Three Cybersecurity Funds to Purchase Using CIA Analysis 12/31/2021 | | | Forget AT&T, T-Mobile, or Verizon - the truth is, you're too late to profit by investing in 5G directly. A better route is to focus on the $1.4 trillion aftershock market that 5G will create - and the 20 companies Michael Robinson has identified. Each is projected to return 10X by the end of the year and could dwarf the 5G gains we've seen already.

Get the details here. Click Here... | | | | Three cybersecurity funds to purchase using analysis from the usually secretive Central Intelligence Agency (CIA) may become profitable, income-producing trades that would be aligned with an enhanced U.S. national defense.

The three cybersecurity funds to purchase allow investors to tap into the CIA's and the Department of Defense's growing interest in cybersecurity to fend off adversarial foreign governments and terrorist groups intent on identifying and exploiting U.S. weaknesses. CIA leaders see partnering with the private sector as "really critical," especially as China has set a goal of achieving global superiority in artificial intelligence by 2030, said Jennifer Ewbank, the CIA's deputy director of digital innovation, in a Billington CyberSecurity webinar.

China has turned into America's most important and difficult cyber challenge, said Ewbank, who is responsible for speeding up the development and integration of digital and cyber capabilities across all the CIA's mission areas. She took the helm at the CIA's Directorate of Innovation a couple of years ago, following the agency's 2015 creation of its first new directorate in more than 50 years.

"It is a pivotal moment in the intelligence business," Ewbank said.

Ewbank oversees the agency's chief information officer (CIO), chief information security officer (CISO) and its chief data officer, as well as helps to spearhead the reengineering of the entire intelligence enterprise at the CIA.

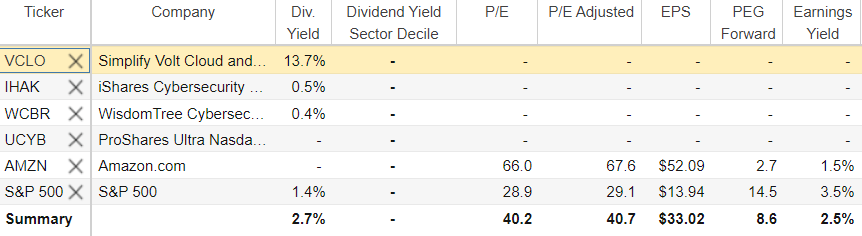

Source: Stock Rover. Click here to sign up for a free two-week trial.

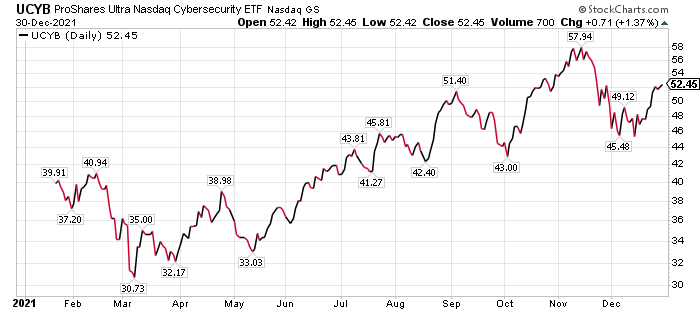

ETFs Featured in Three Cybersecurity Funds to Purchase Using CIA Analysis

Investors interested in profiting from cybersecurity stocks that benefit from rising interest at the CIA and the Department of Defense to enhance America's national defense have several exchange-traded funds (ETFs) available to choose, said Bob Carlson, who heads the Retirement Watch investment newsletter. Unfortunately, none of those ETFs has a long history, he added.

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

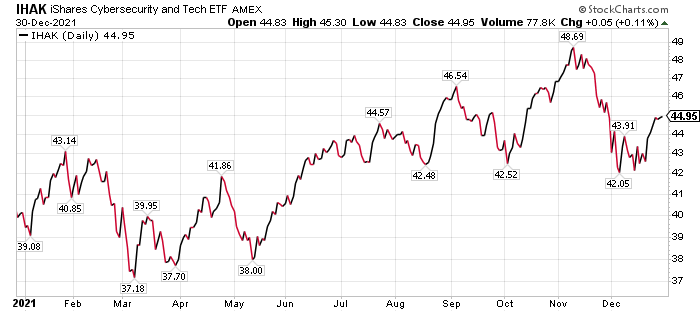

The oldest of those funds is iShares Cybersecurity and Tech (IHAK), said Carlson, who also serves as chairman of the Board of Trustees of Virginia's Fairfax County Employees' Retirement System with more than $4 billion in assets. The fund has been around since mid-2019, charges the lowest fees of any of its competitors and has done quite well since inception, Carlson counseled.

The ETF seeks to track the performance of the NYSE FactSet Global Cyber Security Index. The index also is global and includes companies from both developing and emerging economies, Carlson continued.

Chart courtesy of www.stockcharts.com

IHAK Is One of Three Cybersecurity Funds to Purchase Using CIA Analysis

Companies in the index can be engaged in cybersecurity hardware, software, products and services. Roughly 80% of the fund is in U.S.-based companies, while its holdings on average are mid-cap growth stocks.

The fund recently held 52 stocks, with 42% of the ETF's assets coming from its 10 largest positions. Top holdings include Citrix Systems, Inc. (NASDAQ: CTXS), Fortinet Inc. (NASDAQ: FTNT), DocuSign (NASDAQ: DOCU), Juniper Networks (NYSE: JNPR) and Palo Alto Networks Inc. (NASDAQ: PANW).

IHAK is up 3.96% in the last three months, 11.98% so far this year and 12.03% in the past 12 months through Dec. 29. The fund did even better in 2020 by soaring 51.21%.

Three Cybersecurity Funds to Purchase Using CIA Analysis Include ETF With a Big Dividend Yield

IHAK's competing ETFs began in very late 2019 or early 2020, Carlson commented. As a result, there is scant information about investors to use to decide whether to buy shares in them, he added.

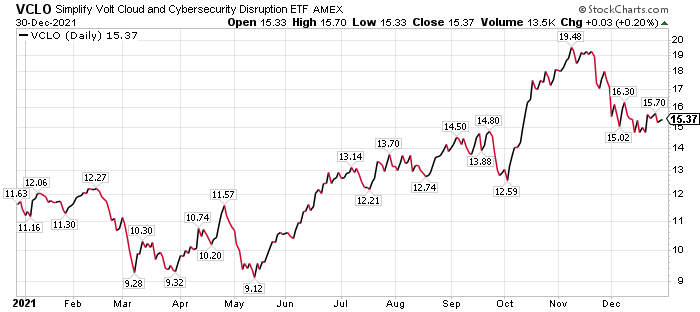

However, Simplify Volt Cloud & Cybersecurity Disruption (VCLO) stands out with its current dividend yield of 13.7%. It is possible that lofty dividend yield may not be sustainable, since the fund just launched on December 28, 2020.

Nonetheless, the fund's holdings include a number of established technology stocks that pay dividends. VCLO's top three holdings and weightings feature Cloudflare Inc. (NYSE: NET), 18.77%; Datadog Inc. (NASDAQ: DDOG) 9.85% and Crowdstrike Holdings Inc. (NASDAQ: CRWD), 7.00%.

Investors may find the holdings enticing enough to buy shares in the ETF for the dual opportunity of receiving income and potential capital appreciation. As of Dec. 29, the fund is up 20.16% in the past three months, 35.67 for the year to date and 32.32% in the past 12 months.

VCLO is designed to focus on the relatively few "disruptive companies" poised to dominate the new era of the cloud. Plus, the fund also invests in options to intensify its exposure and enhance its potential returns.

The investment process of the fund's management begins by identifying the companies poised to lead cybersecurity "disruption." The use of sophisticated options trading creates an overlay to enhance the upside and reduce drawdowns.

Chart courtesy of www.stockcharts.com | | | It's not only about timing the market to near perfection to make money… you also need to know WHERE the opportunities are.

The Stormproof system has a winning track record of MORE THAN 40 years.

Imagine you can time your exits BEFORE the next major crash… and your entries when the market rebounds.

Find out what the Stormproof system can do for YOUR portfolio. Click Here... | | | | Three Cybersecurity Funds to Purchase Using CIA Analysis Include WisdomTree ETF

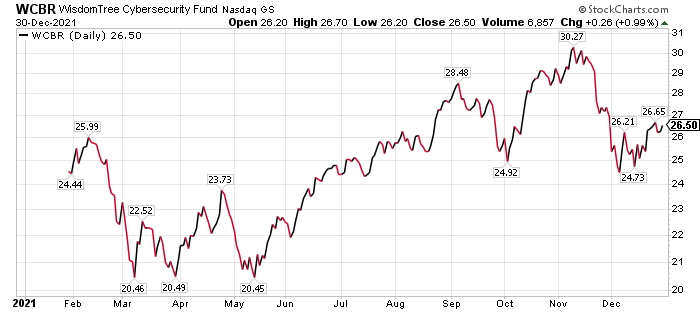

WisdomTree Cybersecurity (WCBR) is a third dividend-paying fund that investors might find tempting. The fund is designed to track the performance of companies primarily involved in providing cyber security-oriented products that meet the eligibility requirements of the WisdomTree Team8 Cybersecurity Index.

The three largest holdings and weightings in the fund feature Datadog Inc., 6.96%; Palo Alto Networks Inc., 6.37%; and Cloudflare Inc., 5.55%. Those three stocks have produced gains of 81.67%, 58.23% and 74.48%, respectively, during the past year through Dec. 29.

Overall, WCBR has produced a gain of 3.46% for the past three months, but is down 4.07% during the past month. Its track record is limited, since its launch on January 28, 2021, gives it less than one year of existence thus far.

Chart courtesy of www.stockcharts.com

As with all fledgling funds, these ETFs need to establish a track record of positive returns and develop sufficient volume to give investors the freedom to buy or sell when desired, without facing a financial hit to do so. None of the three newest funds has a rich history of gains at this early stage of their existence.

Chart courtesy of www.stockcharts.com

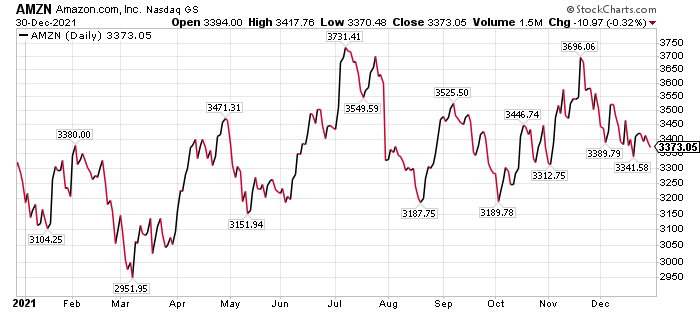

Non-Dividend-paying Amazon Offers Alternative to Three Cybersecurity Funds to Purchase Using CIA Analysis

Seattle-based online retailer Amazon.com Inc. (NASDAQ: AMZN) has found a growing niche in cybersecurity, even though it is best known for its global online sales leadership. Amazon.com recently secured a Bank of America Global Research buy rating and an upgraded price target of $4,450 from $4,250.

However, Amazon ended up in the firing line lately when a scathing letter came from Sen. Elizabeth Warren of Massachusetts and other influential Democrats in Congress who claimed the company sacrificed worker safety in pursuit of profits when tornadoes tore apart its warehouse in Edwardsville, Illinois. Amazon's prospects still appear favorable, despite the terrifying tornado on Dec. 10 that killed six of its warehouse workers.

BofA rated Amazon.com as the top choice for 2022 among the FANG stocks of Meta Platforms Inc. (NASDAQ: FB), formerly Facebook; Amazon; Netflix Inc. (NASDAQ: NFLX); and Alphabet (NASDAQ: GOOGL). One reason is that Amazon underperformed in 2021 but it may be poised for a comeback.

Three Cybersecurity Funds to Purchase Using CIA Analysis Focus on Disruptive Advances

As the calendar moves to the summer and fall of 2022, expect strength in e-commerce as online penetration gains renewed momentum, BofA wrote in a recent research note. The outlook for Amazon should improve during 2022 to allow the stock to finish much better than it starts the new year, BofA added.

The investment firm predicted Amazon will gain a lift from supply chain improvements and infrastructure investments. Plus, Amazon Web Services is an existing partner with the CIA and its role in serving the agency may grow.

Tom Lash, the federal portfolio director of Amazon Web Services, participated in the same webinar as the CIA's Ewbank and remarked that key areas of interest for the company include cybersecurity, the cost of optimizing cloud technology and the agility and speed of proposing and testing potential solutions.

Chart courtesy of www.stockcharts.com

Private Sector Cybersecurity Companies Partner with the CIA

Three key priorities for the CIA include its missions on cybersecurity, enterprise ID and open-source information collection around the world. The CIA aims to harness the power of data, raise the digital acumen of its workforce and strengthen its partnership with the private sector, Ewbank said.

The CIA also has set a goal to enable artificial intelligence, machine learning and recognize cybersecurity as a critical part of the CIA's mission, Ewbank said.

To try to keep up with the technology advances occurring in China, the United States is emphasizing partnerships with other agencies, allied governments and private industry. | | | Our "Learn How the Smartest Traders Pick Stocks" masterclass expires soon.

You're running out of time to grab your seat at this LIVE, interactive masterclass for traders. It's your chance to finally learn the secret behind how the wealthy elite choose their stock picks.

Simply click this link to join the unique audience that gets FREE access to the valuable forecasting of Vantagepoint's A.I. Click Here... | | | | Passage of DoD Funding Bill Funnels Money Toward Cybersecurity Upgrades

President Biden signed a new law on Monday, Dec. 27, for a national defense bill almost reaching $770 billion to strengthen America's national security. The bill gained bipartisan support to provide the DoD with $740 billion in funding, rather than President Biden's requested amount of $715 billion for the Pentagon.

However, the bill currently only authorized the money, without Congress yet appropriating the funds. The National Defense Authorization Act for Fiscal Year 2022 is intended for the 12-month period that would start Oct. 1.

"The national defense bill is critical to maintaining our competitiveness on the global stage -- particularly as other nations, like the Chinese government, look to expand their influence," said Sen. Gary Peters, D-Michigan, a former Lieutenant Commander in the U.S. Navy Reserve and a key member of the Senate Armed Services Committee. "I'm pleased this bipartisan bill was signed into law."

Sen. Peters, as Chairman of the Homeland Security and Governmental Affairs Committee, supported strengthening national cybersecurity defenses and holding foreign adversaries and cybercriminals accountable for targeting American networks. Peters helped to secure a provision that would authorize additional staffing for the Office of the National Cyber Director -- a new role intended to coordinate implementation of national cybersecurity policy and strategy.

The bill also aims to secure critical infrastructure against cyber-attacks, such as those on oil pipelines and wastewater treatment plants that have disrupted lives and livelihoods across the nation. A provision of the legislation would require the Cybersecurity and Infrastructure Security Agency to ensure it can better identify and mitigate threats to critical infrastructure like pipelines, water and electric utilities.

America Averages a Record 301,000 Cases of COVID-19 for Past Seven Days

The United States averaged a record seven-day count of 301,000 new daily cases on Wednesday, Dec. 29, breaking the previous high mark of 267,000 set the day before. The 2021 holiday season marks the second straight year that COVID-19 has interfered with the travel plans of families and their friends seeking to gather together. Thousands of flights recently have been cancelled due to rising COVID cases, especially with many airline workers calling in sick.

Scientists have found that the new Omicron variant of COVID-19 is spreading even faster than other coronavirus strains, including the highly infectious Delta variant. However, the severity of the Omicron variant compared to Delta version may not be nearly as severe, according to early reports.

Omicron recently has become the dominant variant of COVID-19 in the United States. That version of the coronavirus is blamed for causing Mid-Atlantic areas such as Washington, D.C., Maryland and Virginia to break records for daily cases this week.

COVID-19 Risk Remains a Big Worry as Cases and Deaths Climb

The new Omicron variant of COVID-19 and the highly transmissible Delta variant are heightening concerns in the United States and other parts of the world. Public health experts and government leaders advocate increased vaccinations and booster shots, along with indoor mask wearing.

The Centers for Disease Control and Prevention (CDC) has data that show the variants are boosting the number of people receiving COVID-19 vaccinations. Close to 62 million people in the United States remain eligible to be vaccinated but have not seized the opportunity, said Dr. Anthony Fauci, the White House's chief medical adviser on COVID-19.

As of Dec. 30, 243,527,564 people in the United States, or 73.3% of the country's population, had received at least one dose of the vaccine. The fully vaccinated totaled 205,811,394, or 62% of the U.S. population, on the same date, according to the CDC.

COVID-19 deaths worldwide, as of Dec. 30, topped the 5.4 million mark to hit 5,428,687, according to Johns Hopkins University. Worldwide COVID-19 cases have soared past 286 million, climbing to 286,433,032 on that date.

U.S. COVID-19 cases, as of Dec. 30, hit 54,268,545 and had caused 824,277 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The three cybersecurity funds to purchase using CIA analysis could be among the market's success stories in 2022. The CIA and DoD officials have not been shy about voicing their need to partner with the private sector to protect against rising cybersecurity threats amid the significant lead China has taken in artificial intelligence as it aims to dominant in that key technology by 2030. | | | Sincerely,

Paul Dykewicz, Editor

DividendInvestor.com

| | About Paul Dykewicz: Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul also is the author of an inspirational book, "Holy Smokes! Golden Guidance from Notre Dame's Championship Chaplain", with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz. | | | | | |

Tidak ada komentar:

Posting Komentar