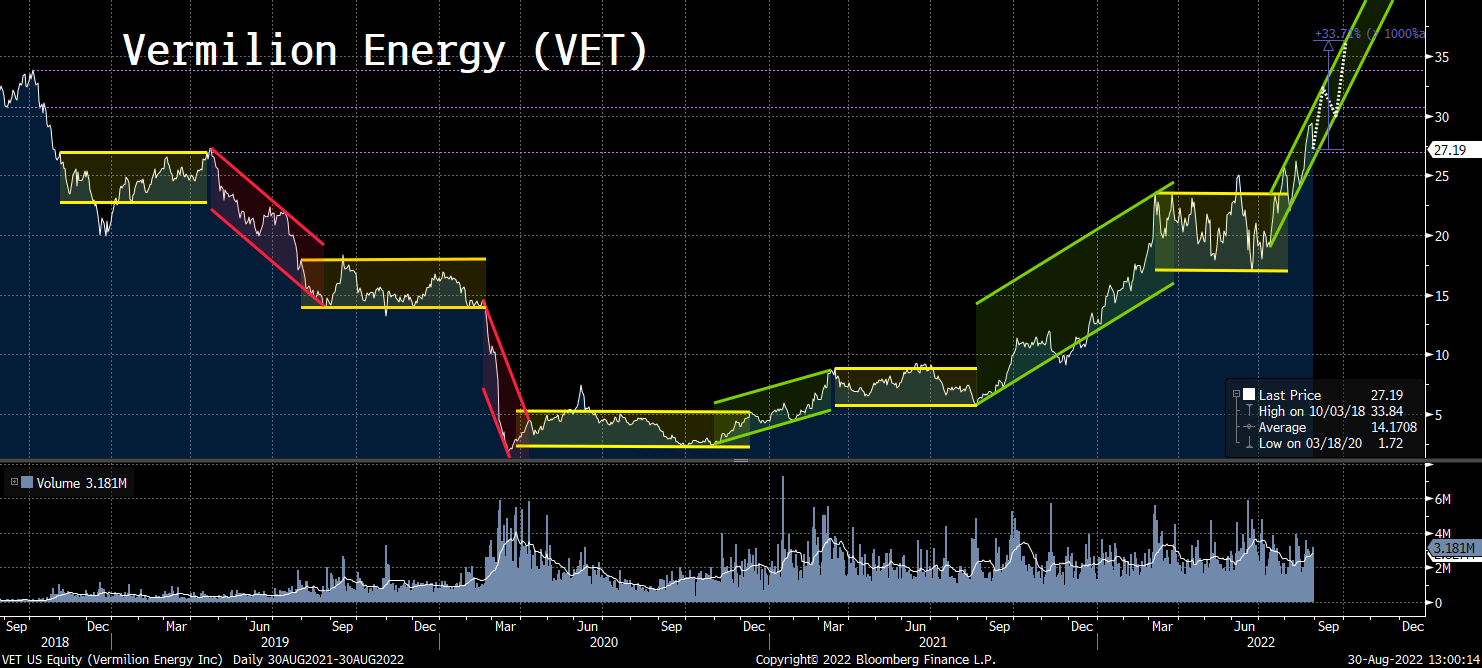

So, let’s examine the chart:

Does this meet my team's strict “Stage-2” criteria?

Here’s what we’re seeing: - The yellow horizontal channels show Vermillion’s basing areas, which have occurred in fits and starts.

- The red descending channel shows a Stage-4 decline that ended around April 2020.

- Since then, VET stock has displayed several prominent air gaps as it oscillated between basing, advancing, topping, and advancing again.

- The most recent uptrend, shown in the green ascending channel, began in June.

- This advancing period is marked by huge air gaps on consistent volume.

Now, if you’ll remember, I’ve outlined a total of three potential Stage-2 breakout stocks: Celsius (CELH), Vipshop (VIPS), and today, Vermillion Energy.

Which of these three actually meets my criteria to buy today? Well, I’ll be going live for the first time ever with these findings.

Today at 4 p.m. Eastern, during my Rapid Cash Flow Summit, I’ll reveal which stock to buy right now, and why this type of investment is the “holy grail” of both short- and long-term wealth.

In the meantime, you can still view my other essays and sign up for our free VIP reminder service here.

I can’t wait to see you there! Sincerely, |

Tidak ada komentar:

Posting Komentar