Looking Ahead To A Bright Future As 2021 winds to a close, the tech world is charging towards the future full steam ahead. The Metaverse is continuing to revolutionize our outlook on business, promising a fully immersive and highly lucrative experience thanks to a new partnership. But not everyone is quite so excited about Meta's progress…and it may lead to a Big Tech showdown in the coming days.

Fortunately for those of us still in the real world, the magic behind Money Moves offers an equally bright financial future for savvy investors. Here's how YOU can get in on it!

You know, with all the twists and turns on Wall Street, with everything that can go well or go wrong, there are a few basic principles that you should always keep in mind when it comes to figuring out where to put your money.

The first is: don’t act on hype.

Hype is a weird thing. It’s often enough for a big pop in the short term–but the problem is that it tends to fizzle out fast while leaving late-comers holding the bag.

However, there’s definitely a difference between hype and momentum, because momentum can take a stock a lot further with bigger returns.

I’m saying this to remind you that, even though it may sound like I’ve been hyping up the Metaverse for the past few months, it has nothing to do with actual hype, but rather the momentum that I see building behind this new innovation.

You might be thinking, “Shawn… what’s the difference between hype and momentum? How do we know which is which?”

Well, hype is when you see it everywhere and everyone is talking about it…but very few people are investing in it. Invest In Momentum, Not Hype Sure, you’ll get the brave ones who will test the waters, and they may even make a quick little profit…

But when the news cycle changes, that’s where the hype ends. Hype doesn’t have a lot of substance to it, and once the conversation dies down, so too does the investment potential.

Momentum is different…

Momentum is the complete opposite, where more people are actually investing in it than talking about it.

That’s how I know that the Metaverse is a viable profit opportunity. While there are people talking about it, it’s not OVERLY talked about (well, except by maybe me) and there is a LOT of money pouring into it.

So much money, in fact, that Apple (AAPL) is getting nervous.

Now, Apple isn’t worried that they’re going to lose market share to Meta Platforms (FB). They’re two separate companies with two separate focuses that maintain a synergistic relationship, so, no, that’s not what has Apple nervous.

Apple’s concern is that Meta is poaching developers as they move to launch the digital world to the masses.

To stop an employee exodus, Apple has issued HUGE stock bonuses to some of its engineers in an effort to retain their services while trying to stave off defections to Meta.

How much is this stock bonus?

Well, the restricted stock bonuses (that vest over four years, providing an incentive to stay longer) have ranged from $50,000 to as much as $180,000.

Many of the engineers received amounts of roughly $80,000, $100,000, or $120,000 in shares, according to unnamed participants, with some of the most talented getting $180,000 to stay. A Talent War Is Brewing Between These Frenemies While that’s a drop in the bucket for cash-heavy Apple, it really does show how much they’re worried about losing their designers to crosstown competition.

While Apple has declined to comment on the program, it’s clear that they’ve found themselves in the middle of a talent war with companies in much-heralded Silicon Valley and beyond.

But Apple’s fears about Meta’s talent-poaching are actually justified, because the rebranded Facebook has hired away about 100 Apple engineers over the past few months.

That being said, it’s important to understand that the aggression in this corporate war isn’t one-sided. Apple is also grabbing talent from Meta just as eagerly.

And while they’re really not “competitors” at the moment, they could easily find themselves becoming fierce rivals as the Metaverse grows and the demand for augmented/virtual-reality products starts growing.

Both companies have some big hardware releases coming out over the next few years.

Are you starting to get the picture now?

Can you see why I’ve been so…well…hyped for Metaverse and the opportunities it’s going to offer?

This is a LONG play, folks.

I’m not targeting 2022 with this one; my focus is 2025 and beyond. That’s when the REAL money is most likely going to roll in. Which is why I want us there now.

The future is here!

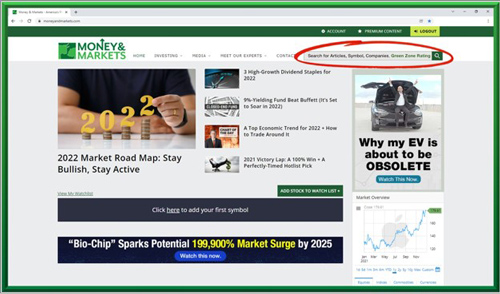

Hey, have you ever wished that there was a place where you could go for quick, reliable, easily-understandable stock advice? Wouldn’t it be great if, just by knowing a stock’s ticker symbol, you could learn all about its value, its projected future, and its benefit to you? And if such technology exists, wouldn’t it be great if it were FREE??

If you answered yes to these three questions, then I have some good news for you.

Your wishes have been granted by the magical widget at MoneyandMarkets.com.

I know, you might be thinking that this is some real Harry Potter stuff and that I am pulling an early April Fools joke on you, but I promise you I’m being serious right now!

Our buddies at Money and Markets have designed a stock-rating system that ranks 8,000 stocks on a scale of 0-100. It is a proprietary system, which is a fancy way of saying that no one can steal the secret code used to design the system.

Money and Markets even designed a whole publication around the Green Zone rating system starring our own financial wizards, Adam O’Dell and Charles Sizemore, which you can learn more about by clicking here.

The stocks are rated using six categories: volatility, quality, size, momentum, value, and growth.

Each stock is given a green, yellow, or red color based on its rating. You know, like a traffic light.

Red indicates the high-risk stocks to avoid or dump, yellow stocks are neutral for the time being, and anything in green means we are super pumped about it and recommend buying ASAP.

And our Green Zone rating system is so easy that even a caveman can use it. (Poor cavemen…everyone is always making fun of their intelligence, but they have feelings too.)

You can simply go to www.moneyandmarkets.com and look for the search box that says Green Zone rating.

Type in the name of the stock you are searching for, and boom! (In honor of John Madden) the Green Zone rating appears.

For example, the other day I wrote a piece recommending purchasing shares of Weis Markets amid an ongoing price hike for meat in the US.

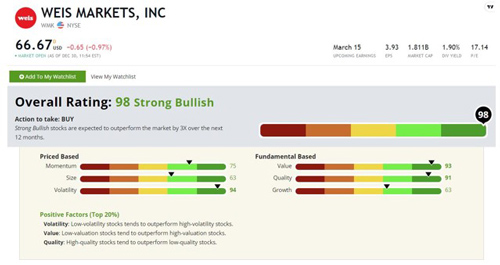

So, if you were to go to the Green Zone Rating search bar, and type in Weis Markets, this is what would appear:

As you can see, this stock is in the green with a “strong bullish” rating and an overall score of 98—which is GREAT! The rating system recommends buying the stock, and if you really want to get into the weeds, you can read all the financial numbers of the company as well.

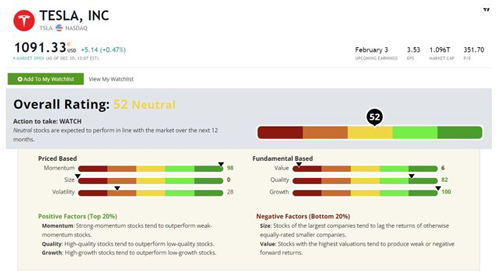

Stocks like Tesla are in the yellow zone, which means we are neutral and have a watch-and-see approach to the stock, as you can see here.

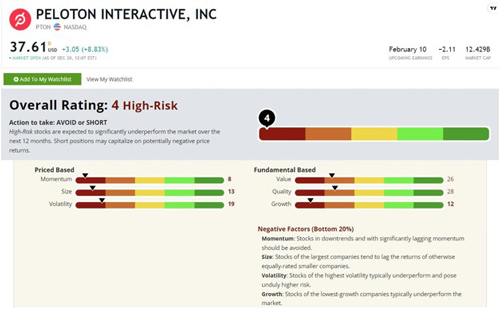

And then there is the dreaded red zone. If you were interested in buying stock in Peloton, then now’s the time to thank us. According to the Green Zone system, Peloton is in the red, marking it “high risk,” and we recommend selling or shorting the stock as soon as you can.

So, there it is, my fellow Money Movers! That’s the magic behind what we do. Our beautiful, brilliant, simple, and FREE Green Zone Rating System.

So now when you read our quality content here at Money Moves and we refer to the Green Zone Rating System, you know what the heck we’re talking about. Don’t forget that you have access to the very same information that my colleague Shawn and I use every single day.

So, head over to Money and Markets and have fun playing with the Green Zone rating system. Click the link here.

Investing tip: Consider searching for stocks on our Green Zone Rating System before purchasing new shares. Just a thought…

Metaverse And Oculus: A Match Made In Investor Heaven

by Shawn Ambrosino Look, I know I’ve been talking about the Metaverse (Meta Platform’s (FB) digital reality) a lot lately, but I’m doing it for a reason. I truly believe that this will be the future of business, society, and human interaction.

The concept itself may be a hard sell to traditional investors, but I’m a BIG believer in following the money. A lot of money is already pouring into it, and it’s not just coming from within Mark Zuckerberg’s company.

There are many venture capitalist collectives that are already finding ways to get a foothold in the Metaverse because they understand what I’ve been showing your guys for months now: there will be all kinds of cash-generating opportunities in this digital world.

The biggest one I see so far is digital real estate. There are companies set up to sell plots of digital land in this online world, and as with all real estate purchases, the biggest factor is location.

You don’t need to be a Millennial or a Gen Z’r to understand that; it’s a concept anybody can grasp.

However, there is a specific aspect of this new world that’s been a major turn-off for people from earlier generations: the Metaverse is going to be a fully immersive experience. Step On In You’re not going to just interact with a keyboard and monitor; you’re going to be “in” this world via digital headsets that put fully “inside.” Your only interactions will be digital, and you’ll experience them like they’re happening right in front of you.

You’ll be wearing headphones, some sort of viewing port, and eventually even haptic gloves that will give you the sensation of touching things.

For some of us, that’s a foreign concept–and a scary one.

However, to the younger generations that have already experimented with virtual reality, this just seems to be the next logical step in our technological journey.

However, as with a lot of new advances, the Metaverse is being met with a lot of skepticism from the older generations. They’ve heard of how “virtual reality” was the future of computing, only for it to fail on the two occasions that it’s been pushed before.

However, this was before the advances in optic headsets like Meta’s ultra-popular Oculus.

The latest Oculus VR headset (called the Quest 2) appears to have been one of the hottest gifts of the 2021 holiday season–and at a price point of $400, we’re not looking at chump change here. That’s just another reason why the social media company turned technology conglomerate remains high on a lot of Wall Street’s “buy” lists. Oculus: FB’s Portal To The Metaverse… And Profits Not only was it one of the biggest gifts of the season, but the Oculus app was the number one most-downloaded app from the Apple App store on Christmas Day.

Oculus downloads and daily active users on Christmas Day surged 70% and 90%, respectively, from the prior year.

That’s HUGE…

And it’s a good sign that people are preparing for the move to the Metaverse–or at least that the games offered on the Oculus are going to be a gateway to that digital world.

Well, at least the younger generation.

And it’s something that is sure to push shares in Meta Platforms (FB) even further north.

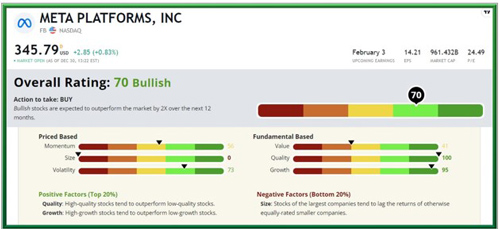

In fact, on the Green Zone Fortunes rating system, Meta Platforms (FB) is VERY bullish a respectable rating of 70, which is impressive given Meta’s size.

Here, see for yourself:

All in all, this is a very good sign for investors.

Not only FB investors, but for those wondering if the Metaverse was worth their time, effort, and money with any other opportunity that pops up.

This just backs up what I’ve been saying for months now.

However, I’ll bet dollars to donuts that there are STILL going to be people that push back against this and say it’s all just a “fad” that will pass.

Those people are wrong…

Prepare now…or watch profits pass you by.

The choice is YOURS!

For more quality content like this, and to learn more about the Money Moves team, visit us at https://moneyandmarkets.com/category/money-moves/ |

Tidak ada komentar:

Posting Komentar